Check out our new platform: https://thecapital.io/

Hi everyone,

Bitcoin is setting up to breakout today as US politics and talks of financial stimulus continue to make the rounds and drive markets. Meanwhile, fresh corona-virus data seems to indicate a disconnect between public discussions and the facts on the ground.

Last but by no means least, fresh on-chain bitcoin miner data suggests the industry is nowhere near the next all-time high.

Let’s dig in.

US politics calling the shots as new Corona data emerges

It’s safe to say that October is full of surprises, and we’re barely a week in.

Just yesterday, Trump pumped the brakes on a new round of stimulus funding, and markets responded in kind; dropping dramatically on Tuesday.

The President announced the decision on Twitter, saying, “We made a very generous offer of 1.6 Trillion Dollars and, as usual, she [Nancy Pelosi] is not negotiating in good faith.”

Nancy Pelosi is asking for $2.4 Trillion Dollars to bailout poorly run, high crime, Democrat States, money that is in no way related to COVID-19. We made a very generous offer of $1.6 Trillion Dollars and, as usual, she is not negotiating in good faith. I am rejecting their…

- Donald J. Trump (@realDonaldTrump) October 6, 2020

Stocks fell sharply, with the Dow dropping 0.9% and the Nasdaq dropping 1%. At the same time, however, Trump also announced a quick extension for another $25 billion in fresh payroll for American airlines, which are collectively burning through $5 billion every month as air traffic remains at 30% of 2019 levels.

The decision to postpone stimulus comes as a surprise, given that both parties are vying to win as much influence as possible before the election.

As it happens, it’s worth noting that unless we’re talking about a mathematically immutable technology like bitcoin, one should never take comfort in the false security of consensus.

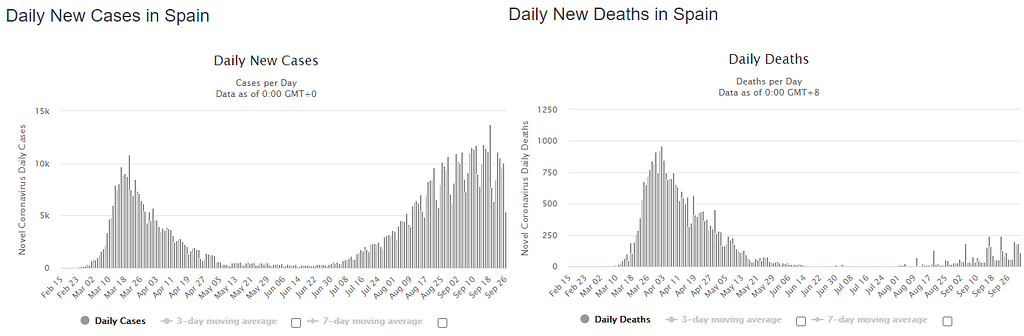

In light of fresh “second wave” corona-virus data, which indicates a significantly lower Infection Mortality Rate (IFR) than initial projections, there appears to be an unfortunate disconnect between political talking points and the facts on the ground.

Indeed, most data-sets across Europe show an increase in second-wave corona-virus detection coupled with significantly lower deaths, effectively indicating an inverse relationship between cases and the IFR.

With this new data coming out, it’s no longer contentious to say that corona-virus measures were overwhelmingly disproportionate to the posed threat, which brings into question whether such stimulus measures were warranted in the first place.

What if there was an honest debate about these findings instead?

At the moment, it looks like this is too much to ask for as fact-free assertions are made by politically-motivated individuals and snowflakes who will not look at the data. Hopefully, this will change sooner rather than later; but as you might have realised, this abject refusal to discuss things is really getting on my nerves.

Technically speaking

The time has come for bitcoin to make a move as the crypto approaches the apex of this consolidation structure.

Unfortunately for bitcoin, there appears to be little reason to analyze its price action without taking into consideration legacy stock markets, which are not only dictating the tone but are actively driving buying and selling pressures.

Per the above 4-hour chart, bitcoin is mirroring the S&P500 to the letter, which is to say that traders are paying close attention to US elections; more specifically, every Trump tweet.

Of course, this correlation is only temporary and could decouple at a moment’s notice. Indeed, when one takes into consideration bitcoin’s fundamentally improving picture, then this eventuality if a question of ‘when,’ not ‘if.’

Bitcoin in macro context

While breakout-price targets are more or less known and risk-adjusted per the last newsletter, what other metrics can we look at to further contextualize bitcoin’s behaviour?

