By Jonny Fry on The Capital

Environmental Social Corporate Governance (ESG) is becoming an ever-increasing topic for organisations as we see legislation regarding it being introduced, as well as asset managers demanding that the companies in which they invest have ESG as a requirement within the core of their business. Indeed, we are increasingly seeing companies announcing initiatives to reduce their carbon footprint as part of their broader ESG commitments, setting aside capital. For example, Unilever has announced that it has set up a €1billion fund to help meet its climate change pledges. The fund is proposing to look at harnessing Blockchain technology, along with AI and other technology, to ensure that its supply chain becomes net-zero by 2029. Amazon has also announced that it is establishing a $2billion fund and, in a recent release, stated, “The Climate Pledge Fund will invest in companies in multiple industries, with an initial focus on: transportation and logistics; energy generation, storage, and utilization; manufacturing and materials; circular economy; and food and agriculture.” Amazon is asking that those wishing to apply for funding email its organisation — this being furthermore to the $10 million it has announced will be used to help fight for justice and equity.

Blockchain technology is also being used to help organisations improve their ESG credentials. Examples include:

· Cybersecurity — as our lives and commerce become increasingly digitised, cybersecurity becomes a greater challenge. Ensuring data is stored on a Blockchain in a decentralised manner determines it is harder to steal the data or corrupt it for ransom purposes.

· KYC and AML — the ability to prove Know Your Customer (KYC) and Anti Money Laundering (AML) procedures and policies is a key requirement for regulated companies in the financial sector but currently, this is invariably carried out using paper-based analogue systems and processes. Blockchain technology offers the opportunity to automate many of the required checks in real-time. Therefore, any changes in a client’s status or fraudulent transactions can be instantly identified and action taken, providing a far more robust solution and thus reducing the compliance risks for the regulated firms. Kompany, from Austria, offers KYC checks by monitoring private and government databases, such as a country’s companies house records, in real-time.

· Renewable energy distribution — there is a growing demand from customers wishing to be carbon neutral to be able to track and trace electricity from renewable sources. Blockchain technology enables microgenerators of renewable energy to trade energy, peer-to-peer, with consumers in their local area rather than submit their power into the grid. Such an initiative has been launched by the British energy company, Centrica. Carbon Trust and Imperial College, London, claim such initiatives could save £17 to £40billion for the UK by 2050.

· Supply chain traceability — given the number of parties often involved as goods are moved around the world it can be a challenge to ensure standards on conduct and quality together with environmental and employee working conditions are maintained throughout the supply chain. Blockchain-powered platforms can create a record of the origin of a product and this, according to IBM, means that over 70% of customers are prepared to pay more for a product which can prove its provenance, while the manufacture can have greater transparency. This helps to explain why Smuckers, a brand of coffee established in the US in 1850 and Zoegas, one of Nestle’s coffee brands, are using Blockchain technology and IBM’s expertise.

· Voting — this can be cumbersome and inefficient, especially where shareholdings are held in trust or by nominees, which is often the case for quoted companies. Broadridge Financial Solutions carried out a voting tracking service for Banco Santander’s 2018 AGM and again in Japan in 2019. Blockchain-based voting is also planned for the 2020 Emmy awards illustrating how this technology is not simply being harnessed in the financial services sector. However, there are concerns that Blockchains can be hacked and MIT in the USA is subsequently calling for Blockchains not to be used for voting.

There are risks and challenges of using Blockchain technology, some of which include:

· Consumption of energy — although this is becoming less of a concern as a result of Blockchain’s being developed to use less energy, certainly the initial Blockchains (such as Bitcoin) were very inefficient from an energy perspective. According to the UK’s Telegraph newspaper, a Bitcoin transaction uses more electricity than a single household does in two months.

· Data laws — public Blockchains face a major challenge in jurisdictions, such as Europe, where there is a requirement for the ‘Right to be Forgotten’ under the EU’s General Data Protection Regulation (GDPR).

