The world of web3 is obsessed with Tokenized Real World Assets (RWA), citing it as the next big thing in the world of crypto. Klaytn Foundation, the legal entity behind Klaytn Blockchain ($KLAY), reports that the tokenization of real-world assets could turn into a $16 trillion industry by 2030

For context, the global crypto market cap today stands just shy of $1.8T (at the time of writing). At its peak, when BTC was $60k+, the global crypto market cap was at $2.5T. At first glance, with that context, it might seem unlikely that the market cap of tokenized real-world assets could overtake the peak crypto market cap by over six times.

Before we disregard it as an impossibility, let’s look at it from another angle. The market cap of the top five stock exchanges is $74.63 trillion, and that’s not even accounting for corporate debt, government debt, real estate, and a plethora of other real-world assets that can be tokenized.

Tokenized RWAs are an on-chain representation of real-world assets that have been around for centuries. With that in mind, the $16 trillion estimate doesn’t sound far-fetched. The market growth potential of RWA isn’t oversold.

How to Start a Tokenized RWA Project: Dealing with the Legal Layers

The DNA of blockchains is decentralised, permissionless, and trustless. However, the underlying real-world assets are highly regulated, with a fairly standardised framework of regulations around the globe.

The mainstream adoption of blockchains and crypto is still in its nascent stage. The world governments have started building their policies around it fairly recently. Unlike stock markets, there is no standard framework when it comes to tokenization or blockchains as a whole. For example, the laws and policies of Singapore are quite friendly towards blockchain as a whole, but the same can’t be said about the policies of a country like India.

This gives rise to a unique problem wherein there is no framework for a decentralised or, permissionless, or trustless entity to hold RWAs such as stocks, bills, real estate, etc.

Most of the existing RWAs are built around a legal layer of Special Purpose Vehicle, or a trust, or an unregulated fund. The problem with these legal layers is the fact that, in the eyes of the government, the assets are held by the legal entity rather than the token holders.

Let’s discuss this in depth.

The Legal Problems with RWA

Let’s assume the example of real estate. A tokenized RWA company bought houses worth $10,000,000 and tokenized them into 10,000,000 $CONDO tokens.

Now, depending on the underlying legal structure of the company, they have the option to either KYC their investors or to not KYC their investors.

Case 1: KYC’ed Investors

If the underlying legal structure of the company is a special purpose vehicle (SPV), a trust, or an alternate investment fund, the tokenized RWA would be legally obligated to KYC their investors.

Depending on the underlying legal structure, the company would have its hands tied when it comes to onboarding customers. They’d be unable to raise funds from specific jurisdictions and may also have to impose high entry barriers, such as a minimum investment of $100,000.

In such a case, the tokenized assets can’t be freely traded on dexes or even transferred to other wallets without the permission of the issuing party.

This often limits the liquidity of the asset. Most of the time, they can be either traded only on approved platforms or sold back to the company, which makes it sound awfully similar to redeeming your units in an investment fund.

In the worst of cases, it could also lead to the elimination of the free market, making the issuing authority the price decider, specifically in the case of tokenized real estate. For example, if the underlying asset loses 25% of its value, the company may decide not to depreciate the tokens. Thankfully, this hasn’t happened so far yet, and it is only an imaginary worst-case scenario.

On the plus side, however, the governments recognise the investor’s ownership over the assets in the fund. This means that if the tokenized RWA fund operators ever dip their feet into malicious practices, the investors can rightfully take them to the courts.

In conclusion, such a set-up is simply a traditional alternate investment fund. The tokenization of the assets may not add a lot of value in such a scenario, depending on the type of assets and the consumer base.

However, there are two main benefits that a tokenized RWA may offer over an AIF:

- Distribution: The distribution of an AIF is, more often than not, a non-standard and tedious process, often targeting investors from a single jurisdiction. Tokenizing real-world assets would greatly reduce, not eliminate, the hassles related to the distribution of the fund. Note that distribution to different jurisdictions would still be ruled by existing laws, it’s just a matter of convenience that’s provided by tokenization.

- Availability: Tokenizing real-world assets would considerably increase the availability and access of otherwise inaccessible assets. For example, for a man based in South Africa, it’d be next to impossible to buy a quarter of a property in Tokyo, but it can be accomplished with tokenized real estate. Similarly, it’s next to impossible for foreign investors to invest in the Indian stock market, which has averaged >15% annually over the past 20 years. Tokenized RWAs can open the doors of the Indian stock market for foreign investors.

Lastly, the crypto native audience has been around for long enough to nurture thousands, if not ten thousand, of millionaires. Crypto-native folks have built their wealth and may wish to diversify, without off-ramping. Tokenization of real-world assets would give them exposure to all sorts of assets while still being crypto-native.

