CryptoQuant: Miners Moving Unusually Big Amounts of BTC — Price Analysis, 7 Sep 2020

Check out our new platform: https://thecapital.io/

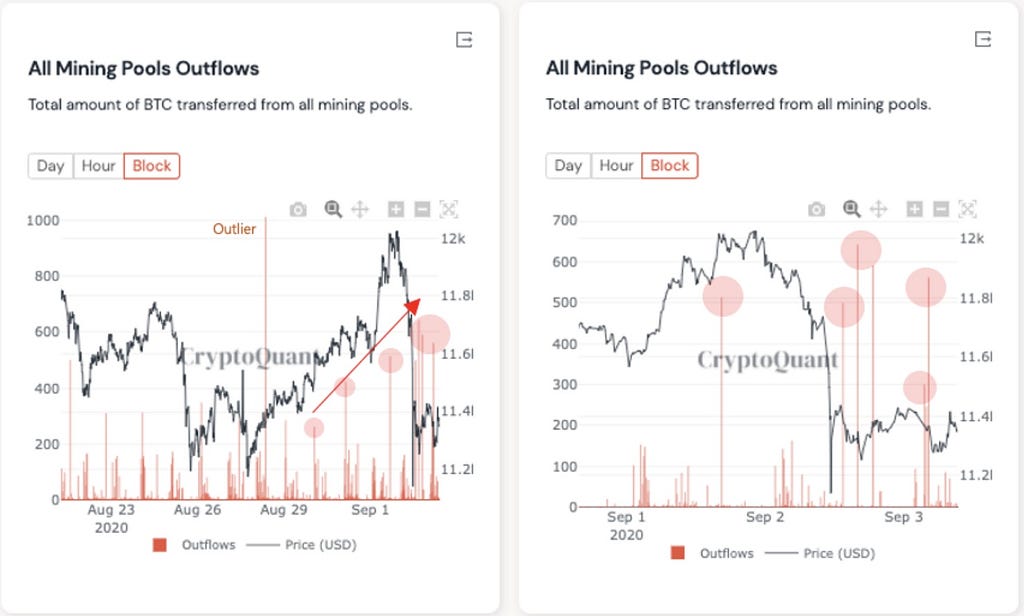

On-chain data/chart provider for investors CryptoQuant has tried to explain the recent solid and rapid price decline in the cryptocurrency market as triggered by massive Bitcoin outflows from the mining pools:

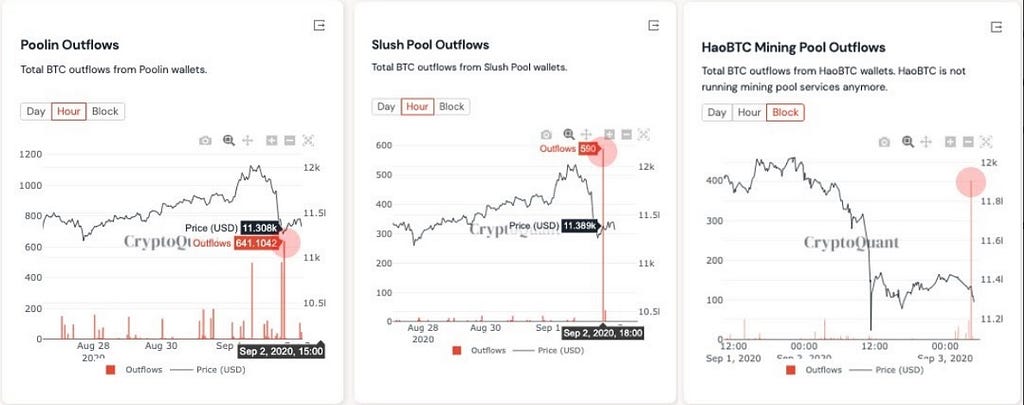

According to CryptoQuant’s data, three mining pools (Poolin, Slush, and HaoBTC) withdrew 1,630 BTC on Wednesday, September 2nd:

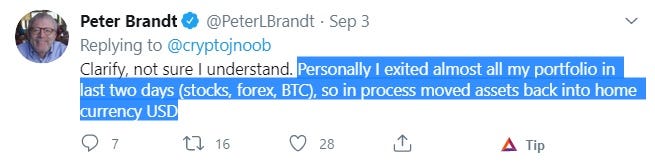

On the eve of the solid pullback in the crypto market, the well-known trading veteran and technical analyst Peter Brandt got rid of all positions on the stock and currency markets and also sold his Bitcoins. He shared his trading decisions with his subscribers on Twitter on September 3rd:

