The Biggest Surprises You Missed in Crypto Last Week.

Welcome to your one-stop source for all things crypto! 💡

Prices of major cryptocurrencies like Bitcoin and Ethereum went up and down quickly, mostly because of things like U.S. inflation and world events. Investors were still determining what would happen next, leading many to sell their crypto.

Subscribe to my Substack at TheLuwizz to get weekly & monthly updates delivered straight to your inbox! No more scrambling on the news or scrolling through X to know what’s new!

Let me do the work for you and wait for it to be delivered to you!

The cryptocurrency market often changes a lot, and last week was no different, especially with Bitcoin and Ethereum prices swinging like a pendulum.

In this article, I am here to help you understand everything. From price drops to trend predictions, this weekly newsletter is packed with everything you need to stay on top of your trade!

Below are some of the key highlights from last week’s crypto activity:

- Market Volatility: On September 11, 2024, the crypto market experienced a significant drop, with total market capitalization falling by 9.6%.

- Investor Sentiment: Only 6% of respondents were interested in hearing about cryptocurrency during the 2024 presidential debate, with the majority focused on the economy and jobs.

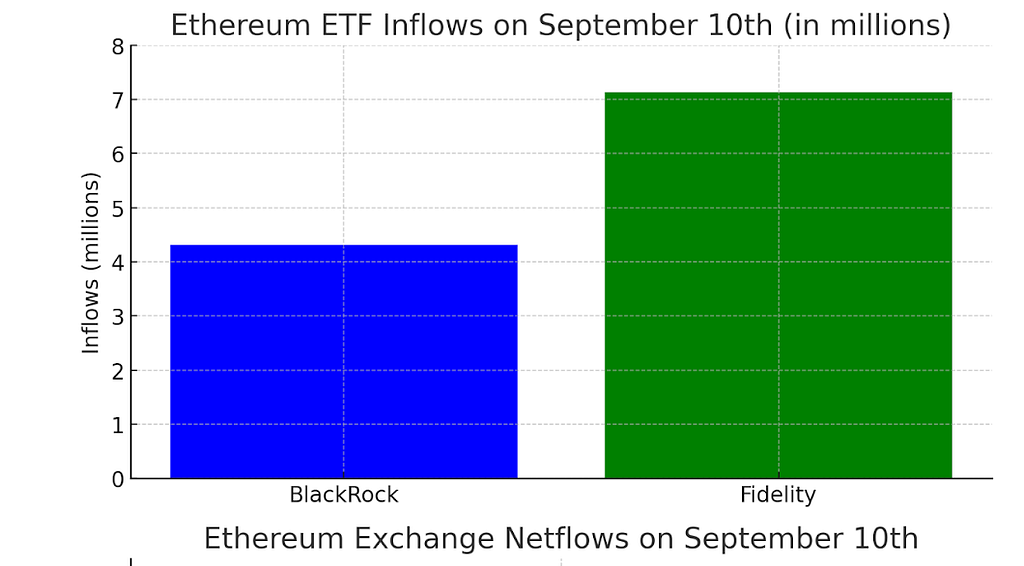

- Ethereum ETF Trends: For the first time in three weeks, Ethereum exchange-traded funds saw $11.4 million in inflows.

- Solana’s Critical Moment: Solana’s price dropped to $124, raising concerns about falling below the crucial $100 level.

Crypto Market Price Drops

Yes, you read that right.

The crypto market experienced a sharp drop on September 11, 2024, with total market capitalization falling by 1.5% before bouncing back. This volatility was largely influenced by the release of U.S. inflation data, or CPI, which showed that inflation had slowed slightly.

The uncertainty led to market sell-offs, affecting both crypto and stock markets. Bitcoin and Ethereum saw significant swings in their prices, with Bitcoin dropping 2% before partially recovering. Traders are now looking ahead to the Federal Reserve’s decision on interest rates, which could further impact the crypto market.