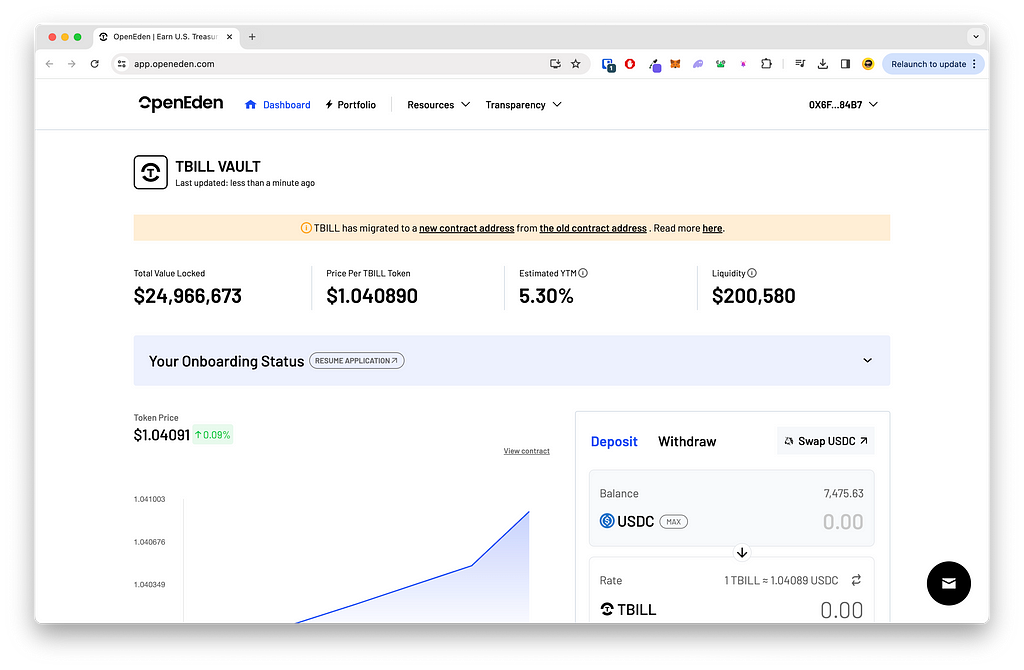

A great example of a tokenized RWA company with KYC’ed Investors is Open Eden, with a TVL of just shy of $25m (at the time of writing). They describe themselves as the:

“First tokenized RWA vault to offer 24/7, direct access to U.S. Treasury Bills.” They’ve gone a step ahead when it comes to transparency and quote that their “Chainlink feed gives you on-chain proof that TBILL tokens are backed 1:1 by U.S. Treasury securities, USDC, and US dollars.”

Open Eden uses a legal wherein they have an alternate investment fund by the name of Hill Lights International Limited registered in the British Virgin Isles, a tax haven. Investors invest in the BVI fund and are issued tokens via a Singapore entity. Hill Lights International Limited off-ramps USDC into USD, and buys T-Bills from the US Government, and holds them under their BVI company.

They suffer from all of the problems mentioned above, that is, a high entry barrier, limited liquidity, and limited jurisdictions from where they can onboard investors. You can buy a T-Bill directly from the US Government for as little as $100 without paying any additional management fees.

However, what they enable, or rather what’s their main USP, is the availability of T-Bills to people and organisations, for whom it was otherwise inaccessible.

Case 2: Non-KYC’ed Investors

Let’s take the same example again of real estate. A tokenized RWA company bought houses worth $10,000,000 and tokenized them into 10,000,000 $CONDO tokens.

If the company decides not to KYC its investors, then all of the problems previously discussed are eradicated. $CONDO tokens can be sold to anyone anywhere without any KYC or AML checks, hence, there are no bars on the jurisdictions of investors.

The entry barriers of high minimum investments will be quashed as well, with investors having the choice of investing as little as $1. Liquidity pools for such tokens can also be created using Uniswap or other AMMs, enabling free trading on dexes and access to liquidity.

In essence, removing the KYC barrier makes a tokenized RWA company more of a web3, permissionless company rather than an alternate investment fund.

However, there’s one crucial problem in this case: the problem of trust.

Web3, as a whole, is designed to be trustless. However, in this case, we’re trusting the issuing authority with the custodianship of our underlying assets.

In the eyes of the law of the land, the underlying assets are owned by the company and not the token holders. So far, there are no laws in any jurisdiction that would recognise the token holders as the legit owners of the assets, be it real estate, stocks, or anything else.

