Be the Bank — Earning Real Yield in DeFi

In the first two articles of this series, we explored what DeFi is and how it stands apart from traditional finance (TradFi). Now, let’s take a closer look at how DeFi users can earn real, sustainable income by “being the bank.” This isn’t about betting on a specific project or hoping for the next big token moonshot. Instead, it’s about actively participating in the DeFi ecosystem — specifically, by providing liquidity to decentralized exchanges (DEXs).

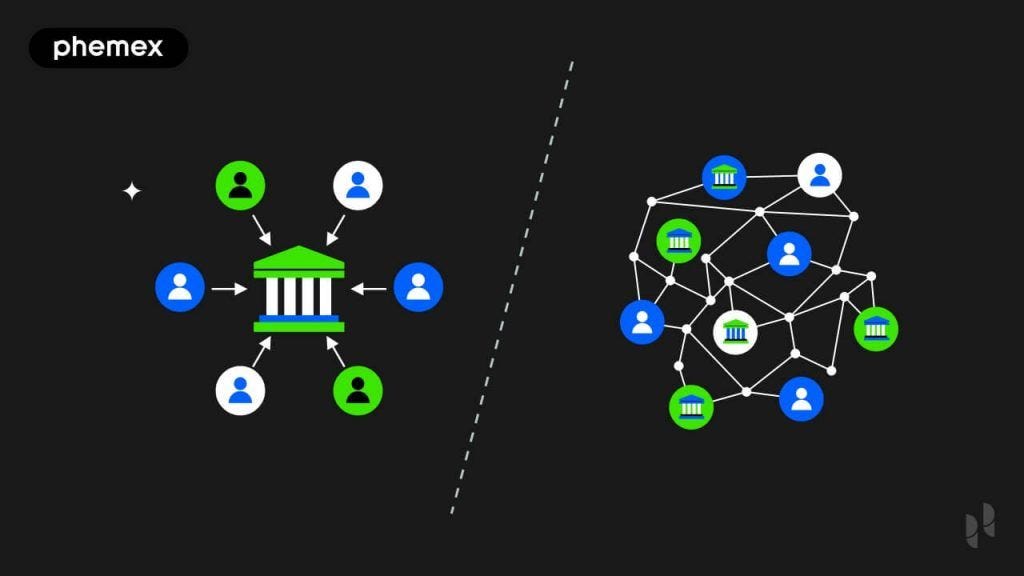

Market Making: From TradFi to DeFi

Imagine walking up to a currency exchange at an airport. The rates you see — the bid (buy) and ask (sell) prices — are set by the market maker. They profit by:

- Capturing the Spread: The difference between what they pay for a currency and what they sell it for.

- Charging Fees: Additional commissions for each transaction.

In TradFi, this system is controlled by large institutions, and the profits from these activities flow directly to them.

DeFi flips this on its head. Instead of institutions acting as market makers, DeFi allows everyday users to step into that role. Platforms like Uniswap, SushiSwap, and Aerodrome empower you to provide liquidity and earn the fees traditionally captured by banks and brokers. This is real DeFi: a system where users are integral to the financial ecosystem and rewarded for their contributions.

How You Can “Be the Bank”

Here’s how liquidity provision works:

- Deposit Assets: You add two assets (e.g., ETH and USDC) into a liquidity pool on a DEX. These pools enable trading without needing a centralized order book.

- Earn Fees: Each trade in the pool generates a small fee, which is distributed proportionally to all liquidity providers (LPs).

- Passive Income: Once you’re in, you start earning fees. Your returns depend on trading volume and the size of your contribution to the pool.

The Uniswap v3 Revolution: Concentrated Liquidity

Uniswap v3 took liquidity provision to the next level by introducing concentrated liquidity. Instead of spreading your assets across all price ranges, you can now focus your liquidity in specific ranges, maximizing your capital’s efficiency and your earnings.

Here’s how it works:

- Set a Range: For example, provide liquidity between $3,200 and $3,600 for ETH/USDC.

- Boosted Earnings: Since your liquidity is concentrated, it’s more likely to be used in trades, earning you a greater share of fees.

- Active Management: If ETH moves out of your range, you may need to adjust your position to stay effective.

This model allows users to earn yields that were previously unimaginable in traditional financial systems. However, it does require some active management to optimize returns and manage risks.

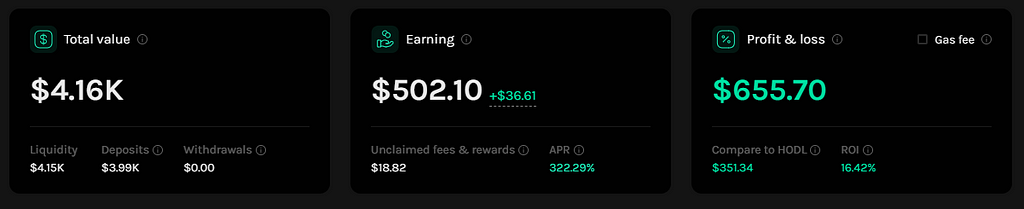

The image above shows an example of one of my recent Concentrated Liquidity positions on the LINK/USDC pair using Quickswap DEX on the Polygon Network. I haven’t had to touch this position for over a month, and it has been earning an impressive 322% APR — that’s approximately $35 per day on my original $4,000 investment.

Risks and Rewards

Providing liquidity isn’t without risks. The most common concern is impermanent loss, which occurs when the value of your deposited assets changes relative to simply holding them. Despite this, the rewards can often outweigh the risks, especially for savvy users who:

- Select pools with high trading volume.

- Use concentrated liquidity strategies effectively.

- Actively monitor and adjust their positions as needed.

The opportunity here is enormous. Providing liquidity can be as active or passive as you want it to be. Some users prefer to “set and forget,” while others actively manage their positions to maximize returns. What’s more, DeFi is always evolving, with new tools and platforms being developed to make liquidity provision even easier and more accessible. You’re not just earning from the fees — you’re an integral part of a financial system that rewards your participation.

Why This Matters

DeFi’s ability to let users earn by providing liquidity is a game-changer. It takes the mechanisms that have enriched banks and brokers for decades and hands them directly to you. Instead of watching institutions capture the profits, you’re the one earning — and it’s all built on transparency and fairness.

This is the essence of real DeFi: no gimmicks, no reliance on a project’s tokenomics. It’s a system where your participation directly powers the ecosystem, and you’re rewarded for it.

In the next article, we’ll explore another core DeFi use case: lending and borrowing. We’ll look at how it works, how it’s different from TradFi, and how you can leverage it to create more opportunities in this evolving financial landscape. Stay tuned!

Disclaimer

The content provided in this article is for educational and informational purposes only and should not be considered as financial or investment advice. Always do your own research (DYOR) and consult with a professional before making any financial decisions. The opinions expressed are solely those of the author and do not represent any financial institution or organization.

Getting Real with Defi: Be the Bank was originally published in The Capital on Medium, where people are continuing the conversation by highlighting and responding to this story.

from The Capital - Medium https://ift.tt/QZiz4hR

0 Comments