Check out our new platform 🚀 https://thecapital.io/

The Stock to Flow model treats Bitcoin as a scarce digital asset that should retain its long-term value, potentially better than gold or silver.

The S2F model treats Bitcoin as being comparable to commodities such as gold, silver, or platinum.

The S2F model of an anonymous Dutch institutional investor, known on Twitter as Plan B, has gained viral popularity and is used by Bitcoin supporters for price forecasts. However, its accuracy is approximately the same as that of the astrological models of the past for financial forecasts. But astrology was really considered a mathematical science at the beginning of the XX century.

Let’s find out what it is about.

What is Stock-to-Flow model?

In simple words, the Stock-to-Flow model is a way to measure the sufficiency of a certain asset. The stock-to-growth ratio is the amount of resources held in reserves divided by its annual production.

Usually, Stock-to-Flow is applied to natural resources. Take, for example, gold. This may be inaccurate data, but the World Gold Council estimates that a total of about 190 000 tons of precious metal was mined. This amount (i.e. the total supply) is what we call a “stock.” Meanwhile, about 2500–3200 tons of gold are mined annually. This amount is what we call an “increase.”

We can calculate the Stock-to-Flow ratio using these two initial parameters. But what does it really mean? Essentially, it shows how the annual market supply of a given resource relates to its total supply. The higher the Stock-to-Flow ratio, the less new supply is made to the market relative to the total supply. Thus, an asset with a higher Stock-to-Flow ratio should theoretically retain its value over a long period of time.

On the contrary, consumer and manufactured goods tend to have a low Stock-to-Flow ratio. Why is this the case? Because their value usually comes from being destroyed or consumed, reserves (inventory) generally exist only to cover demand. These resources do not necessarily have high value as property, so they usually do not serve well as investment assets. In some exceptional cases, the price may rise rapidly if there is an expectation of future shortages, but when this is not the case, production keeps pace with demand.

It is important to note that the deficit itself does not necessarily mean that a resource has value. Gold, for example, is not so rare — after all, there are 190 000 tons available! The Stock-to-Flow ratio indicates that it is of value because annual production, compared to the existing stock, is relatively small and constant.

What is the Stock-to-Flow ratio of gold?

Historically, gold has the highest Stock-to-Flow ratio of any precious metal. But what exactly does it matter? Let’s go back to our previous example, divide the total stock of 190 000 tons by 3200 and we get a Stock-to-Flow ratio of about 59. This tells us that at the current rate of production it will take about 59 years to cover 190 000 tons of gold reserves.

However, we should keep in mind that estimating how much new gold will be mined each year is just an estimate. If we increase annual production (growth) to 3 500, the stock-to-flow ratio will drop to about 54.

By the way, why don’t we calculate the total value of all the gold produced? This parameter, to a certain extent, can be compared to the market capitalization of cryptocurrencies. If we take the price of about $1500 per ounce of gold, the total value of all gold would be about $9 trillion. It sounds like a lot, but in fact, if we combine all the metal in one cube, this cube could fit in one soccer stadium!

For comparison, the highest total cost of the entire Bitcoin network was about $300 billion at the end of 2017, and at the time of writing, it was fluctuating around $130 billion.

Stock-to-Flow and Bitcoin

If you know how Bitcoin works, then you won’t have a problem understanding what the meaning of the application to its model Stock-to-Flow. In essence, the model looks at Bitcoin compared to scarce commodities like gold or silver.

Gold and silver are often referred to as a means of saving. They are supposed to retain their value in the long term because of their relative rarity and low growth. Moreover, it is very difficult to significantly increase their supply in a short period of time.