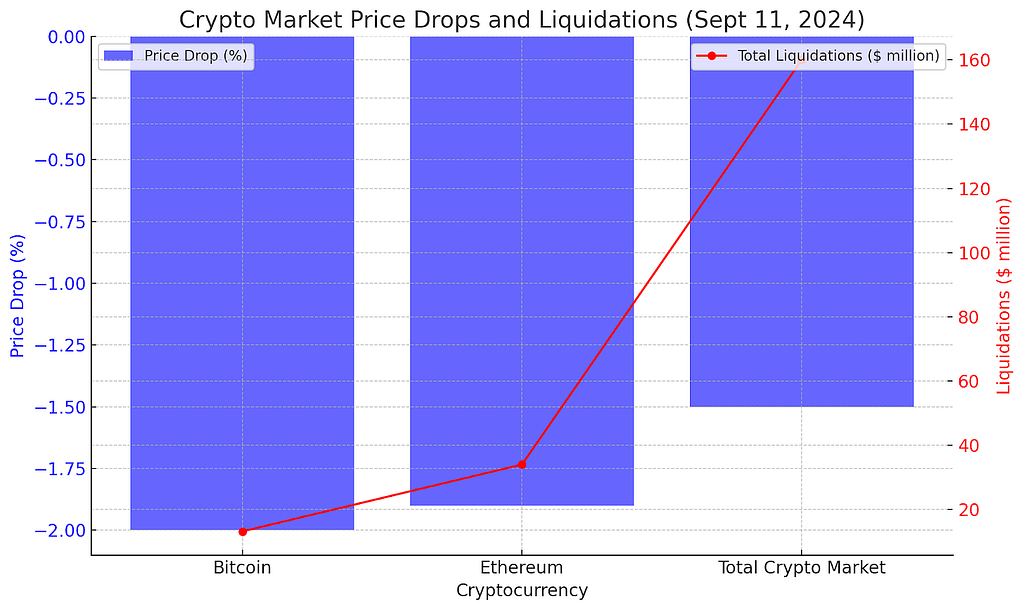

This chart presents a detailed analysis of large-cap cryptocurrency performance alongside total liquidations within the crypto market during the specified timeframe. The data visualization illustrates the percentage price decline of major cryptocurrencies, including Bitcoin and Ethereum, on September 11, 2024.

The accompanying bar chart quantifies the percentage decrease in prices, while the line graph delineates the liquidation amounts expressed in millions of dollars. This dual representation effectively highlights the pronounced volatility characterizing the market during this period.

What is the Market Analysis on Bitcoin’s Current Downturn

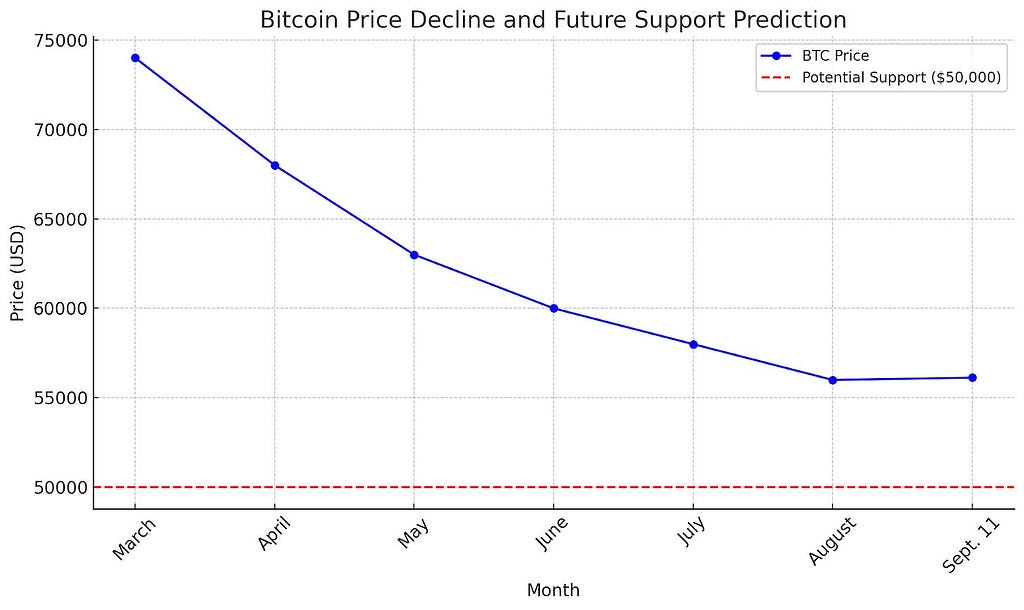

The decline of Bitcoin (BTC) is no longer new. In fact, it has experienced a significant decline in recent months, dropping nearly 25% from its all-time high of around $74,000 in March to $56,000 by September 11.