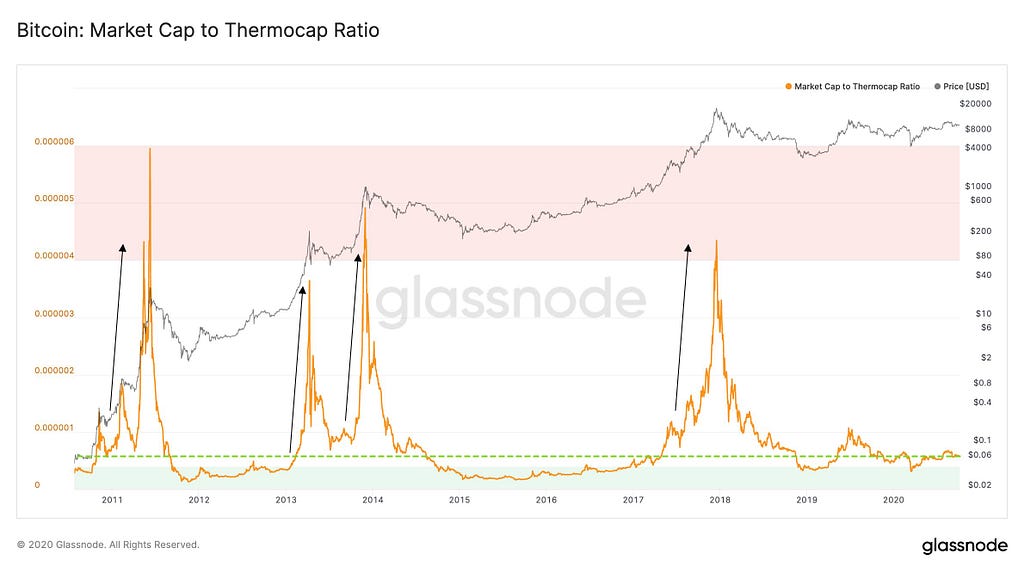

To this end, the Market Cap to Thermocap Ratio tells a compelling narrative. It shows significant upside potential for bitcoin when seen in light of previous market cycles. Per Glassnode, the ratio is used to assess if bitcoin’s price is currently trading at a premium with respect to ‘total security spend’ by miners, and is adjusted to account for the increasing circulating supply over time.

Technically, the ratio suggests a lot of room for growth given that it hasn’t even begun to show any sharp increases typical of bitcoin bull markets. In fact, current levels are an entire order of magnitude away from bitcoin tops.

While this data is not helpful for the immediate short term, it gives credence to the idea that bitcoin owners are earlier than early. This thesis lines up with prior cycles as well. Before bitcoin hit $1000, nobody believed it was possible until it happened. The same could be said for every other cycle as well as today’s apparent acceptance of bitcoin above the $10,000 level.

Bitcoin dominance reverses

As the DeFi bubble deflates and begins to come to terms with the fact that regulators will have to be dealt with in the not-too-distant future, investors continue to retreat into bitcoin and stablecoins.

Notably, though, it’s conceivable that bitcoin dominance does not experience a major rally beyond 2019 highs due to increased options for investors to diversify into stablecoins instead. Pending a major stablecoin regulatory crackdown or a re-calibrated method of measuring bitcoin dominance, then relative stability around the pivot point (60%-65%) is entirely possible moving forward.

To my estimation, a surge in bitcoin dominance will mark the start of the bull market, as altcoin-heavy portfolio investors ‘FOMO’ into the crypto when it outperforms typically volatile cryptocurrencies (with much to be desired in long-term value). After bitcoin reaches all-time highs, then it’s likely for alpha-seeking investors to begin diversifying into other assets once again. Naturally, this is all good speculative fun and might not happen.

In any case, there is a sense in this community that everyone knows what’s about to happen, despite the in-fighting and alpha-seeking degeneracy of late. When seen in context, what happens today will be a mere blip amidst and avalanche of capital inflows, innovation and monetary enlightenment.

Catch you next time.

Share this content on your socials. Appreciate your support!

Join theTelegram channel for live updates!

Follow me onTwitter & Instagram for more lighthearted content.

Referrals, business opportunities and feedback are also appreciated.

Read More: $9 Trillion later: US FED Eclipses Centuries of Money Printing

Are you a frequent reader? Tip me! Send

BTC to this address:

3EydsEYpjHn68axKnCUqBB7EbqcxrEjamr

Best regards,

Christopher Attard

Founder of Chris on Crypto

Contributor to www.cityam.com

Connect directly on: Telegram

Originally published at https://mailchi.mp.

https://twitter.com/thecapital_io

US Stimulus Talks Drive Markets as Bitcoin Teeters on a Big Move was originally published in The Capital on Medium, where people are continuing the conversation by highlighting and responding to this story.

from The Capital - Medium https://ift.tt/2I5jTp1

0 Comments