In the worst case, if the issuing company is feeling a little naughty, they may choose to simply sell the underlying asset and cash out, rendering the tokens of RWAs worthless. Thankfully, something so naughty hasn’t happened so far at a noticeable scale.

One of the best examples of this is $USDC, a stablecoin backed 1:1 by USD and a market cap of $27b.

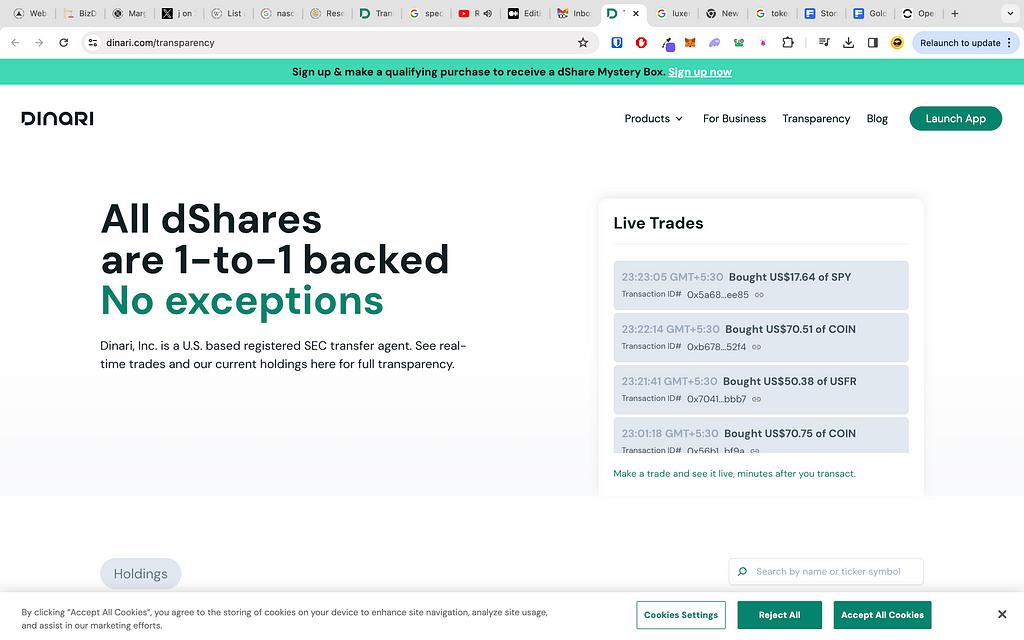

A more fitting example is the new start-up called Dinari. Dinari describes themselves as “Securities Backed Tokens (dShares) that provide direct exposure to the world’s most trusted assets such as Google and Apple shares.”

Dinari has all the benefits of a non-KYC’ed tokenized RWA platform. The investors don’t need to fulfill any KYC requirements, there is no minimum entry barrier, and the tokens can be freely traded. Dinari presents its data on a transparency portal, where they quote, “All shares are backed 1:1.” However, they’re not free from the one crucial problem mentioned above: trust.

Dinari is not a trustless platform. Investors are trusting Dinari to hold their assets and sell them when a request is submitted. While the team behind Dinari has been nothing but transparent in their endeavours, the problem of trust still looms on the horizon. Trustlessness is one of the core ethos of web3, and it’s a tough goal to achieve for RWA companies.

The Legal Framework of to Start a Tokenized Real World Assets (RWA) Company

Now that I’ve laid out the bare facts and two roads to start a Tokenized Real World Assets (RWA) Project, here’s how you should go about the matter.

If you want to tokenize real-world assets such as real estate, securities, debt, etc, the first thing that you need to do is identify the type of investors you want to on-board.

If your investors are fine with a KYC check, then it’s best to go down that route. Here are the top jurisdictions to set up your AIF as a legal layer for holding the tokenized RWAs:

- An unregistered fund in the British Virgin Isles

- A SPV in Luxembourg

- A registered fund in Dubai

- A Trust in the UK (best for real estate)

However, if you want to provide easier access, automate the whole process, preserve the ethos of web3, and don’t KYC your investors, then the best option is to form an LLP or an LLC, ideally based in the jurisdiction where you’d hold assets, along with a token issuing “tech” company.

In the next blog, we’ll discuss the legal layers of a tokenized RWA company and set-up costs in-depth.

If you’re still confused about the framework of your tokenized real-world assets or have any other queries related to the matter, feel free to reach out to me via email or on Twitter. I tend to respond to all the emails within 72 hours.

How to Start a Tokenized Real World Assets (RWA) Project in 2024 was originally published in The Dark Side on Medium, where people are continuing the conversation by highlighting and responding to this story.

from The Dark Side - Medium https://ift.tt/X46BEhv

0 Comments