A potential “death cross” pattern is forming on the charts, indicating a possible continuation of this downtrend, with the 50-day exponential moving average (EMA) moving below the 200-day EMA.

This technical pattern often signals bearish momentum, as seen in a similar instance in January 2022 when Bitcoin dropped by 60%. Analysts predict that Bitcoin might drop to $50,000 due to factors like US inflation and changes in the yen carry trade market.

However, some experts remain optimistic, expecting a rebound toward $60,000 if Bitcoin holds above its $55,000–56,000 support level.

Presidential Debate 2024: Low Sentiments on Crypto?

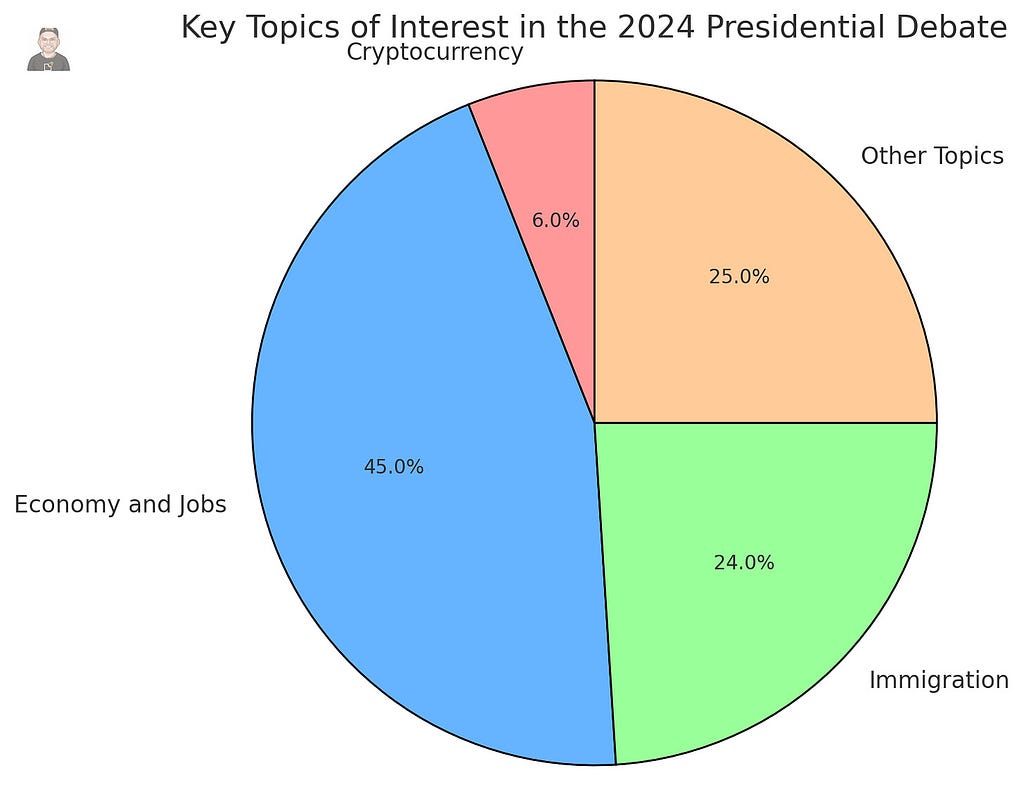

In the upcoming 2024 presidential debate between Kamala Harris and Donald Trump, many Americans are more focused on hearing about issues like the economy and jobs rather than digital assets such as cryptocurrency.

