Data shows early signs it could break out of this cycle, but very few are paying attention.

If you're still figuring out crypto, stick with the big three: Bitcoin, Ethereum, and Solana as your biggest position.

Anything else is just asking for trouble.

Narratives can crash fast and end up in an ICO graveyard quicker than you can say, Sam Bank-Rupt Fried.

- Luna.

- FTX.

- FTT.

Just typing those names gives me PTSD.

In a bull market, all assets rise optically, so picking the fastest horse in the race on a risk-adjusted basis is how you win.

In other words, if its price appreciation potential is high but it's a high-risk asset, I don't touch it.

More users = Less risk.

But having a solid user base (i.e. Bitcoin) can also mean less price appreciation, so I'm trying to find the sweet spot.

According to Metcalfe's Law, a network's value is driven by its users, and each new person who joins makes the network infinitely stronger.

Social media apps work the same way, which is why companies like Facebook (Meta) get away with copying competitor app features.

People don't want the mental arithmetic of upping sticks and moving platforms, so they shamelessly accept Mark Zuckerburger's plagiarism.

Worse, they fight off other ideas just like in Crypto, creating this unbreakable tribe effect.

Crypto is a money network.

The double-edged sword of investing in altcoins further down the risk curve is that most people tend to make speculative investments to scratch their degenerate gambler itch.

This leads to less focus and a dilution of capital away from higher-conviction plays (The Big 3). I've been there—it's chaotic.

You miss out on the compounding, especially if you're the type to:

“Buy the dip.”

I'm not here to lecture you.

Being in Crypto means taking calculated risks, jumping ahead of the herd, and enjoying the thrill of the ride.

But don't screw up the entire trade chasing an imaginary 100x when everything is going up by a factor of 10 — A 10x gain is plenty.

When sharing the log chart of Bitcoin's potential, Dan Tapiero said:

“Zero exposure (Bitcoin) will pose career risk for traditional money managers as money and value get redefined.”

At most, 20% of your allocation can be in these more minor (unproven) alts, with the rest concentrated in the top three I mentioned earlier.

