The crypto market is swayed by intrinsic and external drivers, dictating caution and a well-thought-out approach. One way to mitigate wild swings is programmed purchases, with a consistent dollar amount methodically invested in the same tokens over time.

Dollar-cost averaging is an alternative to lump-sum buying aligned with the buy-and-hold strategy. Removing emotions from trading enables you to profit with minimal long-term effort.

What is dollar-cost averaging?

DCA involves buying the same amounts of the same crypto over a predetermined period. The increments are executed at regular intervals, and various prices, with the cost averaged over time. Thereby, DCA mitigates risk but also makes outsized returns less likely.

Say you have $10,000 to invest in crypto. You could spend it all at once or set up recurring transactions. A DCA tool will split it into equal parts and execute each purchase based on your settings (for example, ten transactions worth $1,000 each).

An alternative scenario is programming purchases totaling $10,000 without having the entire amount available. DCA software can execute transactions one by one as long as the available balance allows, so the investor may top it up gradually if this option is provided.

The DCA strategy has long been used in traditional finance — even 401(k) plans in the United States work in a similar fashion. The money is allocated to one or more investment vehicles on a fixed schedule, regardless of trends. Wherever the market goes, the buying continues.

More examples

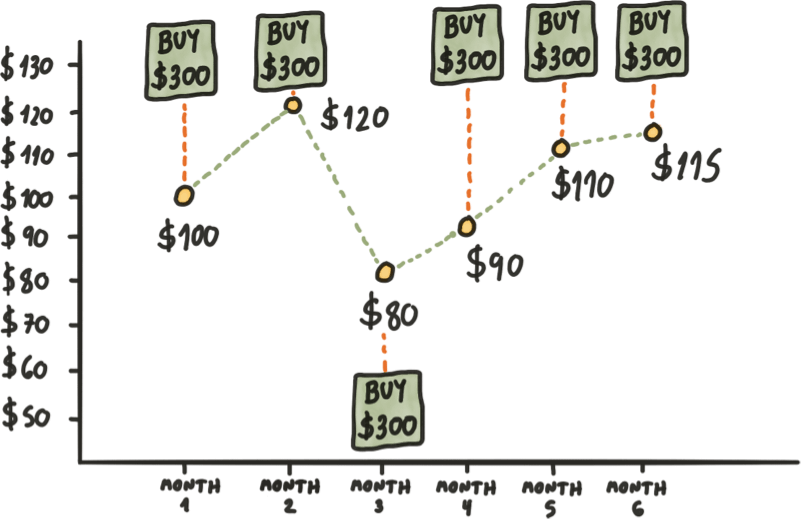

The following graph illustrates the core principle of DCA. Instead of spending $1,800 on a particular cryptocurrency in one go, the trader spreads the amount over six months, buying $300 worth of tokens each time. This constant dollar amount reduces the impact of volatility.

The investor does not aim to time the market — buy high and sell low. Ignoring its swings, they buy tokens regardless, getting an average purchase price of $102.5. While the actual price fluctuated between $80 and $120, DCA balanced the cost.

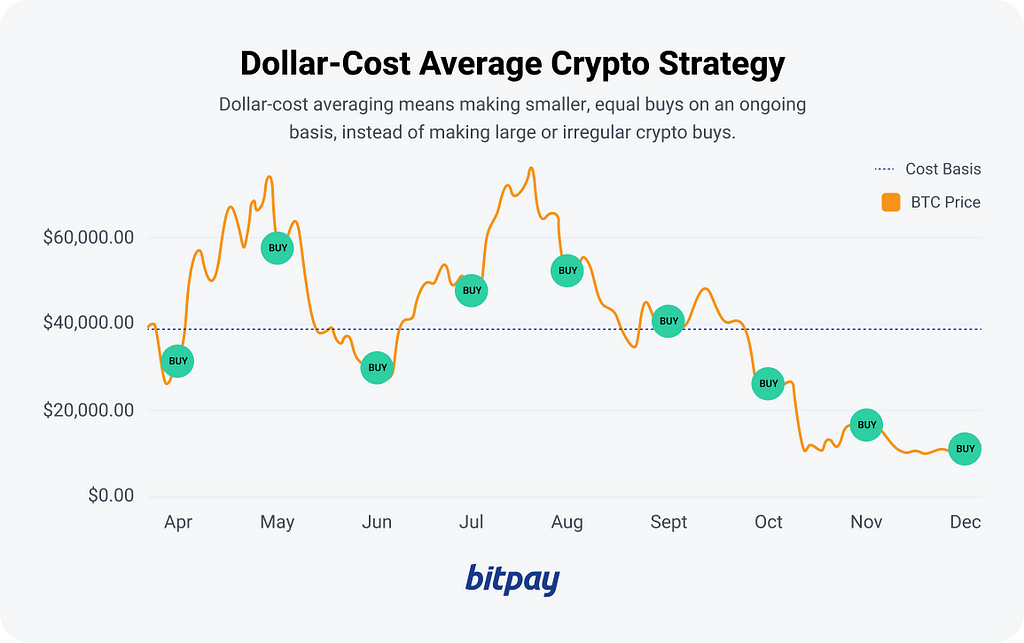

Suppose you invested $6,000 in BTC in $500 monthly increments throughout 2022. Here’s how the price changed:

- January — $47,500

- February — $43,500

- March — $44,500

- April — $45,000

- May — $38,500

- June — $30,000

- July — $23,500

- August — $22,500

- September — $19,000

- October — $19,500

- November — $17,500

- December — $16,500

Each of these months, you bought $500 worth of BTC. With an average purchase price of $29,000, you acquired around 0.205 BTC.

