Check out our new platform 🚀 https://thecapital.io/

Hi everyone,

Just like clockwork, the International Monetary Fund (IMF) has revealed the dire situation world economies find themselves in due to lockdowns, announcing that a water-shed Bretton Woods-style money renegotiation is at hand.

Under the Bretton Woods System, gold was the basis for the US dollar and other currencies were pegged to it until it came to an end in the 1970s, wherein the US Dollar standard effectively took over.

Back then, bitcoin did not exist. How will negotiations fare now that an opt-out solution is on the table?

Let’s dig in.

IMF calls for Bretton Woods-style monetary renegotiation

Just like in the Bretton Woods agreement in 1944, the International Monetary Fund (IMF) has called for a similar round of negotiations to ‘save the global economy.’ Back then, this history-making meeting aimed to solve the Triffin dilemma or Triffen paradox. In short, this is the conflict of economic interests that arise between short-term domestic and long-term international objectives for countries whose currencies act as global reserve currencies.

Today, these macro objectives are spreading further apart as a global currency war becomes more apparent. As such, various international players, which include organisations like the IMF, are attempting to navigate these waters, invariably to get the best deal that ensures their survival (at the very least).

If history is to repeat itself, then countries with the largest amount of gold reserves will have a front-seat at the negotiating table, namely the United States, China, Germany, and Russia.

In the massive revelation, Managing Director Kristalina Georgieva said that governments must work together to save the world from the economic fallout caused by lockdowns, which she says could be done by issuing the right economic policies.

How can we seize this new Bretton Woods moment to build forward to a better world after the pandemic? IMF Chief @KGeorgieva highlights three imperatives: implement the right economic policies, invest in people, and tackle climate change. #IMFmeetings https://t.co/2g6AzteLx0 pic.twitter.com/tDl9jJ6WhY

- IMF (@IMFNews) October 15, 2020

Among the list of vague and nebulous factors listed in this call to action was the importance of investing in people, supporting emerging economies and fighting climate change.

Of course, much of the feel-good talk is code for repackaging predatory loans for various economies, as is customary for organisations like the IMF and the world bank.

Interestingly enough, this announcement comes just as most central banks are ramping up discussions about central bank digital currencies ( CBDCs), which is no mere coincidence.

The question is: how will these CBDC’s be monetized?

According to the co-founder of BnkToTheFuture Simon Dixon, the idea is to “let private banks go bust” and issuing helicopter money directly through CBDCs which will empower central banks like never before.

CBDC’s would be issued through a government-approved mobile application which will have fully-automated features like automatic tax-collection, automated negative-interest rates (to encourage spending), black-listing of addresses, and easier control mechanisms, generally.

Indeed, if history is a guide, the promise of ‘free money’ is ultimately a trade-off one should be aware of, as various institutions and countries jostle for monetary control.

Later today, Federal Reserve chairman Jerome Powell is set to speak in a panel discussion on cross-border payments and digital currencies at the IMF’s annual meeting; all eyes will be on this development.

Technically speaking

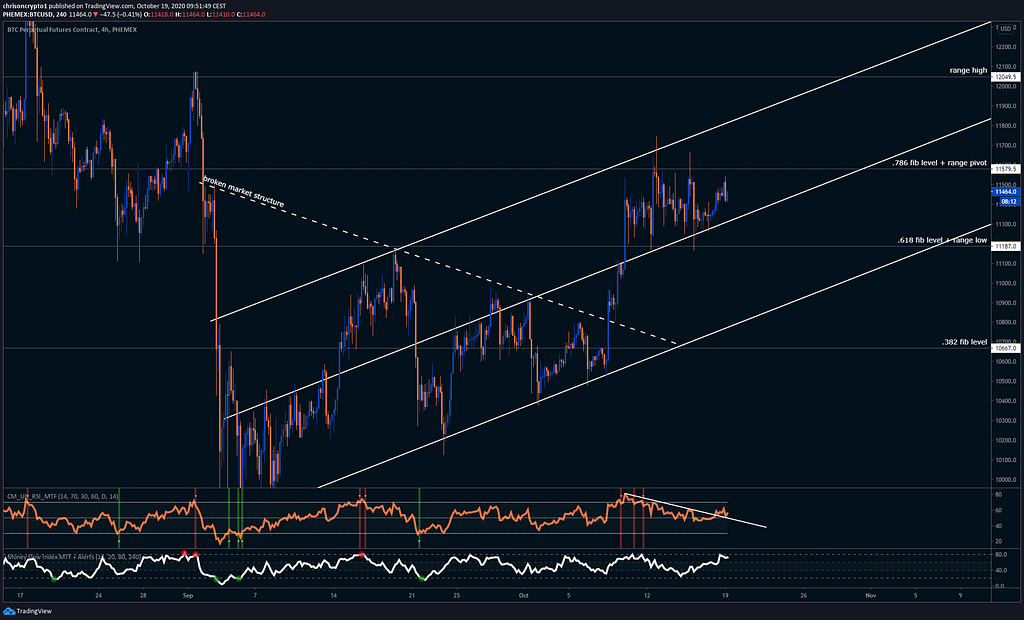

Bitcoin has traded within a tight range over the weekend between $11,187 and $11,579, as the crypto looks for a market signal to provide directional impetus.

Presently, the prospect for continued upside after consolidation is technically higher than the possibility for a reversal.

Bearing in mind that bitcoin has already broken out of mid-term market structure to the upside — testing the $11,500 area seven times since the breakout on the 8th of October — the burden lies on bulls to push through towards $12,000.

On the flip-side, a decisive break below the $11,187 would inform a move towards $10,900, i.e. the .618 fib retracement level of this impulse move as delineated below.

To my estimation, both scenarios are preludes to further upside in the coming weeks. Pending a legacy market catastrophic failure, bitcoin is poised to continue grinding towards higher levels, largely due to the significant technical level that held just a few weeks ago — the 20-weekly EMA. As long as bitcoin remains above this key indicator, then all medium term time-frames remain technically bullish.

Levels to watch

- 4-hour close above $11,579 for an impulse move to $12,000.

- 4-hour close below $11,187 informs a move to $10,900.

- Macro-breakouts above or below $12,050 & $10,667 inform continuation to either side, respectively.

Onward bitcoin Spartans.

Catch you next time.

Share this content on your socials. Appreciate your support!

Join theTelegram channel for live updates!

Follow me onTwitter & Instagram for more lighthearted content.

Referrals, business opportunities and feedback are also appreciated.

Read More: Unstoppable: the investment case for Bitcoin in 2021

Are you a frequent reader? Tip me! Send

BTC to this address:

3EydsEYpjHn68axKnCUqBB7EbqcxrEjamr

Best regards,

Christopher Attard

Founder of Chris on Crypto

Contributor to www.cityam.com

Connect directly on: Telegram

Originally published at https://mailchi.mp.

https://twitter.com/thecapital_io

IMF calls for a Bretton-Woods-style Money Renegotiation was originally published in The Capital on Medium, where people are continuing the conversation by highlighting and responding to this story.

from The Capital - Medium https://ift.tt/3m7PEwm

0 Comments