· Education — this represents a major adoption challenge as people are often reluctant to change existing business practises and feel uncomfortable embracing new technology. Many still associate Blockchain and Bitcoin with fraud, hacking, and the dark web. These concerns will have undoubtedly been reinforced by the recent incident of Twitter accounts being hacked, where it appeared that the likes of Elon Musk (Tesla), Jeff Bezos (Amazon), Bill Gates (Microsoft), etc were asking people to send them Bitcoins.

· Lack of regulation — the use of Blockchains on a commercial scale is still relatively new with many countries scarcely beginning to legally recognise the smart contracts and digital assets that Blockchain technology can create.

· Transaction speeds — some of the better-known Blockchains such as Bitcoin (taking 9.8 minutes to confirm a transaction) or Ethereum (processing 15 transactions a second )are well-below the potential 45,000 that the Visa network is able to process. However, with new types of Blockchain-processing being developed it is hoped that transaction speeds will substantially increase.

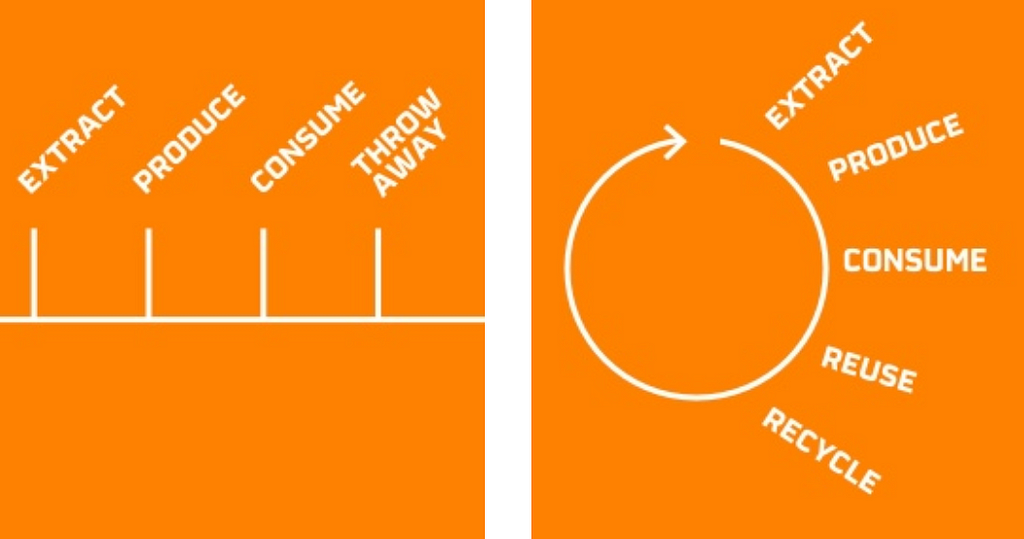

Notwithstanding this, Blockchain technology is equipped to offer organisations greater transparency and so engender far greater levels of trust, vital for consumers and governments wishing to track those organisations’ ESG credentials. A good example of this is the Spanish petrochemical firm, Repsol, which has made a commitment to the circular economy. Last year, Repsol, bought an 8% stake in Finboot in order to trace oil and gas in its supply chains and to assist in certifying its products’ compliance with regulations together with its products quality. Finboot CEO, Juan Miguel Pérez, believes; “The positive impact that follows ESG is going to play a big role in the future of blockchain in enterprise.”

Repsol’s view of a circular economy

Source: Repsol.com

The ability to track the recovery and recycling of the Repsol’s products could save the company at least €400,000 per year. Therefore, surely with savings of this magnitude and increasing pressure from governments, investors, and customers it is likely that we will see greater adoption of Blockchain technology in assisting organisations to track and monitor ESG credentials.

Brought to you by Digital Bytes for more articles like this email info@teamblockchain.net

https://twitter.com/thecapital_io

How Blockchain technology can help organisations’ ESG credentials was originally published in The Capital on Medium, where people are continuing the conversation by highlighting and responding to this story.

from The Capital - Medium https://ift.tt/33fcYSP

0 Comments