According to a survey conducted by Benzinga on September 9–10 with 133 respondents, only 6% were interested in hearing about cryptocurrency.

The majority, 45%, wanted the candidates to discuss the economy and jobs, while 24% were eager to hear about immigration.

Though Trump has voiced support for Bitcoin in his campaign, Harris has largely remained quiet on the topic of digital assets.

Cryptocurrency Market Faces Decline as Investors Await Key U.S. Report

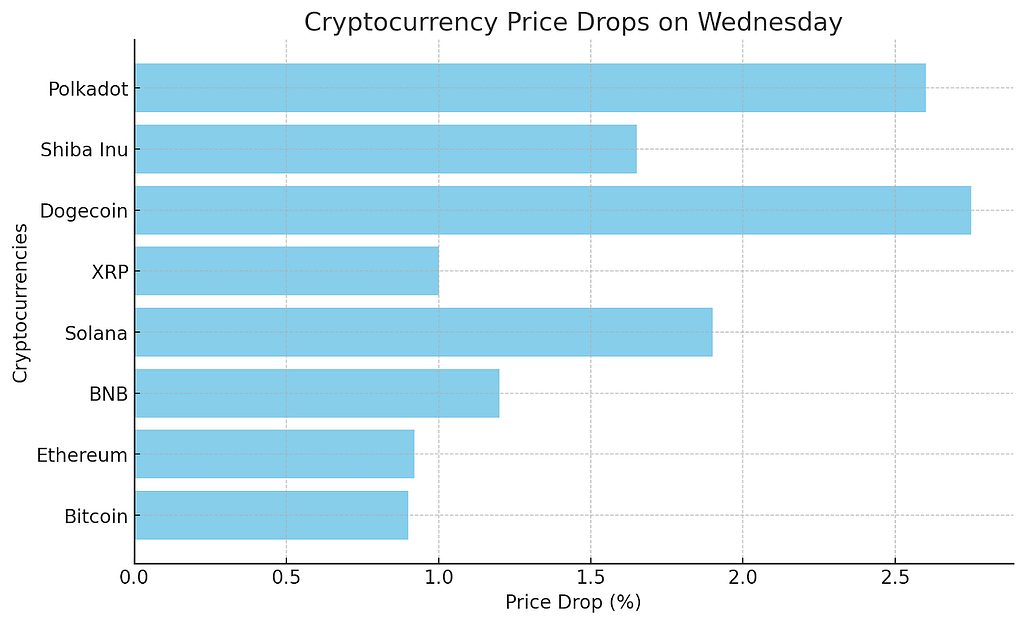

The cryptocurrency market saw a drop on Wednesday as Bitcoin, Ethereum, and Solana experienced declines, with investors awaiting the U.S. consumer price index (CPI) report for insights on future economic policies.

As of 1:30 pm IST (Sept.11, 2024), Bitcoin had fallen by 0.9%, reaching $56,706, while Ethereum was down 0.92% at $2,341. Other major cryptocurrencies like Solana, BNB, and Dogecoin also saw declines, contributing to a 9.6% drop in the overall global crypto market cap, which now stands at $1.99 trillion.

Investors are also paying attention to the possibility of the U.S. Federal Reserve cutting interest rates next week, with a 65% chance for a 25-basis-point cut. Despite these declines, experts believe Bitcoin may show resilience if it can surpass key resistance levels.

What do you think will change next week? Subscribe to TheLuwizz and get the most updated crypto news next week!

Ethereum Exchange-Traded Funds: Recent Trends

Meanwhile, Ethereum (ETH) exchange-traded funds (ETFs) saw a positive shift, with $11.4 million flowing into the market, marking the first positive inflows in three weeks.

Big players like BlackRock and Fidelity were key contributors, adding $4.31 million and $7.13 million, respectively.

However, Ethereum ETFs have struggled compared to Bitcoin ETFs, which have seen $562 million in outflows. While there is less selling pressure as more ETH leaves exchanges, a lack of strong demand and high selling momentum could push ETH prices lower.