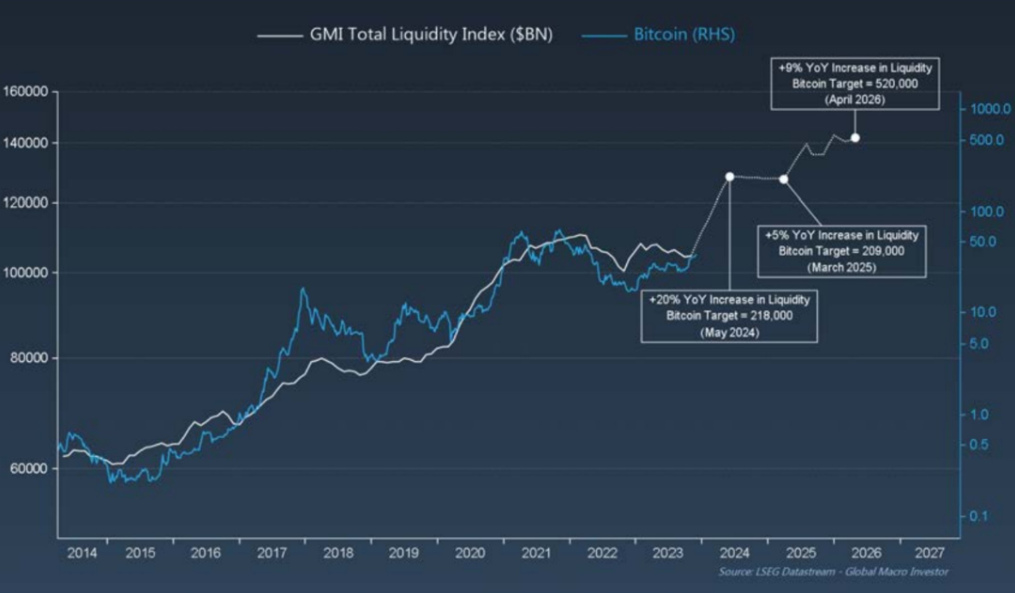

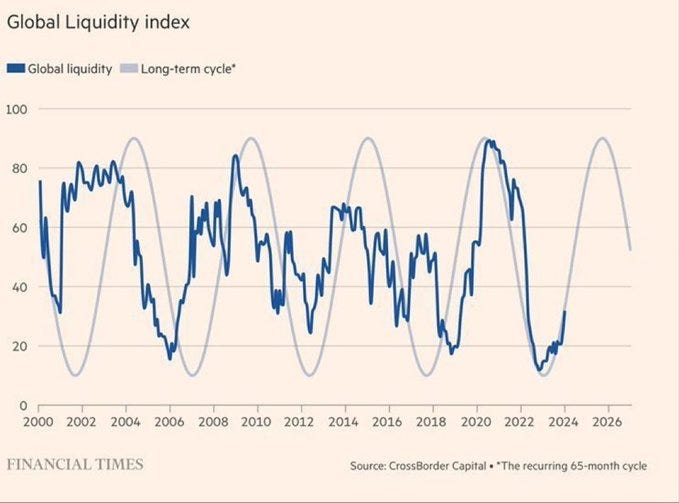

Global liquidity is set to increase, which will likely impact the prices of riskier assets. This macro trend should lift most cryptocurrencies in the short term, providing a temporary shield for more speculative altcoins.

I round-tripped Crypto in 2017 and then NFTs in 2021 because I believed the market would do an absolute missile. But the truth is that things take longer to play out.

