Bitcoin has sustained a strong drop over the past few days as legacy markets have undergone a strong correction after a record rally. The leading cryptocurrency traded around $9,800 on Friday morning as bears sent the cryptocurrency lower.

This is a stark correction from the $12,000 local highs seen just days ago and the $12,500 seen in August.

Bitcoin remains bullish on a macro scale, though, as analysts note that the asset’s long-term chart and fundamentals remain skewed to appreciation.

Related Reading: These 3 Trends Suggest BTC Is Poised to Bounce After $1,000 Drop

Bitcoin Remains Bullish on a Macro Time Frame: Analyst

Bitcoin remains bullish on a macro scale despite the recent drop, one analyst noted in the wake of the correction.

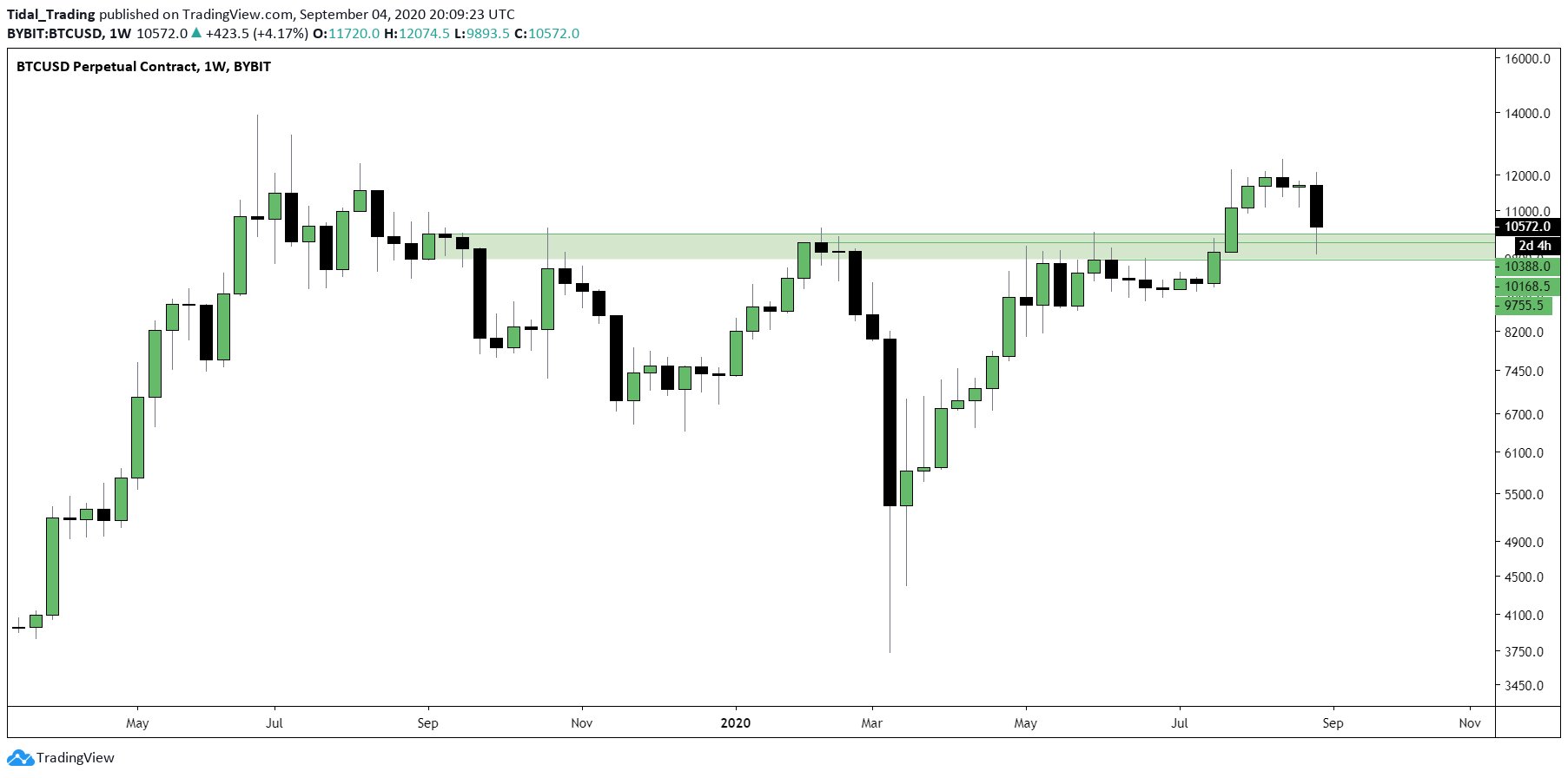

He shared this chart below, which shows BTC printing a clear bounce off a pivotal macro level, suggesting it has turned into support. Not to mention, BTC is currently in a macro bullish market structure due to the break above $10,500 just weeks ago.

Also discussing how Bitcoin’s funding rate on BitMEX and premium crashed as investors sold the cryptocurrency in mass quantites, the

“$BTC funding and premium index reached the lowest it had been since March 19th yesterday… Except this time we’re retesting a multi-year S/R level with a confirmed bullish break in MS all the way up to the monthly chart…”

Chart of BTC's macro price action with analysis by crypto trader HornHairs (@CryptoHornHairs on Twitter). Chart from TradingView.com

Adding to this, Bitcoin’s relative strength index, a measure of the severity of price action, reached notable lows during the drop on Friday. The commonly-used indicator hit the lowest value since the March capitulation.

After March’s crash, BTC underwent a strong bounce that brought it back to pre-crash levels within three months.

Related Reading: There’s an “Unusual” Amount of Bitcoin Sellling Pressure From Miners

Not the Only One That Thinks So

This trader isn’t the only one that thinks Bitcoin is still positioned to appreciate in the longer run. Raoul Pal, CEO of Real Vision, commented last week on comments from the Federal Reserve’s Jerome Powell on future inflation:

“Most people don’t understand the latter but is simply put, Powell has shown that there is ZERO tolerance for deflation so they will do ANYTHING to stop it, and that is good for the two hardest assets – Gold and Bitcoin. Powell WANTS inflation. I don’t think he gets true demand push inflation but he will get fiat devaluation, in conjunction with the other central banks all on the same mission.”

Others that have shared bullish long-term sentiments include Arthur Hayes of BitMEX, Mike Novogratz, and Pantera’s Dan Morehead.

Related Reading: Here’s Why This Crypto CEO Thinks BTC Soon Hits $15,000

Featured Image from Shutterstock Price tags: xbtusd, btcusd, btcusdt Charts TradingView.com This Simple Chart Shows Why Bitcoin Remains Bullish on a Macro Scale

from NewsBTC https://ift.tt/31Xkvoi

0 Comments