What is money? A medium of exchange for value between two parties. The currency must be durable. It must be portable; gold is not good money. It must be fungible, with no difference among others. It must have verifiability and authenticity. It must be divisible and have a level of scarcity.

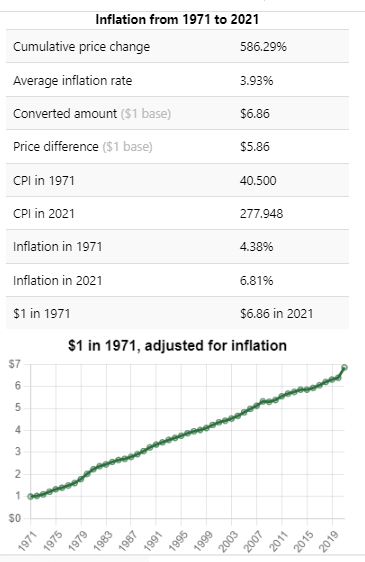

Why do people broach alternative money to the US Dollar and worry about its value? This elaborate question begins with the short history of money in the last hundred-fifty years. Although gold is not portable, its value has remained relatively the same, thus making it an asset you can stake value. Since 1880, the United States has had two gold-standard periods. “The first was from 1880–1914, known as the classical gold standard”. “Congress passed the “Gold Standard Act” fixing its price at $20.67 an ounce”. Secondly, the “Bretton Woods system in which most countries settled international balances in US dollars.”. This period lasted until 1971 when President Richard Nixon announced the US would no longer redeem currency for gold. A pivotal move for the global economy fifty years later. Without a safety net, how has the global economy faired in terms of inflation and bankruptcy? A decade later, “Mexico becomes the first of many Latin American nations to have a debt crisis.”. “Twelve years later, the Mexican peso devalued, prompting IMF $50 billion-program to stabilize Mexican economy. Followed by Russia and Brazil seeking financial assistance”. “15 years later, another financial crisis, this time in Asia. Thailand, Indonesia, and South Korea seeking billions of dollars in financial assistance from the IMF.” Fast-forward to the infamous 2008 crisis, where the US now required a bailout. A domino effect led to another continent facing a financial collapse. “Several European nations: including Cyprus, Greece, Ireland, and Portugal, required IMF bailout between 2010 and 2013”.

Fifty years, four continents, four massive financial collapses due to bailout from the IMF, and consumer purchasing power rapidly decreasing. The one benefit stemming from the 2008 collapse is the birth of Bitcoin. What is Bitcoin, “Bitcoin is a purely peer-to-peer version of electronic cash that would allow online payments to be sent directly from one party to another without going through a financial institution”. Let us review what money is about Bitcoin. Money has to be durable and portable. Bitcoin is digital money stored on an immutable ledger called a blockchain. Bitcoin utilizes a digital wallet, either a wallet(mobile app) on a phone or a hardware wallet that works like a USB. Money must be fungible, meaning there is no difference between that and the currency. One Bitcoin is the same as that of another. Money has verifiability, and Bitcoin is verified on the blockchain. Money is divisible, Bitcoin is divisible in terms of Satoshi. A satoshi is a millionth of one Bitcoin. One difference between many fiat currencies and Bitcoin is its scarcity. Fiat currencies are controlled by central entities. Central entities can manipulate the value of the currency by printing. According to “The Bitcoin Standard”, “Bitcoin has unforgeable costliness, it is difficult to mine due to its electric cost, thus making it scarce.”. Bitcoin has a set supply of 21 million and practices halving, or the use of cutting the block reward in half to de-incentivize mining more Bitcoin. These processes are to inflation the coin and make it more scarce.

Why not go back to a gold standard? The obvious answer, the lack of portability and divisibility make gold a terrible use as money. Unpacking the history of money for the last 150 years, one theme you find is centralization. The IMF, Bretton Woods, or Congress, relying solely on a central entity for the global economy, has only caused financial collapse across multiple continents and higher and higher levels of inflation. Re-instituting gold as the standard is a slippery slope for one nation to control its supply and force the global economy to succumb to that nation, thus creating a cyclical system of the financial collapse we witness today. Let us do a deep dive into the Stock-to-flow ratios of the two assets.

What is a Stock-to-Flow Ratio? Stock-to-Flow is an investment model that measures an asset’s current stock against the rate of production or the total amount mined over a year. A high Stock-to-Flow ratio results in low inflation. A low Stock-to-Flow ratio results in high inflation. The estimated S2F ratio of Bitcoin is 62, and the S2F of Gold is 57. The halving process will result in an increased S2F ratio of Bitcoin. Although the S2F ratio does not determine the price of an asset, a low S2F ratio has resulted in a currency collapse. The Stock-to-Flow Ratio goes a long way in determining the success of a currency and its value as money.

Bitcoin as Money was originally published in The Dark Side on Medium, where people are continuing the conversation by highlighting and responding to this story.

from The Dark Side - Medium https://ift.tt/jDQ3uef

0 Comments