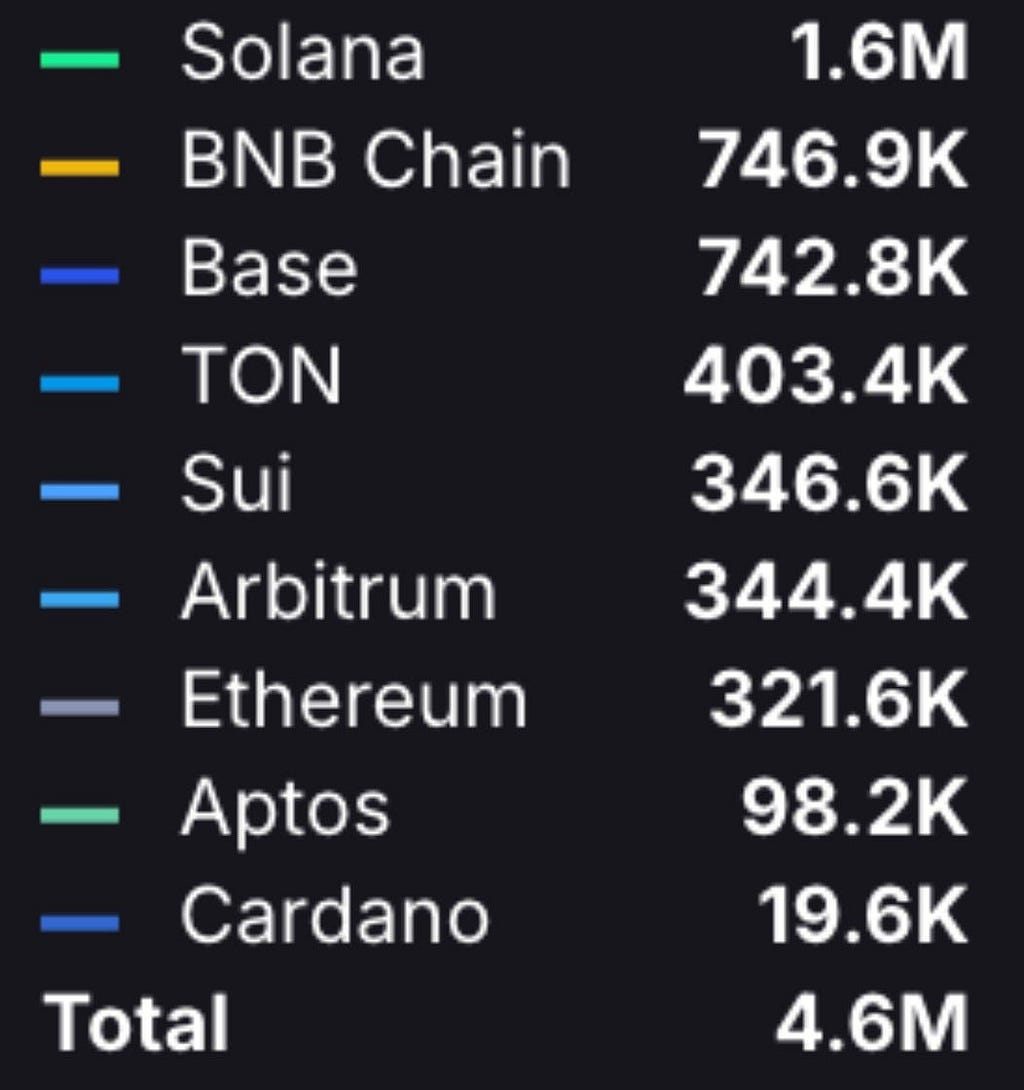

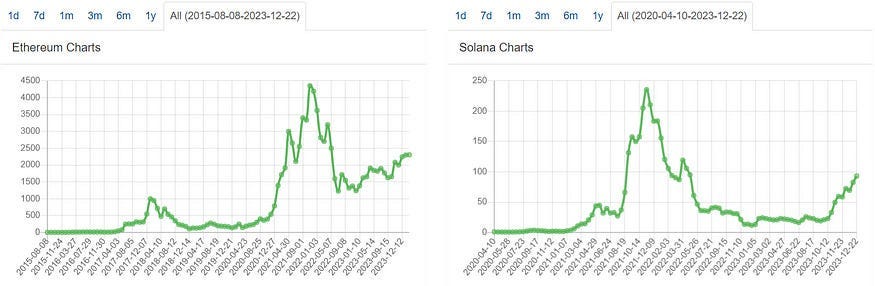

Ethereum soared from its low in 2018 to a 47-x multiplier. Solana mirrors ETH from the last cycle, but the landscape is very different. SOL has outsized usage this cycle, with about 50% of crypto users active daily on there.

15,000 meme coins are created daily on SOL and are expected to continue outpacing ETH and BTC because of their high speed, low cost, and simple user experience.

I have 80% of my allocation in SOL that I don't touch come hell or high swamp water.

But there's one question on everyone's lips:

What will be the SOL of this cycle?

Buckle up, and let's get into it.

I'm betting on this unexpected Crypto for explosive growth.

Raoul Pal said recently:

“I’m interested in the next round of Big Layer One’s, and there are a few interesting ones in that game. That’s a really profitable part of the banana zone. This next trade was an enormous money-making trade last cycle, and it will be again this time.”

He's right.

We've been given this gift of investing in these cryptos on an equal playing field with VCs, who usually get a giant headstart on us ordinary folks.

It's one thing to have the opportunity, but another to get it right.

While these newer networks don't have consumer adoption, it's almost impossible to tell this early, but like the famous crypto commentator and Bitcoin bull since 2012, Beanie says:

“There’s no such thing as a free lunch.”

Either you're early and risk looking stupid, or you're late competing for less meat on the bone.

Here's the moment you've been waiting for.

SUI.

I won't give you the same old Crypto Oscar speech about "It's a groundbreaking technology" and other such nonsense.

You've heard that BS from people before.

These technologies will evolve and improve over time, but we've seen that their actual value is in people's adoption of them, not in the technology itself.

This blog will provide an objective view of why SUI could be next.

SEI and APTOS are the other two running for the Layer 1 race based on price performance, but that's a blog for a different day.

In full disclosure, I have a 20% allocation in SUI.

So here's my take: if it walks like a duck, quacks like a duck, and shits like a duck, it's probably a duck.

SUI has it.

SUI's five founders originated from Facebook (Meta) and were part of the Diem team tasked with launching their project Libra.

You might recognise Libra as the token FB tried to launch and the scrutiny Zuckerberg got in Congress.

The regulatory heat got too much to handle, and the project closed in 2022. These five stooges founded SUI in late 2021 while the Facebook project was shutting down.

This isn't a sales pitch for SUI or a resume, but it's important to know the calibre of the team, starting with the CEO Evan Cheng. He used to be the Technical Director at Meta. Before that, he spent a decade at Apple.