Had you spent the whole amount in January, you would only have 0.105 BTC. Hence, DCA doubled the new holdings. On the other hand, spending a lump sum in December would have entailed a lower average price with significantly higher risks.

Benefits of crypto DCA

Facilitated by modern trading tools, DCA is convenient, passive, and simpler than manual strategies. You “set it and forget it,” buying more tokens in downturns and fewer in upturns. Other crucial benefits concern volatility, discipline, and cost basis.

Smooth out volatility

DCA does not eliminate negative volatility — the market can always move against you. However, it mitigates the impact of deviations as the amounts you buy are spread over time.

This is a strategic approach to navigating capricious markets where determining a bottom is next to impossible. Going all in is dicey, as you may invest before a steep decline. Those who spent a lump sum on stocks before the 2007 meltdown lost more than if they had invested gradually.

The same applies to the harshest crypto winter triggered by the unpegging of TerraUSD and Luna in 2022. On December 21, CoinGecko reported that the global market cap for almost 13,000 tokens had declined 65% year-over-year to just $845B. Since then, it has grown to $2.345T as of this writing.

Lower your cost basis

When the market goes south, DCA automation guarantees execution at progressively lower prices. With the average cost per token reduced, the potential returns grow. Furthermore, compared to fast-paced strategies like scalping, DCA will save you money in fees, and there are fewer entries and exits.

Eliminate bias

DCA imposes discipline, being the antithesis of chasing trends. Automation prevents impulsive moves driven by irrationality due to FOMO, herd mentality, and other mental traps. Check out our guide to such delusions below.

💡 Become a smarter trader: 5 mind traps to avoid

When FUD sweeps the community, traders make decisions they later regret. Prices nosedive, and investors rush to sell. Then, growth resumes, so they miss out on renewed gains. Yet if they rush back in, they may well face another decline.

Stop timing the market

Always “buying at the right time” is notoriously hard — virtually impossible — due to countless potential drivers. They range from political disruptions to changing investor sentiment to black swans within and beyond crypto. The Bank of Japan’s August 2024 interest rate hike triggered precipitous declines across risk assets as the yen carry trade unwound.

Unlike speculators, monitoring myriad fleeting changes, DCA’ers are not glued to charts. They enter and exit at preset intervals, buying more in downturns and less when prices hike — the investment amount remains constant. Steady and consistent accumulation is a more convenient and relaxed approach.

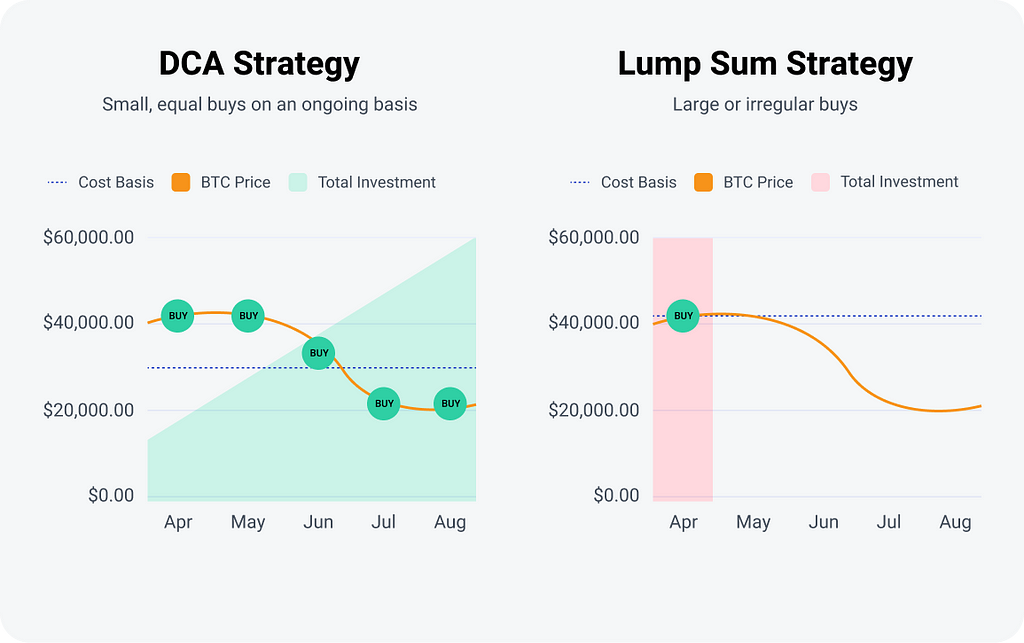

DCA vs. lump-sum investing

Manual trading is demanding — not only due to waiting for the right entry/exit points but also because orders are placed separately. With DCA, there are a handful of parameters to fill:

- Asset

- Amount

- Interval

- Duration

A strategy setup includes the total amount spread over specific intervals and the amount per interval. Typically, DCA software lets you specify either amount and calculates the rest.

