DeFi in simple words

What is DeFi? Why do you need it? Let’s talk about DeFi in simple words: the most discussed topic in crypto today.

Check out our new platform: https://thecapital.io/

Hi! I’m Garri, the co-founder and CEO of the Moni project. Me and my guys from the Moni team made it a rule to speak to each other on certain days with presentations on different topics, and share text versions here. Today’s topic is DeFi. Let’s go!

More than one and a half billion people don’t have access to banking services, even such primitive ones as money transfer. DeFi aims to give an opportunity to everyone on the planet to use financial services.

Bankless is the way to freedom, sovereignty, and financial independence.

What are the benefits of Bankless?

1. Reduced dependence on central banks

2. Reduced dependence on commercial banks

It would be a mistake to claim that bankless fans hate banks. Rather, the banks are no longer needed by society. At least in the context of using crypto.

People who once made a trip to “NoBank Land” will eventually see two perks:

* Perk 1: more pure crypto value than in the traditional system;

* Perk 2: more bank transactions on cryptosystems than in the traditional system.

So, what is Defi?

Cryptocurrency promises to make money and payments public, regardless of the location of the user.

The movement of decentralized finance (DeFi) or open finance is taking this promise a step further. For a better understanding, it is possible to present a global open alternative to any of the financial services you know: savings, loans, trading, insurance, etc. And this alternative is available to anyone on the planet Earth, only a smartphone and Internet connection are needed.

Slowly but surely, this scenario becomes real with the help of smart contracts on the Ethereum blockchain.

Smart contracts are programs that work on the blockchain. They are executed automatically if certain conditions are met. Essentially, they are scripts in a decentralized field.

DApps are built using combinations of different smart contracts.

You can think of DApps as applications built on top of decentralized technology, rather than created and controlled by one centralized organization or company.

There are decentralized DeFi-applications that allow you to create stablecoins (crypto backed by U.S. dollar or other currency), borrow money, trade assets, open long or short positions on assets, and implement automated investment strategies.

The key differences between DeFi and traditional services are:

- DeFi companies’ operations are not managed by any institution or its employees.

All management rules are pre-defined in a protocol (or smart contract, as mentioned above). Once a smart contract is deployed on blockchain, DeFi applications can run on their own with little or no human intervention (although in practice developers often support decentralized applications with updates or bug fixes).

- Blockchain is transparent so anyone can check it out.

It gives users confidence because everyone has the opportunity to understand the functionality of the contract or find any possible mistakes. All transactional activity is available on every participant as well. Although this may raise privacy issues, transactions are by default pseudoanonymous, i.e. not directly linked to anyone’s true identity.

- DApps are designed to be global from the start.

No matter wether the user is in Texas or in Tanzania, he always has access to all services and DeFi networks. Of course, local rules can also apply, but from a technical point of view, most DeFi applications are available to anyone with an Internet connection.

- “Permissionless” to create, “Permissionless” to participate.

Anyone can create DeFi applications, and anyone can use them. Unlike traditional finance, there are no gatekeepers or accounts with tons of paperwork. Users interact directly with smart contracts from their crypto wallets.

- Flexible user interface.

You don’t like the interface of a certain application? No problem! You can use a third-party interface or create your own. Smart contracts are like an open API, and anyone can create an application.

- Compatibility.

New DeFi applications can be created or composed by combining other DeFi products (just like Lego bricks): for example, stablecoins, decentralized exchanges and forecasting markets can be combined to create completely new products.

