Can Solana (SOL) actually make you rich in 5 years?

Solana (SOL) has emerged as a major player, known for its impressive technological capabilities and growing ecosystem.

But setting the hype aside, is it a worthwhile long-term investment?

Let’s explore the potential of Solana as a 5-year investment based on its technological foundation, market performance, expert predictions, and risk factors.

Source: B2Binpay

Read Also: Most Effective Crypto Trading Strategies for Beginners and Experts

Understanding Solana’s Technological Edge

Solana distinguishes itself through its innovative architecture and performance capabilities:

Speed and Scalability

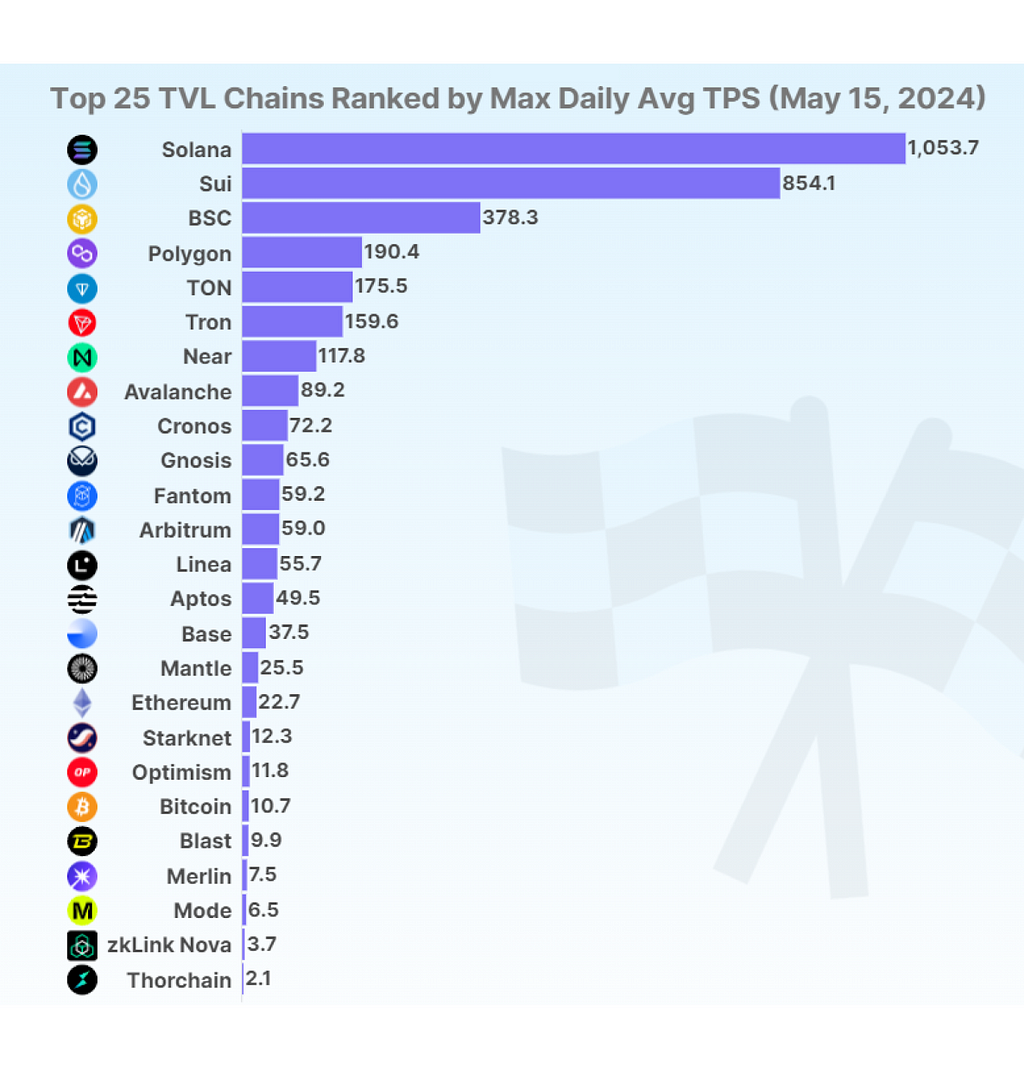

Solana’s blockchain can theoretically process up to 65,000 transactions per second (TPS), making it one of the fastest blockchains.

While this is the theoretical maximum, real-world performance has reached record highs of 1,504 TPS during peak demand periods — still significantly outperforming competitors:

- Solana: 1,504 TPS (peak performance)

- Ethereum: 30–45 TPS (approximately 46 times slower)

- Polygon: 300 TPS (approximately 5 times slower)

- Bitcoin: 7 TPS (approximately 215 times slower)

Proof of History (PoH) Mechanism

The cornerstone of Solana’s performance is its unique Proof of History (PoH) consensus mechanism.

Unlike traditional blockchains that rely on validators to agree on time, PoH creates a historical record that timestamps transactions sequentially:

PoH solves this time challenge. Solana created a clock that essentially timestamps each transaction. It also automatically decides the order in which transactions get recorded onto the blockchain. This dramatically boosts its speed.