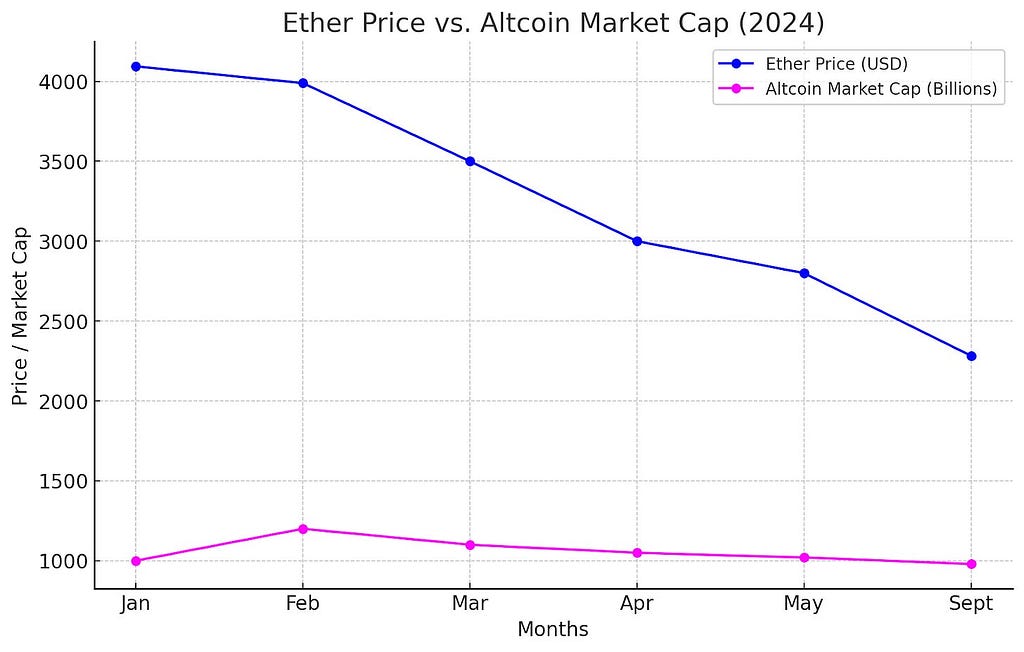

Ether Price Struggles Amid Market Uncertainty

Ether, the second-largest cryptocurrency, has also been unable to close above $2,500 since early September 2024, facing challenges from declining interest in decentralized apps, tokens, and recent regulations in the U.S.

While it reached its peak at $4,094 earlier in the year, retail investor enthusiasm has faded.

External factors like the upcoming U.S. elections and decreasing demand for crypto projects have pressured Ether’s price.

Additionally, a drop in activity on popular Ethereum-based platforms and investor outflows from Ether-related exchange-traded funds (ETFs) have contributed to its current price stagnation.