His four other co-founders are also best in class, with multi-decade-long experience in engineering, data science, blockchain development, cryptography, marketing, and product development.

If you're new to all this, this next part will stretch your brain, but get through it and feel free to re-read.

The long and short of what the former product lead at Libra and now co-founder of SUI is trying to say in this next piece is that they want to be the "global bandwidth of the internet".

SUI wants to add the entire WEB2 internet to its blockchain at a tiny cost while maintaining its privacy, decentralisation and allowing user permissions.

Former product leads for research and development for the Libra project and now Co-Founder of SUI — Adeniyi Abiodun, says:

“Our Vision for Sui is to build a global coordination layer for intelligent assets, going beyond traditional blockchains. We’re creating a decentralised web stack that supports everything from smart contracts to decentralised storage with Warus, a global storage layer that is more distributed and cost-effective than AWS. This infrastructure will underpin a wide range of applications, offering unprecedented security and decentralisation.”

Let's simplify it.

Simply put, AWS is the primary cloud service provider that stores data for the world's largest companies.

Sui's storage system (Warus) is designed to be significantly cheaper, and the team's vision is to onboard the entire WEB2 Internet.

- Netflix:

- It uses AWS to stream its library of movies and TV shows, handle high-traffic loads, and ensure global scalability.

2. Facebook (Meta):

- It utilises AWS for some aspects of its infrastructure, although Facebook has its own data centres for many of its core services.

3. Amazon (Retail):

- It uses AWS to support its massive e-commerce platform and various services like Amazon Prime Video.

4. Spotify:

- It relies on AWS to manage and deliver its music streaming service to millions of users worldwide.

5. Airbnb:

- It uses AWS to scale its online platform for booking accommodations and experiences globally.

6. Slack:

- Leverages AWS to support its real-time messaging and collaboration platform.

7. Samsung:

- Employs AWS for various services, including data storage and application hosting.

8. Adobe:

- Utilises AWS for services.

9. General Electric (GE):

- It uses AWS for data analytics to optimise its industrial operations.

10. Toyota:

- Relies on AWS for cloud-based services to support its connected vehicle platforms and data processing needs.

The potential is seriously massive.

If these companies can save hundreds of millions, maybe even billions, of dollars on storage fees and do so safely and securely, why wouldn't they use SUI?

It could push down storage costs as one use case if widely adopted.

Let's dive in deeper!

The SUI foundation is based in the Camen Islands, ironically where Raoul Pal is based and now occupies a position on their board.

Pal is the foremost voice in Crypto.

It's like an old marketing manager once said to me:

“Jay, if you’re in a yacht race, you want to follow what the yacht out in front is doing”

The foundation has raised almost $400 million for its project, but it hasn't been smooth sailing because the now-defunct FTX was one of its largest investors.

SUI bought back $96 million worth of coins from FTX last year, so any risk associated with Sam and his cronies seems to have been eliminated.

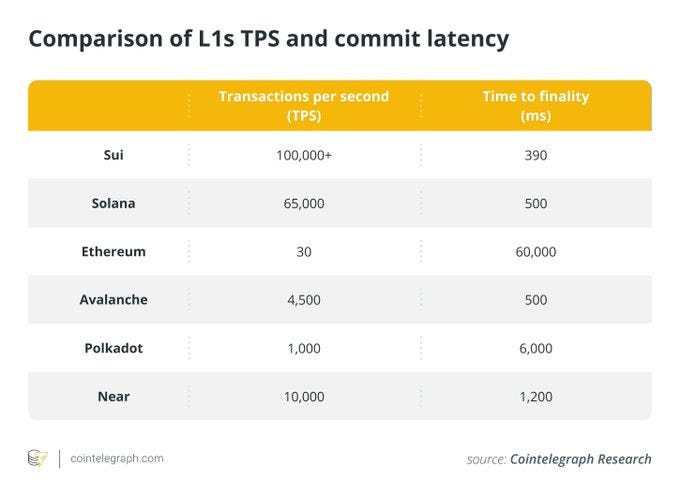

SUI is a high-speed chain that can process 297,000 transactions per second, compared to the current fastest chain, Solana, which does 65,000 and ETH, which does 30 tps.

