Next month, Ethereum’s “London” hard fork will go live, and with it comes Ethereum Improvement Proposal (EIP) 1559. One of the most significant but also controversial alterations to the Ethereum blockchain since the split between Ethereum and Ethereum Classic in 2016, EIP-1559 brings with it several changes to the way fees are set and distributed on the network.

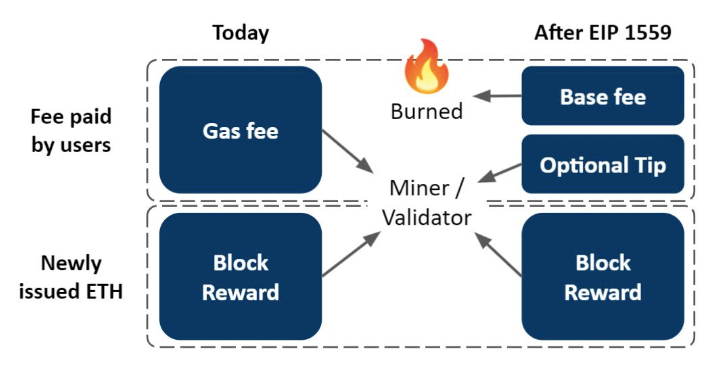

Traditionally, users include a “gas” fee in their transaction to incentivize miners to include it in the block, and fees are set by the highest bidder model. If you set your fee too low, other users might outbid your gas fee and your transaction may linger in the pool until it expires and is cancelled. This can lead to unpredictable and volatile fees during high usage times. The new model will set fees according to network usage with a variable “base fee,” which will be burned or destroyed, and only an optional tip will go to the miners. The base fee, or minimum fee, is automatically set by the Ethereum protocol based on usage and demand, aiming for 50% network utilization and drifting up or down to meet that goal.

Considering over $1 Billion was earned in transaction fees by miners in May, miners and mining pools are understandably upset about this change and have vocally opposed it over the past couple of months, organizing protests and even threatening to stall the network in a show of force against the upgrade. These actions have only led to Ethereum developers pushing up their desired timeline for a move to Eth 2.0, which would formally transition the Ethereum blockchain from proof-of-work to proof-of-stake, cutting out the miner’s role in securing the blockchain by basing security on staked assets, rather than hash power.

Since the base fee will be burned when the transaction is included in a block, therein lies the potential for Ether to be deflationary. If the amount of Eth burned, based on gas fees, is higher than the amount of Eth given as a block reward, the total amount of Eth generate per block would end up being in the negative. During previous network highs, this threshold would have been passed, and people believe this would create upward pressure on the price of Eth as the supply is slightly diminished.

When it comes down to it, EIP-1559 is a much-desired upgrade to the blockchain and could aid adoption as institutions and individuals can better predict how much they’ll need to spend to complete a transaction and how long it will take for that transaction to be confirmed. Clarifying how much and how long is extremely important for wider adoption and acceptance among the greater financial community.

Cheers, and thanks for reading.

- JefeDix

Disclaimer: None of this is to be considered financial advice. Of the cryptocurrencies mentioned, I hold Eth.

Check out our new platform 👉 https://thecapital.io/

https://twitter.com/thecapital_io

Ethereum’s EIP-1559 Goes Live Next Month, Here’s a Quick ELI12 was originally published in The Capital on Medium, where people are continuing the conversation by highlighting and responding to this story.

from The Capital - Medium https://ift.tt/2TjPRDH

0 Comments