CRYPTOCURRENCY RESEARCH

What is the future of Harmony One?

In this article, we’ll look at Harmony and its significance in the realm of digital currencies. We’ll also explore what makes Harmony One appealing to many people, such as the clever method it handles its token, ONE. Let’s start with a definition of Harmony One. To comprehend it, we must first examine what prompted its construction. For a few years, Ethereum has showed enormous potential, but it wasn’t quite up to standard.

On a podcast, the CEO of Harmony One stated that Ethereum suffered with speed and performance. As a result, they set out to build a blockchain system that was not only fast and widespread, but also extremely safe, with the ability to serve billions of people through numerous applications.

Many blockchain initiatives promise to be extremely fast, widely distributed, and safe.

Harmony One, on the other hand, is obsessed with speed. They stated that by December 2020, transactions were settling in one to two seconds, which is far faster than most other blockchains. When everyone on the network agrees that a transaction is complete and irreversible, this is referred to as “finality.” Harmony One accomplishes this speed by letting individuals who check blocks to send messages throughout the network.

This technology reduces the demand for computer processing power and speeds up the entire procedure. They also employ a method known as ‘block proposal pipelining.’ It’s similar to when a grocery cashier begins scanning the next client’s products while the current customer is still packing or paying. It means that the network can start working on new blocks before the existing ones are finished.

Speed is great, but it frequently comes with trade-offs, particularly in terms of security. Harmony’s mission, on the other hand, is to address real-world difficulties and make blockchains more user-friendly. Most people will not accept a dangerous blockchain.

Sharding

So, how can Harmony maintain its momentum while maintaining safety as it expands? The essential word is “sharding.”

Harmony One’s amazing features are maintained thanks to sharding. It’s similar to splitting a blockchain into numerous portions that all function at the same time to speed up the process and prevent overpopulation. Consider it as converting a one-lane road into a five-lane expressway, allowing more room for blockchain data to travel. Adding extra shards reduces blockchain congestion, allowing for more users without slowing things down or raising transaction costs. This is due to the fact that more users competing for space in the blocks raises costs owing to supply and demand.

Why Harmony is unique in the cryptocurrency industry?

In this section, we’ll look at why Harmony is unique in the cryptocurrency industry, with a special focus on sharding, its drawbacks, and how Harmony One overcomes these issues. We’ll also discuss Harmony’s distinctive ecology and how it differs from other platforms such as Polkadot.

To begin, you may be wondering why not every blockchain employs sharding, especially given Ethereum 2.0’s ambitions to do so. While sharding allows a blockchain to manage more users by breaking it into smaller portions (shards), it also presents security problems. Consider a blockchain divided into ten shards. It is easier for a bad player to control one shard than it is to control the entire network.

So, How does Harmony One approach this problem?

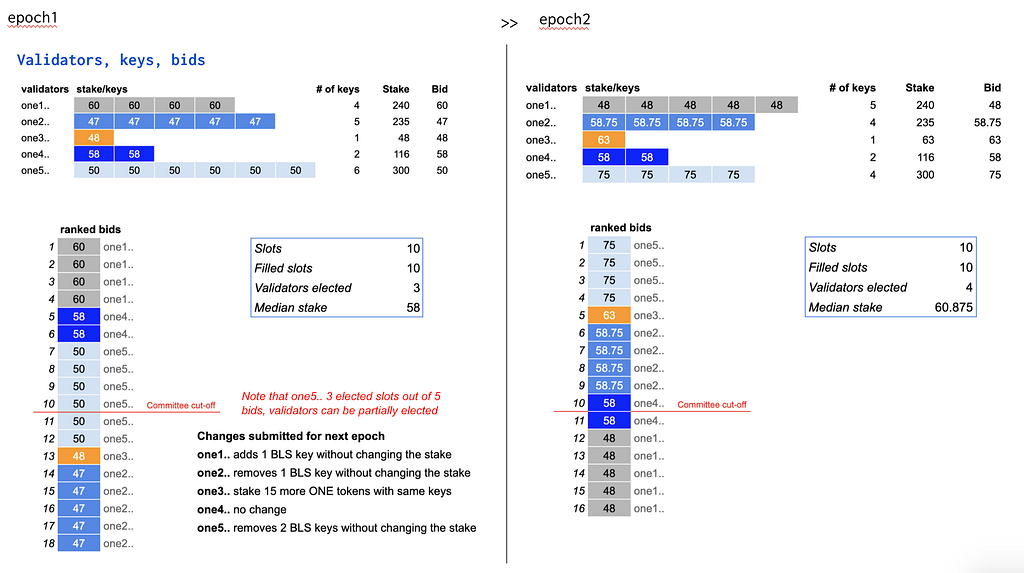

They employ a variant of the commonly used proof of stake approach known as ‘effective proof of stake.’

