A tour to India, China, USA, and Cryptocurrency market situation in this pandemic era

Check out our new platform: https://thecapital.io/

Corona Virus Pandemic is slowing our life, slowly engulfing mankind and throwing us to an unpredictable future. While crisis hits the global market then it is likely to understand that the share markets are also going to be affected. Let’s not relate to the market with panic conditions. Since everyone around the world is thinking about saving lives and protecting family, society, and above all mankind, share markets are also acting with the emotion. Now, I will elaborate on the share market status of notable countries.

Indian Share Market:

Recently India has established its status and enrolled its name on one of the fastest-growing countries. It has also set an example of a country which conducted the longest lockdown in the world. If the whole country is going to shut then the share market will be affected. However, India is gradually opening the market so the result reflected on 24th august. Two major share markets NIFTY and SENSEX ended its day on a high note.

After the afternoon trading session on 24th August, Indian markets finished the day strongly. BSE Sensex traded by 372,66 points at 388,807,38 at 3:00 p.m. while NSE Nifty50 traded by almost 1%. At 3:00 p.m. A solid banking inventory rally on Monday helped markets grow profits.

Not only that the rupee saw its best rate since 18 March, 0.7 per cent, to 74.31 compared with the US Dollar. Indian equity closed just timidly on Monday with its six-month high, driven by a rally in privately held banks, as several companies resumed operations after lockouts and hopes of Covid-19 recovery increased. The index for S&P BSE Sensex rose at 0.95% to 38,799 and ended at 0.83% higher at 11,466.

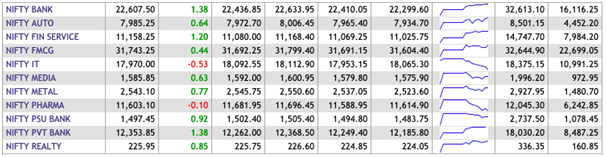

Here is the list of top performer from NIFTY and Sensex:

As you can analyze, the Indian Share market is moving forward despite the pandemic situation. It was the market’s best performance in the past 6 months which is remarkable. Now if India is flourishing then what about those leading countries in this pandemic? Yes, I will lead you to the Chinese as well as the USA stock market. First, we should focus on China.

China:

The country which is the main reason for the coronavirus pandemic seems to do well in their country. Took all major precautions and now have stabilised the situation. China should be the most affected country around the world as it is the birth country of the Corona Virus pandemic. But is it really affected at the level we are expecting?

The Asian markets were largely lower on Wednesday after the Wall Street mediocre after negotiations between the US and China on the future of a deal intended to function in their economic warfare as a truce. The sector recently walked through snips of data, advances in a proposed antidote for the coronavirus, and other problems. But overall the world economy is still hurting; with airlines still operating mostly empty at a fraction of their capacities and restaurants.

On Wednesday on a global mixed trade day, shares in mainland China triggered declines in the major Asian Pacific markets. The mainland stocks in Chinese countries contributed to declines in the big companies of the region, with the Shanghai-based business decreased by 1.3% and closing by nearly 3,329,74.

Recently conflicts increased between the United States and China, with President Donald Trump concentrating in particular on Chinese technology firms. The deteriorating relationship was one of the most important issues for investors and the regional economies of China.

When it comes to china then the United State’s stock market has to be involved.

USA:

While the Chinese Stock Market showed bad performance, the USA stock market rose beyond expectation. The most possible cause of the difference is the US-China trade conflict. Apple, Amazon, Facebook, etc major companies share soaring up this month. The average of Dow Jones Industrial jumped to 28,308.46 at 378.13 points or 1.4%. The S&P 500 hit an all-time peak of 1% to 3,431,28. S&P 500 was again the first to finish above 3400 on Monday. The Nasdaq Composite grew 0.6% and was registered at 11,379.72.

The change on Monday coincided with the continuing drop in the number of reported cases of coronavirus in the United States. The sum of fresh regular infections in the US has not surpassed 49,000 since it crossed over 64,000 earlier this month. This could be another major reason for the growth of the US market.

Crypto Market:

Now we need to focus on the fastest-growing market. If we look back at the start of the global pandemic then this sector was massively wounded. The market was expected to rise after Bitcoin Halving but on the contrary, the growth was slow as expected. The highest volume cryptocurrencies price fell near 4000 dollars in the mid of February which was a major loss. Now the market seemed to recover from the fall and accelerating upward. This month's price hiked above 13,300 dollars. So, even though the coronavirus is not going anywhere soon people are taking more interest in the crypto industry. The total market capitalization of the industry is $355,303,354,174 where only Bitcoin occupies 59.2 %.

Cryptocurrency industry is reflecting major strength which also emphasizes the aspect of the growth of the economy. People are trying to find an alternative solution for the current investment strategies and the crypto cloud is just perfect for this.

https://www.coinbreze.com/

Telegram: https://t.me/coinbreze

Twitter: https://twitter.com/coinbreze

Facebook: https://www.facebook.com/Coinbreze

https://twitter.com/thecapital_io

A tour to India, China, USA and Cryptocurrency market situation in this pandemic era was originally published in The Capital on Medium, where people are continuing the conversation by highlighting and responding to this story.

from The Capital - Medium https://ift.tt/3m8NXj6

0 Comments