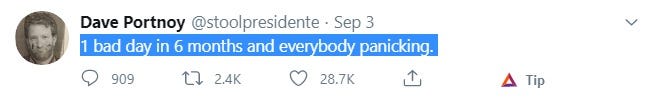

However, some other famous people involved in the cryptocurrency sphere remain bullish. For example, Dave Portnoy, the online sports celebrity founder of Barstool Sports, advised his followers on Twitter not to panic:

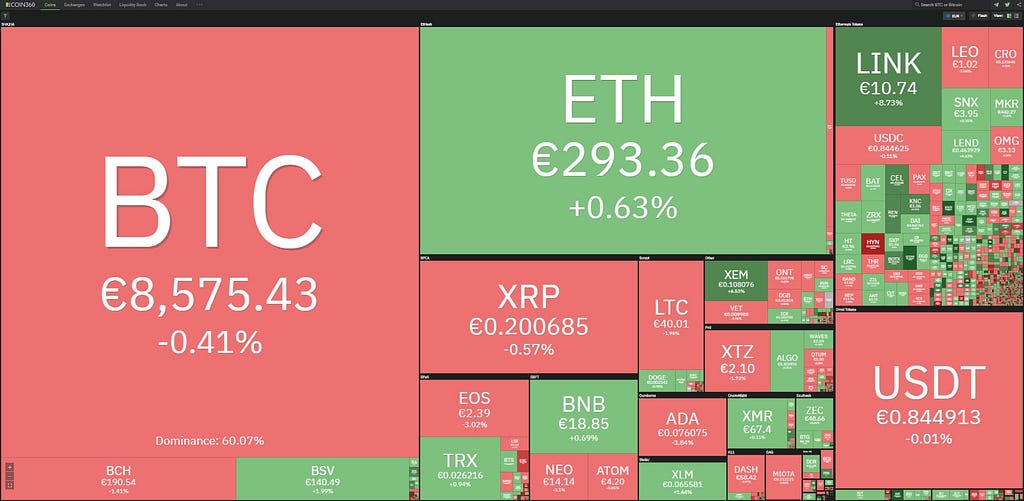

After the recent bloodbath, the crypto market is healing. At the time of writing, according to Coin360.com, one Bitcoin costs €8,575.43 (-0.41%), one Ethereum — €293.36 (+0.63%), and one Litecoin — €40.01 (-1.96%):

Now let’s check the price charts of the major cryptocurrencies against the euro.

BTC/EUR

In the first days of September, BTC/EUR has already dropped below the lowest level for August, thus forming a bearish candlestick in the monthly chart (MN) with a local low below the previous one — a signal indicating that the bears are trying to take control over the market:

However, it is worth mentioning that in the daily time frame (1D), BTC/EUR is approaching the previous local low or a level of approximately €7,984:

That’s why it is highly probable that Bitcoin will receive support at the level of the previous local low and the pair may rebound very soon.

ETH/EUR

In the weekly price chart (1W), ETH/EUR formed a solid Bearish Engulfing — a bearish reversal pattern, usually occurring at the top of an uptrend:

If the bears continue to dominate the market, then ETH/EUR may drop to the lower line of a potential ascending channel (uptrend) in the daily time frame (1D):

If the price of Ethereum drops to the lower line of the ascending channel, we will wait for a price rebound (buy signal) to open a long position.

LTC/EUR

In the daily chart (1D), the market sell-off has brought the price of Litecoin back to the upper line of the Falling Wedge:

In our estimation, the bulls will fiercely defend the upper line of the Falling Wedge. That’s why if LTC/EUR can bounce off the upper line, we will open a long position.

Stay updated on everything Bitcoin-related with Bitvalex. Bitvalex is a licensed digital wallet and cryptocurrency exchange; learn more about us and blockchain technology and sign up to use our services.

The analysis is purely informational and does not constitute investment, financial, trading, or any other sort of advice and you should not treat any of Bitvalex’s content as such. Bitvalex does not recommend that any cryptocurrency should be bought, sold, or held by you. You are solely responsible to conduct your own due diligence and consult an advisor before making any investment decisions.

Originally published at https://bitvalex.com.

https://twitter.com/thecapital_io

CryptoQuant: Miners Moving Unusually Big Amounts of BTC — Price Analysis, 7 Sep 2020 was originally published in The Capital on Medium, where people are continuing the conversation by highlighting and responding to this story.

from The Capital - Medium https://ift.tt/3h4wepf

0 Comments