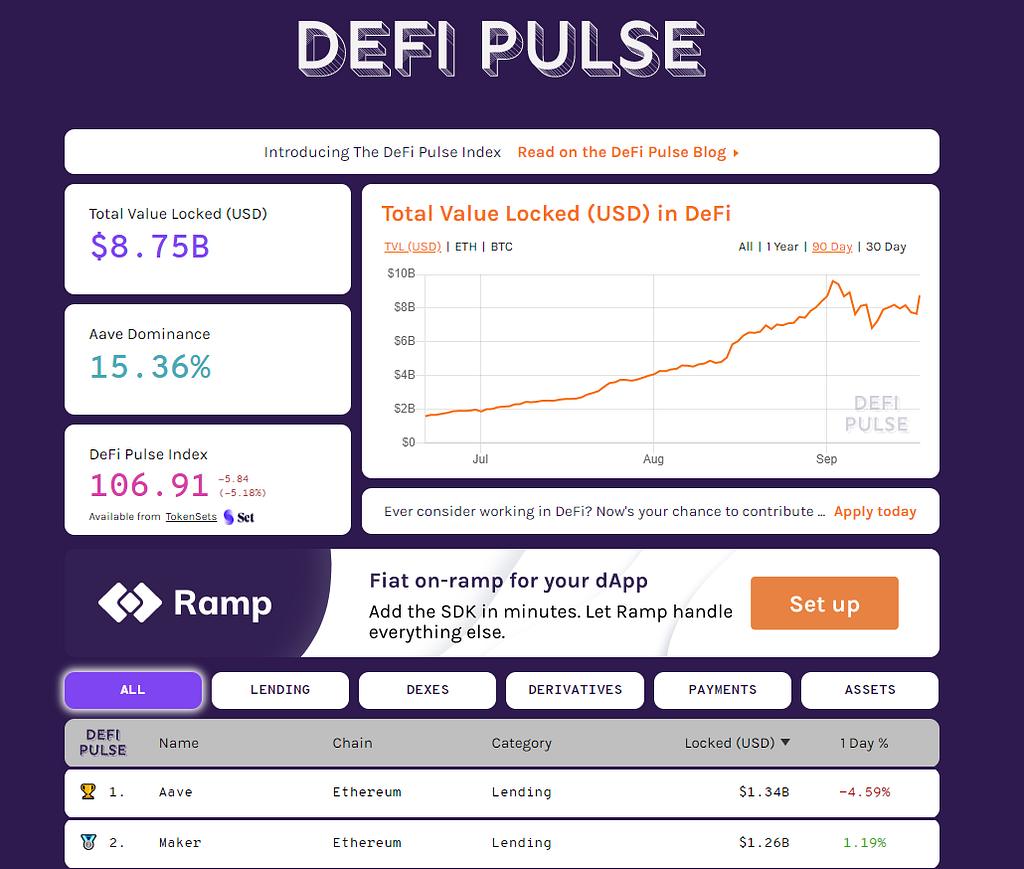

DeFi is the fastest growing sector in crypto at this moment, closely followed by NFT tokens.

That now it is possible to feel (basic), let’s check:

- An example for each and eveyone! MakerDAO (a stablecoin and a decentralized reserve bank)

Maker is a project in which each stablecoin (DAI) is linked to the U.S. dollar and secured by cryptography. Stablecoins offer programmability of crypto without the flip side of volatility, which can be observed with “traditional” crypto such as Bitcoin or Ethereum.

You can create your own DAI stablecoin in Dapp Maker Oasis. However, Maker is more than just a stablecoin project. It aims to become a decentralized reserve bank. People who own a separate but tethered token (MKR) can vote on decisions such as the stability fee (similar to how the Federal Reserve Committee on Open Markets votes regarding the Fed’s rate).

Another stablecoin with a different architecture is the USD Coin (USDC), where each USDC token is provided with one US dollar stored in a verified bank account.

- Credits and Deposits: Compound and Aave

Compound is a decentralized application for borrowing and lending. You can borrow your crypto and receive interest on it. Or, maybe you need money to pay for rent or buy products, but all of your funds are invested in crypto? You can put your crypto into Compound’s smart contract as collateral and borrow against it. The Compound contract automatically analyzes borrowers and lenders and dynamically adjusts interest rates according to demand and supply.

- Automated Decentralized Exchanges: Uniswap

Uniswap is a cryptocurrency exchange, working on smart contracts, which allows you to trade popular tokens directly from your wallet.

It is different from an exchange such as Coinbase, which custodially stores crypto.

Uniswap uses an innovative mechanism (known as Automated Market Making) to automatically calculate trades close to the market price. In addition to trading, any user can become a liquidity provider by providing crypto under a Uniswap contract and receiving a share of commissions. This is called “pooling.”

Augur Prediction Market

This is a decentralized market-based forecasting protocol. With Augur, you can vote on the outcome of events. Forecasting market platforms such as Augur and Guesser are just emerging, but offer a glimpse into the future where users can make more accurate forecasts based on the other users’ experience.

- Synthetix.

Synthetix is a platform that allows users to create and exchange Synthetic versions of assets such as gold, silver, crypto and traditional currencies such as euro. Synthetix assets are backed by redundant collateral in Synthetix contracts.

- Win-win economic games: PoolTogether

The DeFi component opens up endless new possibilities. PoolTogether is a lossless game where participants bring DAI stablecoins to a common pool. At the end of each month, one lucky user wins all the interest earned, and everyone gets their initial deposits back.

Done! The report is over… for now. Tomorrow I will tell you more about Uniswap. Stay in touch, see ya tomorrow!

If you liked the post, please, subscribe, leave a comment and a few claps!

Join our waitlist, we have bonuses for early users!

Don’t forget to subscribe: Twitter, Telegram.

https://twitter.com/thecapital_io

DeFi (DeFi) in simple words was originally published in The Capital on Medium, where people are continuing the conversation by highlighting and responding to this story.

from The Capital - Medium https://ift.tt/367qnO9

0 Comments