Bitcoin’s Taproot Update Gets Approval, Due to Take Effect in Nov — Analysis, 14 June

Last week, miners around the world approved Bitcoin’s Taproot upgrade:

The Taproot upgrade, the most important one since the SegWit upgrade in 2017, is expected to take effect in November. Many blockchain experts believe that Taproot will increase the privacy and the efficiency of Bitcoin transactions.

But this is not the only positive news for the Bitcoin ecosystem. Tesla CEO Elon Musk reiterated that Tesla sold only 10% of its BTC holdings and outlined that it would resume allowing Bitcoin transactions if the cryptocurrency’s mining process becomes more environmentally friendly:

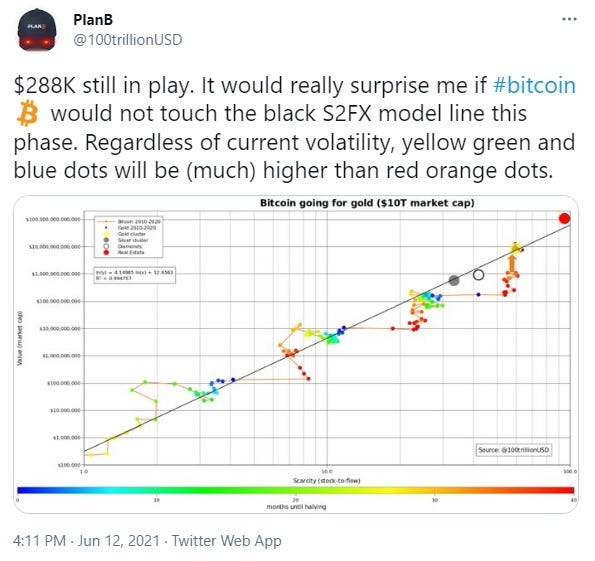

Well-known Bitcoin bull PlanB underlined that the Bitcoin price target of $288,000 for the current market phase remains in place:

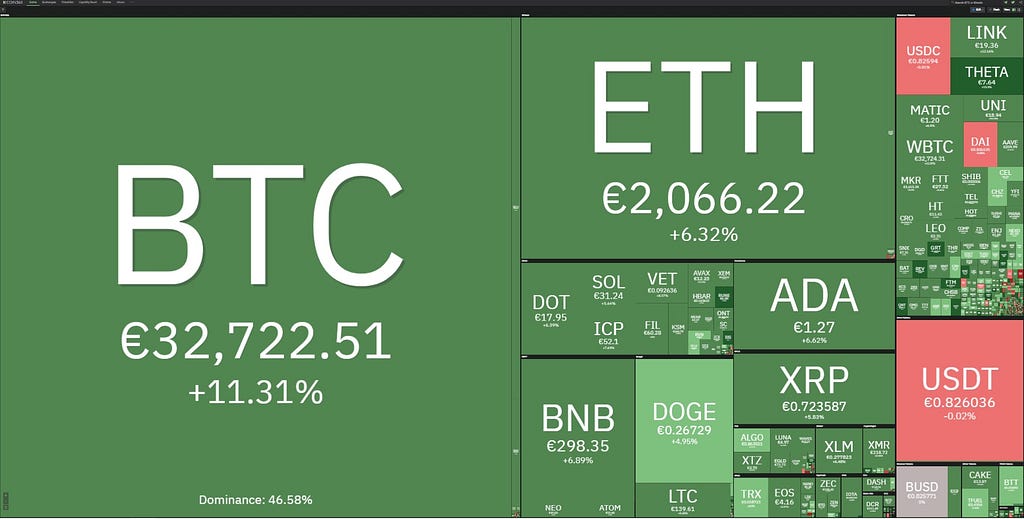

The positive news from last week has supported the cryptocurrency prices. The Monday market starts with a solid price rebound. According to Coin360.com, one Bitcoin costs €32,722.51 (+11.31%), one Ethereum — €2,066.22 (+6.32%), one DOGE — €0.2673 (+4.95%), and one UNI — €18.94 (+10.19%):

Now, let us analyze the price charts of the leading cryptocurrencies against the euro in the most notable time frames.

BTC/EUR

In the weekly chart (1W), last week BTC/EUR formed a Hammer candlestick after the Doji from the previous week:

The Hammer technical pattern is a candlestick formation occurring at the bottom of a price correction and usually marks the beginning of an uptrend renewal. That’s why the chances of a price rebound are increasing.

Moreover, in the 1-hour chart (1H), BTC/EUR has just gone through the resistance line:

We consider this breakout as an initial bullish signal pointing to a potential resumption of the uptrend. In our view, if the price doesn’t drop again below the resistance line, some more aggressive traders will start opening long positions.

ETH/EUR

In the daily chart (1D), ETH/EUR continues to move forward within the Ascending channel (uptrend):

Although there is an Ascending channel, traders with long positions have to be very cautious because, as it is visible in the chart, the 30-day Moving Average (MA 30) is approaching the 90-day Moving Average (MA 90), and a Moving Average Crossover may take place. If it happens, we will consider it a small bearish signal because, according to the Technical Analysis theory, the Moving Average Crossover is a trend reversal technical pattern.

DOGE/EUR

In the 4-hour chart (4H), the price of Dogecoin is consolidating between the 90-day Moving Average (90-day MA) and the 30-day Moving Average (30-day MA):

As can be seen from the chart, the 90-day MA is at the 38.2 Fibonacci retracement level (approximately €0.2305), and the 30-day MA is at the 61.8 Fibonacci retracement level (approximately €0.2821). We expect DOGE/EUR to remain range-bound between these two levels throughout this week. However, if there is some major shift in the cryptocurrency market, it will also affect the price dynamics of DOGE/EUR.

UNI/EUR

As we already outlined in our previous analysis, in the daily chart (1D) of UNI/EUR, a Moving Average Crossover (common trend reversal technical pattern) had taken place:

As can be seen from the chart, the 30-day Moving Average (MA 30) is still below the 90-day Moving Average (MA 90). That is why we prefer to stay away from this cryptocurrency pair.

However, in the 4-hour chart (4H), it seems that UNI/EUR is trying to form an Ascending channel:

If the price continues its journey within this channel, a bullish signal may appear and revoke the bearish signal coming from the Moving Average Crossover. That is why it is worth keeping an eye on the price chart of Uniswap in the different time frames.

Stay updated on everything Bitcoin-related with Bitvalex. Bitvalex is a licensed digital wallet and cryptocurrency exchange; learn more about us and blockchain technology and sign up to use our services.

The analysis is purely informational and does not constitute investment, financial, trading, or any other sort of advice and you should not treat any of Bitvalex’s content as such. Bitvalex does not recommend that any cryptocurrency should be bought, sold, or held by you. You are solely responsible to conduct your own due diligence and consult an advisor before making any investment decisions.

Originally published at https://bitvalex.com.

Check out our new platform 👉 https://thecapital.io/

https://twitter.com/thecapital_io

Bitcoin’s Taproot Update Gets Approval, Due to Take Effect in Nov — Analysis, 14 June was originally published in The Capital on Medium, where people are continuing the conversation by highlighting and responding to this story.

from The Capital - Medium https://ift.tt/3cIkBFg

0 Comments