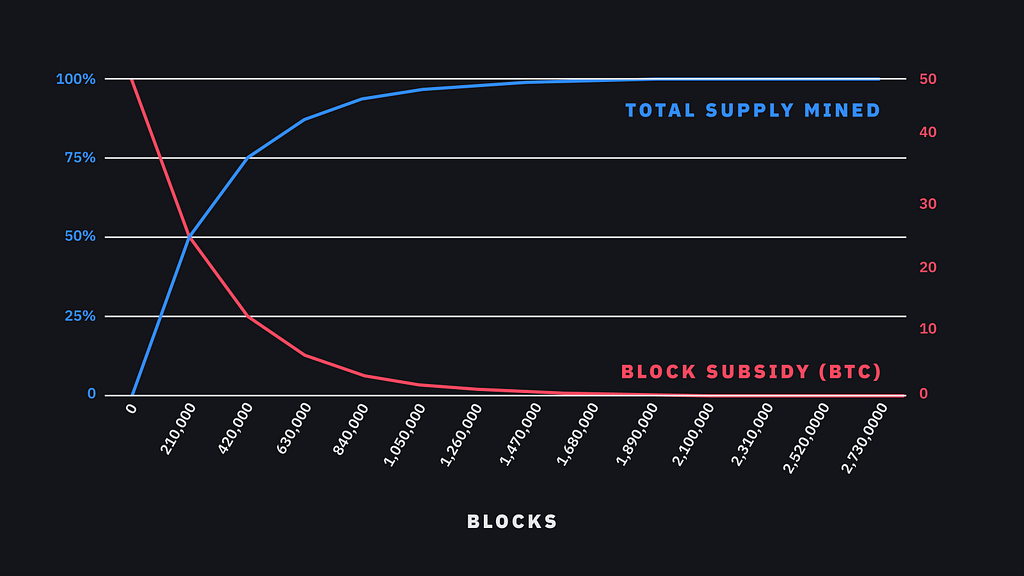

According to the Stock-to-Flow model supporters, Bitcoin is a similar resource. It is scarce, relatively expensive in production, and its maximum stock is limited to 21 million coins. In addition, the production of Bitcoin is predetermined at the protocol level, which makes its growth fully predictable. In addition, you may be aware of halvings, which result in a halving of the amount of asset produced that enters the system every 210 000 blocks (approximately every four years).

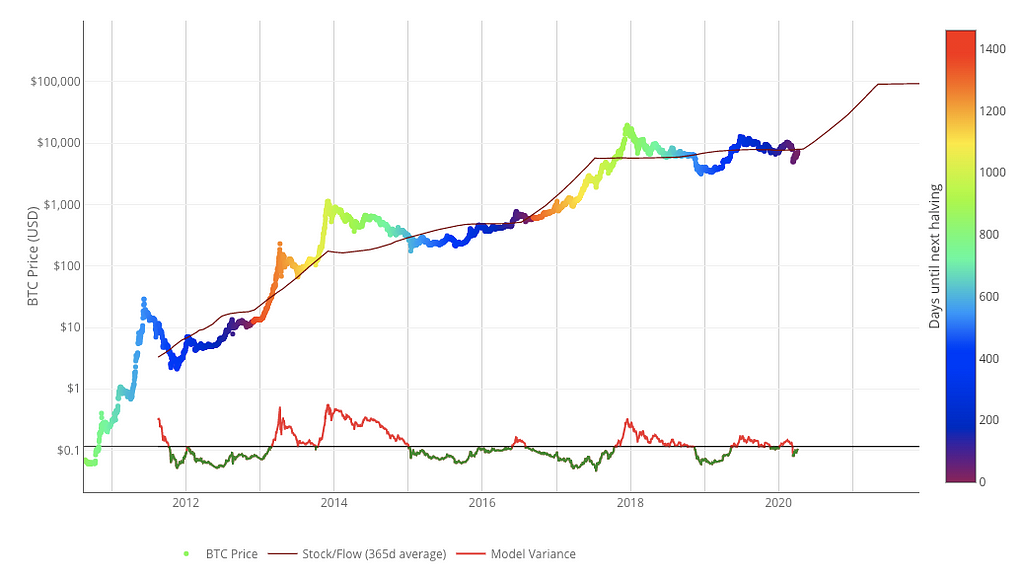

According to the supporters of the model, the combination of these properties creates a scarce digital resource, which has, in the long term, very convincing signs of a means of saving. In addition, they suggest that there is a statistically significant relationship between Stock-to-Flow and market value. The model predicts that the price of a bitcoin will increase significantly over time as the Stock-to-Flow ratio continues to decline.

The application of the Stock-to-Flow model to the bitcoin, in particular, is attributed to PlanB and its article “Modeling the cost of Bitcoin through deficit”.