This strategy strikes a compromise between rewarding individuals who stake their tokens and preventing them from overwhelming a shard. Power concentration in the hands of a few with the most tokens is a concern in a standard proof of stake system. Critics of proof of stake, particularly those who prefer Bitcoin’s proof of work, frequently highlight this possibility for centralization.

Harmony One changes this system to better equitably share prizes and punish bad actors. They provide security by allocating nodes to different shards at random for each new block. Because of this unpredictability, it is extremely difficult for any party to control even a single shard, let alone the whole network.

What about Harmony’s environment now?

You may have heard of their dApps or their initiatives to link with other blockchains. While Harmony One and Polkadot may appear identical at first look, they work differently. Polkadot operates as a ‘layer zero’ blockchain, concentrating on the creation and linking of blockchains. Harmony, on the other hand, functions more like a hub, promoting the building of bridges across different blockchains.

They created the Horizon Bridge, which allows for simple transit between Ethereum, Binance Smart Chain, and even NFTs. They’re also working on connecting to Bitcoin and creating an API to let these procedures go more smoothly. Some may wonder why Zilliqa was not chosen or why Polkadot was not used. Harmony lives true to its name by encouraging chain interoperability and collaboration, departing from the isolated approach of certain blockchain initiatives. Their focus on decentralized autonomous organizations (DAOs) demonstrates their dedication to transparency and community-driven growth.

ONE’s Ecosystem

In this part, we will look at the role of Harmony One’s token, ONE, throughout the ecosystem. Before we go into the specifics of ONE’s tokenomics, I’d like to point out that I’ve produced a comprehensive Harmony One research guide. It contains current insights, and while I’m not generally a fan of price projections, the overwhelming demand for them compelled me to add them in order to help readers make educated judgments about tokens like ONE.

Harmony One, as promised, has its own token, appropriately titled ONE. This coin performs various typical network operations, including fee payment, staking for network validation, and participation in governance and voting on network modifications. A minimum of 100 tokens are required to stake ONE. A bigger commitment of 10,000 tokens is necessary for anyone wishing to validate or contribute directly to the network.

Staking in the realm of cryptocurrencies is providing token support to a network validator, trusting them to represent your interests, and collecting a share of the profits they get, all without the need for complex installations or dedicated internet connections. This procedure is usually known as delegated proof of stake. Harmony One, on the other hand, adds a twist to this approach with its ‘effective proof of stake’ structure, which we mentioned before.

The ONE token, like many other blockchain systems, is used for transaction fees inside Harmony’s network, and these tokens are burnt with each transaction. The annual generation of a maximum of 441 million ONE tokens is an intriguing part of Harmony’s methodology, implying an inflationary tendency for the token’s supply.

This inflation can be countered if transaction volume is high enough to burn freshly generated tokens through fees. A transaction on Harmony typically burns a modest amount of ONE, about 0.01685 tokens. It’s worth noting that ONE can never be deflationary since the tokens withdrawn due to fines and fees are drawn from this pool of newly generated tokens.

Because of its structure, ONE may not have the same price dynamics as Bitcoin, which benefits from deflationary forces. Some contend that if ONE were deflationary, it would favor keeping rather than spending, thereby limiting network activity and contradicting Harmony’s objective of universal adoption.

Harmony One may not have spectacular use cases or a large marketing budget, but it is dedicated to making cryptocurrency more accessible internationally. Its staff is working hard to create a thoughtful and inclusive platform.

Harmony Price Prediction, Harmony One, ONEUSDT, ONEUSD Price, OneUSD Price Predicition, Harmony coin, Which Coin Should I invest in 2024? was originally published in The Dark Side on Medium, where people are continuing the conversation by highlighting and responding to this story.

from The Dark Side - Medium https://ift.tt/G0txMNs

0 Comments