Whether to DCA or not is a choice guided by personal risk tolerance, investment horizon, and available funds. Lump sums may yield bigger returns in a flourishing market: you instantly expose a large amount to the momentum. Yet the same approach magnifies losses when the tides turn. That’s when DCA brings a lower purchase price.

How to set up DCA

As a long-term strategy, DCA caters to investors confident in the prospects of their chosen assets. User settings vary from platform to platform, but the logic is the same, mirroring traditional finance tools.

Choose one or more cryptocurrencies

Sadly, crypto research is complicated as there is too much noise and manipulation on social media. Look beyond FOMO and hype to evaluate long-term prospects. This concerns both fundamentals and market sentiment toward a particular digital asset.

Few investors take the time to dive deep into project white papers. However, they contain essential details on the team background and tokenomics, detailing supply and demand dynamics and drivers. Our guide to tokenomics analysis has step-by-step instructions:

💡 Investor’s guide to crypto tokenomics

Before committing any funds, research the public perception of the token. Your crucial metrics in terms of trends and sentiment are the trading volume, liquidity, and historical price trajectory.

Beginners and more conservative investors prefer well-established coins like Bitcoin or Ether. Their more aggressive counterparts DCA into smaller altcoins with higher risk and reward potential.

Choose an interval

DCA platforms give multiple options for autopilot investing. There is no one-size-fits-all approach. Pick a comfortable frequency considering your financial capacity — some trade every few hours, others buy crypto daily, weekly, every two weeks, every month, etc.

Define your time horizon and investor profile, and remember that each transaction has associated costs. Those aiming for long-term growth may buy crypto once a month to ride out short-term fluctuations. Others may opt for a weekly strategy to capitalize on quicker movements. Generally, active traders pick shorter intervals than HODLers.

Finally, market trends may prescribe some changes. In a bearish market, it is advisable to select cryptos with proven historical resilience or strong fundamentals. In a bull market, investors may reshuffle portfolios toward high-momentum assets.

In terms of timing, look at the token’s historical performance. Distinguish the optimal times that delivered marginally better results in the past, provided they align with your goals and opportunities. Granted, prior performance does not guarantee future returns.

Choose an amount

Take common precautions. Experts typically recommend spending up to 10% of savings on DCA purchases. The latter should not compromise essential needs like mortgage payments, rent, bills, and savings.

Inspect your financial situation and set realistic goals aligned with your risk profile. As volatility never fully disappears, how much can you afford to buy? More modest and frequent investments may be more feasible if your income fluctuates. Novices, for example, may invest $6,000 in BTC over a year, spending $500 monthly.

Choose a duration

Popular choices include periods between 6 and 12 months. The most confident extend that horizon to a decade or even longer. You may also end your DCA prematurely or prolong it, depending on market conditions. Everything depends on what you aim to achieve and how much time you can commit.

Risks of crypto DCA

DCA has drawbacks like any other trading strategy, whether long or short-term. Investors may forfeit higher returns, incur additional costs, and miss out on other opportunities compared to investing in one fell swoop. Here are three crucial concerns.

Extra expenses

Transactions on crypto exchanges entail fees, which mount over time. The higher the DCA frequency and the longer the duration, the higher the potential costs due to exchange fees. Traditional assets like stocks are no different — brokerage fees may eat into returns.

Reduced returns

As we pointed out, DCA is beneficial in a falling market. When it rises, your returns may progressively diminish. Furthermore, investors could lose money when cashing out if the prices are below the average.

While the crypto market is yet to mature, DCA in TradFi has been studied for decades. Here are some insights from Rockland Trust Bank.

- If investors had DCA’ed stocks on a half-year schedule during the Great Depression in 1932, they would have saved over 43%.

- The same approach pursued one year later would have resulted in a 60% negative difference compared to a lump-sum investor.

- During the worst decade for the S&P 500 — between 2000 and 2009 — the chances of success were better than a coin flip, but the average gain was a meager 0.5%

Lack of flexibility

Committing to DCA involves spending specific amounts in specific intervals over a predetermined period. If you have additional funds to move between other assets, you could seize opportunities arising in the meantime. Otherwise, opportunity costs come into play.

Wrapping up

Dollar-cost averaging (DCA) is a strategic, disciplined approach to riding out crypto volatility. Automatic, consistent investments at regular intervals mitigate the emotional pitfalls of market timing and reduce exposure to sharp price moves. While it may limit returns in a bullish market, DCA also smoothens out the impact of declines.

It is a patient, systematic method of accumulating crypto. DCA appeals to investors who favor a passive, long-term strategy, but one should consider transaction and opportunity costs.

Dollar-cost averaging: Guide to crypto DCA was originally published in The Capital on Medium, where people are continuing the conversation by highlighting and responding to this story.

from The Capital - Medium https://ift.tt/F8ZjgMp

0 Comments