What is the Stock-to-Flow ratio of Bitcoin?

The current number of bitcoins in circulation is approximately 18 million, while production is approximately 0.7 million per year. At the time of writing this article, the Stock-to-Flow ratio of bitcoins was around 25. After another halving in May 2020, this figure will increase to more than 50.

In the chart below, you can see the historical dependence of the 365-day moving average Stock-to-Flow Bitcoin line from its price. On the vertical axis, we also dated halvings of Bitcoin.

Limitations of the Stock-to-Flow model

Although the Stock-to-Flow model is of interest for deficit measurement, it does not take into account all parts of the picture. The models are as true as their underlying assumptions. Above all, Stock-to-Flow is based on the assumption that the deficit measured by the model is capable of managing value. According to Stock-to-Flow critics, the model would be untenable if Bitcoin had no other useful properties than supply shortage.

The deficit of gold, predictable supplies, and global liquidity has made the metal a relatively stable means of saving against depreciating fiat currencies.

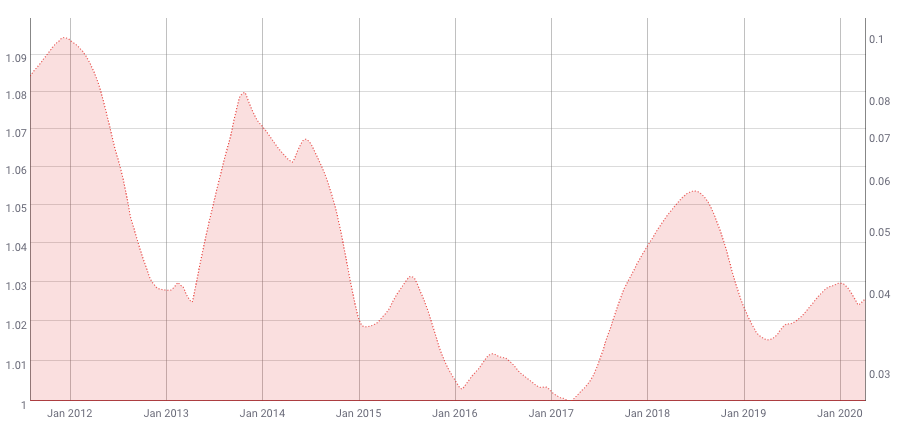

According to the model, the volatility of Bitcoin should decrease over time. This is confirmed by the historical data from Coinmetrics.

Estimating the value of an asset requires considering its volatility. The accuracy of forecasts using an estimating model can increase if the volatility is more or less predictable. Bitcoin, however, is notorious for its strong price movements.

Volatility can also decrease at the macro level, but since the moment of creation, Bitcoin price is determined by the free market. This means that it is under self-regulation of the open market, represented by users, traders, and speculators. The combination of this circumstance with relatively low liquidity should make Bitcoin more susceptible than other assets to sudden outbursts of volatility. Therefore, the model may not be able to take this into account.

Other external factors, such as economic Black Swans, may also undermine the model. However, it should be noted that the same can be said about almost any model that tries to predict the price of an asset based on historical data. The “Black Swan” level event, by definition, has an element of surprise. Historical data cannot account for unknown events.

Conclusion

The Stock-to-Flow model defines the relationship between the currently available resource and the rate of production. The model usually applies to precious metals and similar products, but there are also those who claim it applies to Bitcoin.

In this sense, Bitcoin can be considered a scarce digital resource. According to this method of analysis, the unique nature of Bitcoin mining should turn it into an asset that serves as a means of saving in the long term.

However, each model is as true as its underlying assumptions and it may not be able to take into account all aspects of Bitcoin price formation. Moreover, at the time of writing, Bitcoin has only existed for a little over a decade. From a certain point of view, long-term valuation models such as Stock-to-Flow can only claim to be highly accurate if more substantial data is available.

Learn more about Bitcoin and blockchain with our cloud mining platform Hashmart.io!

https://twitter.com/thecapital_io

What is the Stock-to-Flow model? was originally published in The Capital on Medium, where people are continuing the conversation by highlighting and responding to this story.

from The Capital - Medium https://ift.tt/3mqjrAO

0 Comments