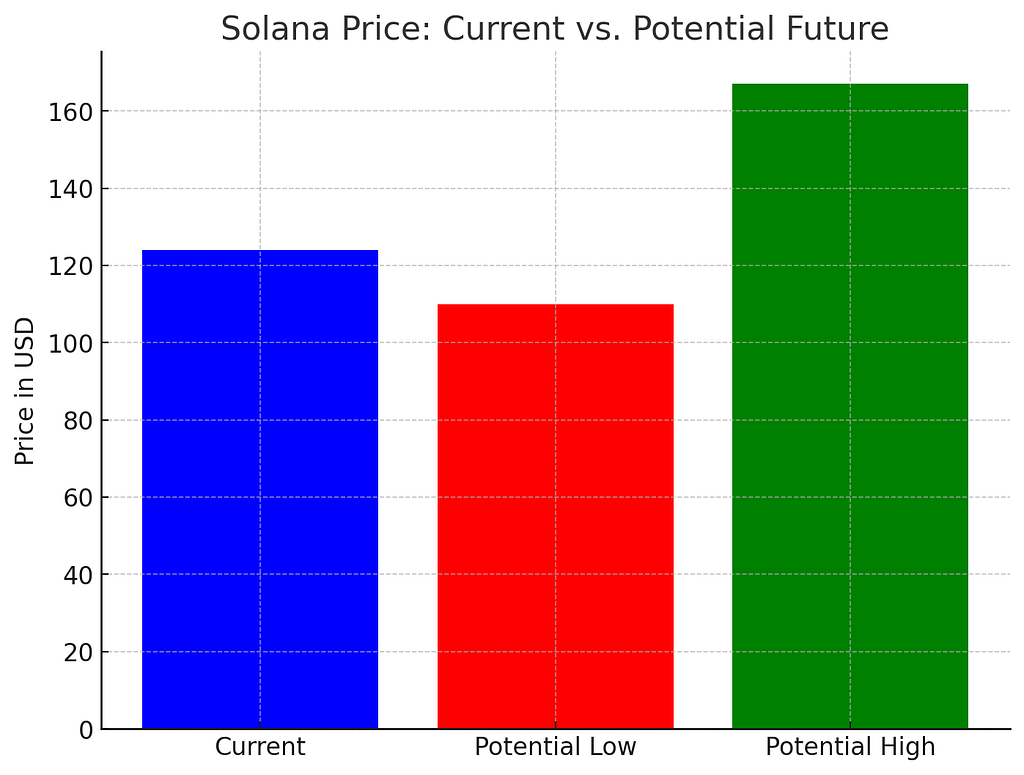

Solana Faces Price Drop with Hope for Recovery

Solana (SOL) is also facing a critical moment as its price has dropped to $124, raising concerns about falling below the important $100 level. Analysts suggest that if Solana closes below $126, its price could fall further, possibly to $110 or even $90. Despite this, there is still hope for a recovery.

Historically, Solana’s price has increased by about 35% before the annual “Breakpoint event,” which could push the price to around $167. Additionally, the expected return of $16 billion to FTX creditors may bring fresh capital into the market, possibly stabilizing Solana and other cryptocurrencies.

What’s Happening?

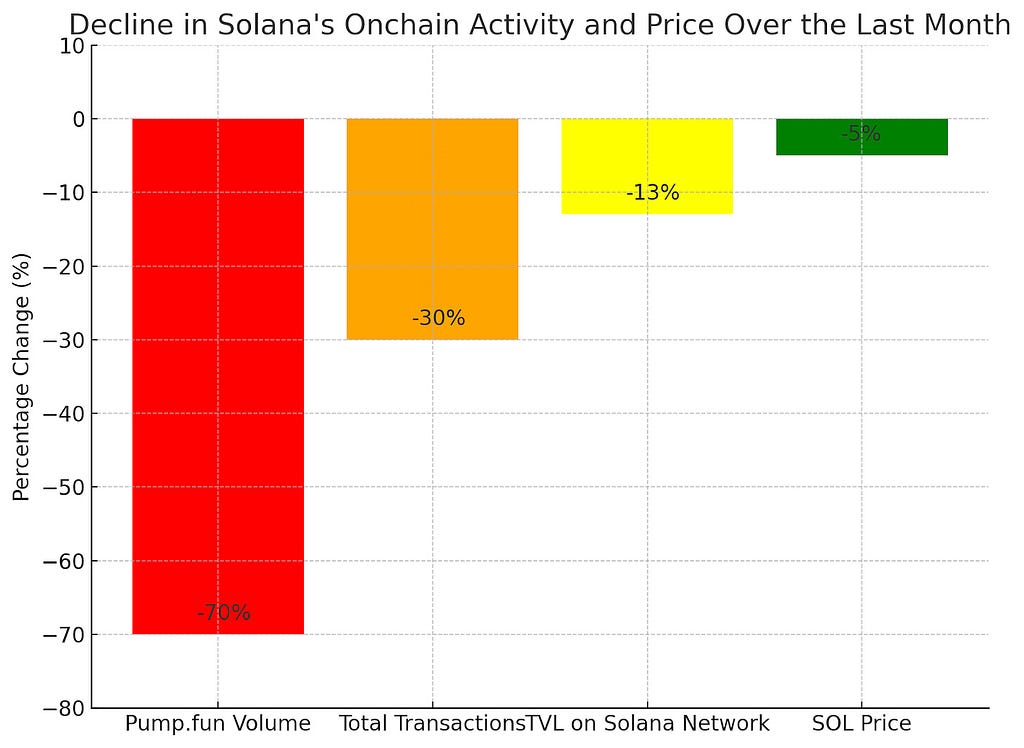

Solana (SOL) has seen its price struggle to rise above $140 recently, despite strong buying activity when the price nears $125. The excitement around Solana-based memecoins and airdrops that pushed its price up 642% over the last year has faded, leading to a price drop.