It can complete a transaction in 390 milliseconds, 22% faster than the current fastest blockchain, Solana.

So far, SUI hasn't had any congestion issues, unlike Solana, which has faced some outages — you'll be aware of this if you've been around the ecosystem long enough.

It's important to note that congestion occurs when the network is busy, which is a product developer's dream because creating demand is the hardest part.

SUI has a total supply of 10 billion tokens, 50% of which is a community reserve for grants, research, and development. Investors hold 14%, early contributors hold 20%, and the rest is held in the treasury.

SUI has signed a multi-year deal with Redbull Racing.

Decentralised social media will likely be a central theme during this bull market. SUI was formerly a Facebook project, and its product promises a significant cost saving and a solution to onboard 4 billion+ active internet users.

From a purely money-making and price-speculation point of view, SUI fits the profile of retail investors looking to invest because its low price tag creates a false illusion of substantial potential gains.

Folks often do quick math and think, 'I have 100 SUI — imagine if it reaches Solana or Ethereum prices!' It's a common reaction. No, people, it's just the market cap. If that doubles, so does your money.

SUI has a smaller market cap than most cryptos, so moving its price will take less buy pressure.

Solana went from $5 to $200, a 50x increase that mirrored ETH from the previous cycle.

If SUI, one cycle behind SOL, performs the same way SOL did, it's a 45x + opportunity.

But it's like my old school grandad keeps telling me about ifs, buts, and maybes:

“If your aunty had bollocks, she wouldn’t be your aunty”.

Here's a closer look at the numbers.

My mate Nick, a cricket pal, always tells me when looking at players' performance, "Jay, there's no hiding place for data."

It's a metaphor for life.

The numbers don't lie: here are the data points and some fundamentals:

- SUI has 8 million active wallets.

- 297,000 transactions per second (TPS)

- No L1 is faster than SUI

- Achieve transaction finality in just 390 milliseconds

- Maintain low gas fees

- Partnership with — Alibaba

- Grayscale launched a dedicated SUI fund

- They are building PLAYTRON, the first handheld device with native Web3 gaming capabilities.

This is what sealed it for me.

Real Vision is regarded as the best Crypto research firm in the world.

Significant hedge funds pay astronomical fees to get an eye-in on the research Julien Bittel and Raoul Pal create.

Pal says that everything is correlated with price. When the price increases, so do the wallet address downloads and network adoption, so using the price action of something is the best measure.

Before we dive into the details, let's clarify the approach.

Pal evaluates whether crypto outperforms by comparing its price action using a ratio or cross method.

Cross Rate Calculation Example:

Assume you have the following data:

- ETH/USD today is: $1,800

- BTC/USD today is: $30,000

This would give you a cross rate of ETH to BTC of 0.06 because $1,800 for one Ethereum divided by $30,000 for one BTC means that 1 ETH is equivalent to 0.06 BTC.

It's simple: You're just looking to see if that ratio goes up or down against other assets.

