Check out our new platform — https://thecapital.io/

The US Dollar Index lost more than 10% of its value since March 19 and is now trading near the lowest level since May 2018.

Historically, a weak US Dollar has been beneficial for risk assets, such as equities, and commodities. There has been a significant difference in asset returns for the years when the dollar gained value as compared to the years when the dollar lost value.

As the data shows, Dollar strength impacts the performance of Gold and international equities negatively as these risk assets tend to perform poorly. On the other hand, dollar weakness helps risk assets to gain value. Gold gained value 80% of the time in years of dollar weakness while the precious commodity was up only 42% of the time in years of dollar strength. So, a weak US Dollar could be really good news for your investment portfolio, but you might be missing something big.

Cryptocurrencies

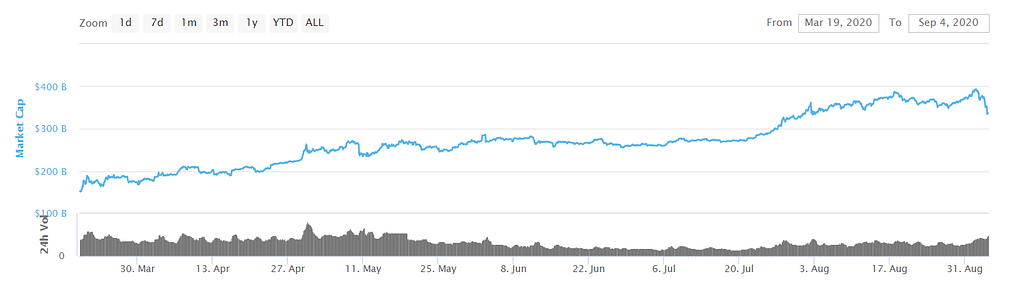

Cryptocurrencies have gained immense popularity in the last few years, either we talk about adoption or increase in market capitalization, the crypto market has been the hottest topic of discussion in financial markets. A weak US Dollar has been beneficial for the crypto market way more than any other asset class. While Gold jumped around 30% since March 19 amid dollar weakness, cryptocurrencies recorded a gain of more than 120% in the same period.

Total Market Capitalization of Cryptocurrencies

Bitcoin, the largest cryptocurrency in the world has outmatched Gold returns of 30% with an astonishing gain of almost 100% since March 19, making it the best performing asset this year. The biggest difference between the current crypto rally as compared to previous rallies is that this time institutional money is coming into cryptocurrencies.

New U.S. Securities and Exchange Commission filings show that American asset management firm, Fidelity Investments, with over $2.5 trillion in assets under management is preparing to launch a Bitcoin Fund. Cryptocurrency asset management firm Grayscale recently announced that it has managed to bring $217 million investment in its cryptocurrency products in less than a week after running crypto TV commercials on CNBC, MSNBC, and FOX BUSINESS. The biggest reason behind recent adoption and increase in demand is the dollar weakness. Analysts are predicting a long-term dollar weakness amid weak economic data, fear of global credit crunch due to coronavirus, and a negative market sentiment regarding the US Dollar. A large number of Millennials and Generation Z retail investors are betting big on digital assets like Bitcoin as they prefer a decentralized form of money over the US Dollar.

https://twitter.com/thecapital_io

Dollar weakness and the rise of cryptocurrencies was originally published in The Capital on Medium, where people are continuing the conversation by highlighting and responding to this story.

from The Capital - Medium https://ift.tt/35ayskG

0 Comments