For instance, Solana-based tokens like Dogwifhat (WIF) and Bonk (BONK) have both lost value in the past month. The decline in user activity on the Solana network is clear, with a 70% drop in Pump.fun volume and a 13% decrease in the total value locked (TVL) on Solana.

This highlights the percentage drops in key metrics like Pump.fun volume (-70%), total transactions (-30%), total value locked (TVL) on the Solana network (-13%), and the overall price performance of SOL (-5%).

These factors decrease reflect reduced user interaction, which has negatively impacted the price of SOL.

Say goodbye to endless news feeds and scrolling through X — I’ll gather all the insights you need so that you can stay ahead effortlessly!

Subscribe to TheLuwizz now!

BaseBros Fi Investors Left High and Dry as Ethereum Tanks

Lastly, the decentralized finance (DeFi) project called BaseBros Fi vanished after stealing users’ funds through a poorly checked smart contract. This caused users to lose trust in the DeFi space.

At the same time, the price of Ethereum (ETH) fell by 6%, dropping from $2,425 to $2,260, partly due to uncertainty about upcoming Federal Reserve decisions and fear of economic changes.

Additionally, news surrounding Donald Trump and issues with Brazil’s social media platform X have contributed to market instability.

What do these situations mean for crypto?

The disappearance of BaseBros Fi adds to ongoing concerns about the security of DeFi platforms, leading to more hesitation from potential investors and developers. With trust eroding, investors may shift funds to more established assets or centralized platforms, reducing liquidity in the DeFi ecosystem.

Furthermore, the drop in ETH prices reflects crypto’s sensitivity to global financial shifts. Plus, political figures like Donald Trump and social media disruptions in major markets such as Brazil, could lead to a “flight to safety” where investors pull out of riskier assets, including cryptocurrencies.

If this continues, this could slow down growth and innovation across the crypto space.

In Summary

The crypto market sure knows how to keep us on our toes!

Last week, Bitcoin dropped by 2%, and Ethereum slipped by 0.92%, both reacting to the U.S. inflation data released on September 11, 2024. This sparked a wave of sell-offs, causing the market’s overall capitalization to plummet by 9.6%.

Bitcoin is now hovering around $56,000, but the big question remains: will it dip below $50,000, or are we looking at a potential surge back to $60,000? Only time — and the market — will reveal the next move.

So far, Bitcoin has lost nearly 25% of its value since its all-time high of $74,000 back in March, and Ethereum is battling to stay above the $2,500 line. Despite these rollercoaster moments, many experts remain hopeful that the market could bounce back if key support levels hold strong.

The crypto space is volatile, no doubt, but staying tuned to these shifts can offer valuable insights into where things are headed next!

So, should you buy now?

Whether you should buy crypto now depends on key factors, including your financial goals, risk, and understanding of the market. If you’re considering making your next crypto move, stay ahead with our exclusive insights!

For in-depth analysis of the latest trends, market shifts, and what’s next for Bitcoin and Ethereum, subscribe to TheLuwizz on Substack!

This way, you won’t miss out on the major crypto news — you’ll get expert analysis sent directly to your inbox every week, so you’re always in the loop on the next big market move.

Ready to stay one step ahead? Subscribe now and never miss a beat in the crypto world. See you there!

You Won’t Believe What Happened in Crypto Last Week! was originally published in The Capital on Medium, where people are continuing the conversation by highlighting and responding to this story.

from The Capital - Medium https://ift.tt/KdtRbuC

0 Comments