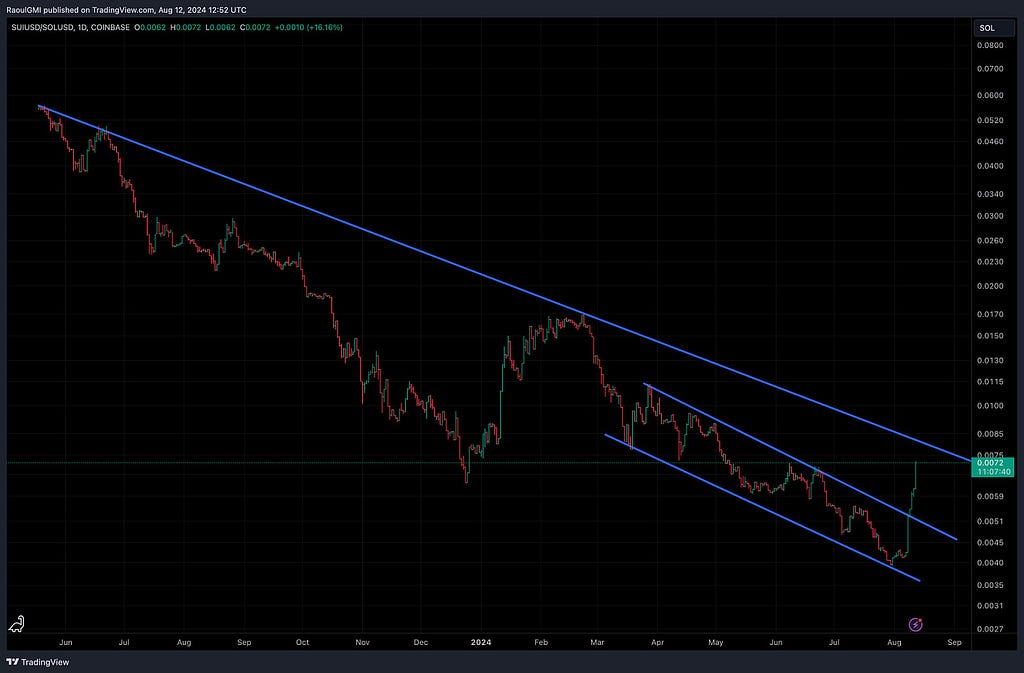

Pal runs this methodology for SUI against the other performing assets, showing a clear performance breakout.

Here's what Raoul had to say:

Sui $SUI is the groundbreaking ultra-fast L1, super efficient, full blockchain ecosystem that came out of Meta’s Diem project.

The idea is that it is built for the scale of 4 billion people… i.e turning Web2 > Web3

I have been looking for signs of the next big L1 mover by comparing the relative charts of many, and I have mentioned this methodology on many podcasts.

$SUI is starting to look very interesting from a price perspective, although still early and unconfirmed, it is showing signs of breaking out against most tokens.

As a caveat — I sit on the board of the Sui Foundation so you can discount this if you like. That is fine…but Im looking at ALL major tokens for the next SOL type opportunity regardless, and this strikes me as one of them.

According to financial analysis firm Strike Money, a falling wedge pattern is right 74% of the time.

They say to pay attention when you spot this pattern because it usually breaks upward (68% chance) and is bullish.

Here are the charts.

SUI vs APTOS another L1 chain: Showing a breakout to the upside.

SUI is showing a small breakout against Bitcoin.

Here, it shows a breakout against SOL: Raoul Pal: "To prove itself worthy of the Next Big Thing, it needs to properly prove itself vs. $SOL by breaking the downtrend."

He means breaking that solid blue line the ratio is creeping up toward.

Final Thoughts.

To manage my fear of missing out on the next big opportunity, I take a small position in something as soon as I see early signs of potential. I accept the risk of it going to zero, viewing it as a defensive strategy.

Then, over time, once I have skin in the game, it forces me to dive deeper into the research, which either results in me feeling as dirty as a dollar store stripper or wanting to double down like a miner who has struck gold.

I don't know if this will be the breakout of this cycle, but SUI sure looks good.

Like my mate Beanie says, there are no free lunches, but if you're a chancer and want to take a punt on something, the team is top-tier, the technology is astounding, and the vision is enormous.

People often say things like well, it's gonna take time for applications to be built out on it. For me, short-term price speculation will drive the price to a different dimension (or not), regardless.

That's the risk you take.

A legit team, incredible technology, and a small market cap of $2 billion make this a good bet ahead of an apparent bull run leading into the elections.

To put this into context, BONK and WIF speculative dog meme coins on Solana have a combined market cap of $3 billion, so SUI is literally the size of a bee's d*ck.

If SUI reaches Solana's peak of $90 billion last cycle, that'll be a 45-x multiplier—remember Grandad's "if" advice.

The crypto space has a more significant mindshare with traditional finance, entering the echo system with ETFs.

It's an opportunity many are missing.

This article is for informational purposes only — it should not be considered financial, tax or legal advice. You can consult a financial professional before making any significant financial decisions.

Many Are Missing the Crypto Outperforming Bitcoin, Ethereum, and Solana. was originally published in The Dark Side on Medium, where people are continuing the conversation by highlighting and responding to this story.

from The Dark Side - Medium https://ift.tt/eskDYlP

0 Comments