By Edward Valencia on The Capital

As of Wednesday, July 29th bitcoin maintains a support level of $11k, giving it a 20% rise for the week. What has caused this surge and will it continue to soar?

Congress is deciding whether to issue a relief package of either $1 trillion or $3 trillion. To many investors, this is seen as a debasement of the US dollar which weakens purchasing power. The USD value relative to foreign currencies has been hitting its two-year low with the dollar index falling nearly 7% in the last 3 months. Goldman Sachs has warned investors of a potential collapse of the USD as the global reserve currency. They explain our current situation as, “an environment … where governments are debasing their fiat currencies and pushing real interest rates to an all-time low.” Similar claims force investors to seek alternative investments that will keep their wealth secure. This is why we have seen a risen value of save havens like gold, silver, and bitcoin.

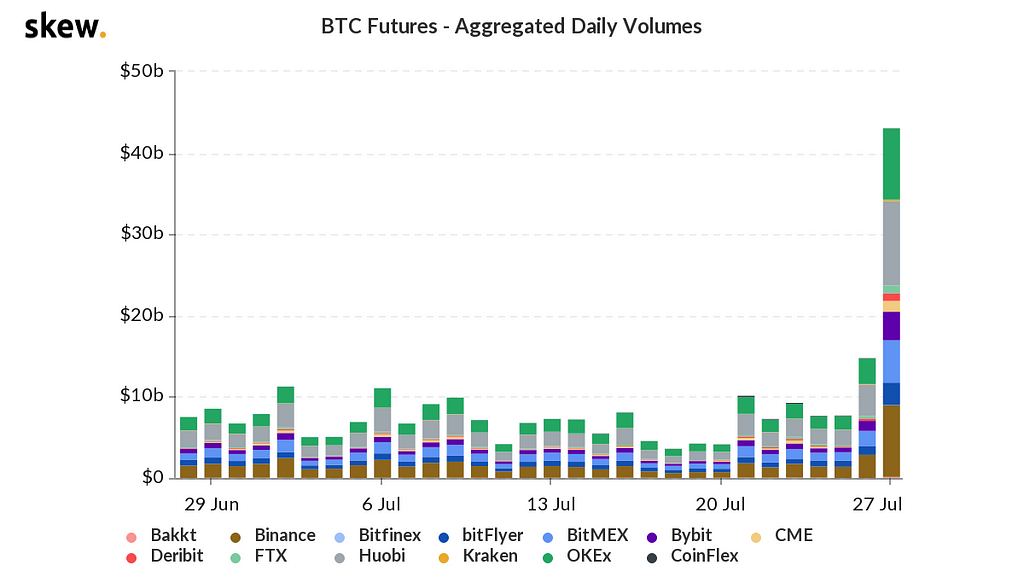

The second reason for bitcoin’s rise is the increased interest from institutional investors. We have seen record volumes of bitcoin futures and new participants in Grayscale’s financial instruments. You can take a look at the increase in volume in futures from the past few days.

Will It Continue?

We must evaluate our current macroeconomic situation to determine if bitcoin will continue to rally as the USD weakens. Our current circumstances provide the perfect conditions for bitcoin to skyrocket to new all-time highs. Governments and central banks around the world are taking extreme precautionary measures to avoid a deflationary environment. A deflationary market will cause many countries to default on their debt and lose credibility as a safe country to invest in. We must consider the possibility of countries around the world continuing to act this way unless we see a significant shift in healthcare, consumer confidence, and foreign affairs.

During 2017, we witnessed a build-up of the bitcoin bubble due to new retail investors — average people that were afraid of missing out. This was due to immense media coverage and the ‘next-big-thing’ effect. Now we’re seeing a yearly increase in interest from institutional investors that have the buying power to have a greater impact on the markets. They are still skeptical and reluctant but they’re willing to hedge their ignorance in the case crypto is actual modern-day insurance against our current financial system.

https://twitter.com/thecapital_io

Why Bitcoin Broke Above $11k was originally published in The Capital on Medium, where people are continuing the conversation by highlighting and responding to this story.

from The Capital - Medium https://ift.tt/2PaN6PQ

0 Comments