Transaction Costs

Solana offers exceptionally low transaction fees compared to competitors:

- Solana: $0.00025 per transaction

- Bitcoin: Approximately $3 per transaction

- Ethereum: Between $8-$40 per transaction

These minimal fees make Solana particularly attractive for applications requiring frequent small transactions, such as gaming, NFTs, and DeFi protocols.

You may also want to read this: The Best Strategy to Do Copy Trading this 2024!

Market Performance and Growth Trajectory

Historical Price Performance

Solana has demonstrated both remarkable growth and significant volatility:

- Initial offering price (2020): $0.22

- 2021 year-end price: $170

- All-time high (November 2021): $260

- Low point (late 2022): $8.9

- 2023 performance: +770% growth

- 2024 performance: New peak of $223.50

- Recent all-time high (January 2025): $294.85

- Current price (March 2025): Approximately $134.27

This roller-coaster journey reflects both Solana’s potential and the broader volatility inherent in cryptocurrency markets.

Source: MotleyFool

Market Position

As of early 2025, Solana has secured its position as a top cryptocurrency:

- Market rank: #5–6 cryptocurrency globally

- Market capitalization: Approximately $80–89 billion (compared to Bitcoin’s $1.7 trillion)

- 24-hour trading volume: $2–4.6 billion

- Circulating supply: 449,155,040 SOL

Source: TheCoinRepublic

Growing Ecosystem Metrics

Solana’s network activity reflects robust adoption and usage:

- Daily transactions: 67 million (late 2024)

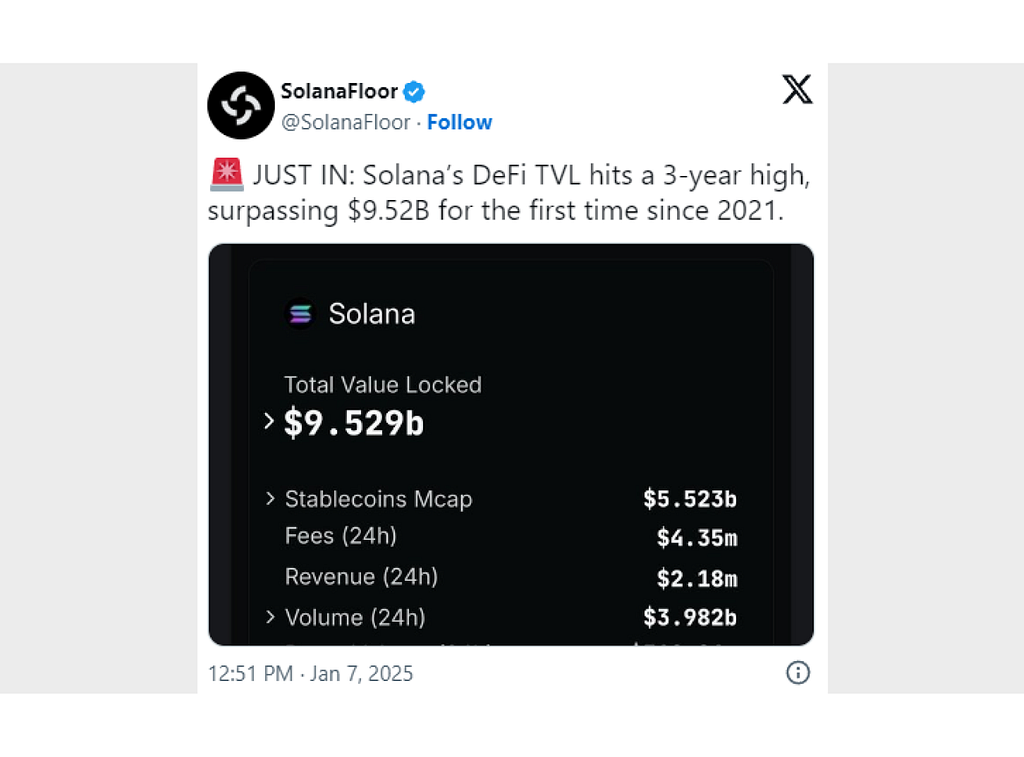

- Decentralized exchange (DEX) volumes: $3.8 billion in a single day (January 2025)

- Total Value Locked (TVL): Over $9.52 billion (January 2025, highest since 2021)

- Monthly active addresses: 120 million (end of 2024, up from 12.7 million at the start of the year)

- Network validators: Over 2,300 nodes actively securing the blockchain

- Transaction fees generated: $177 million in November 2024

Read more about DEX here: What is Decentralized Exchanges (DEXs)

Catalysts for Future Growth

Institutional Adoption

Institutional interest in Solana is growing significantly:

According to a recent report, 15% of surveyed institutional investors are now buying Solana. That’s a big deal when considering that these investors collectively manage $600 billion in assets.

Potential ETF Approval

The possible approval of Solana-based Exchange-Traded Funds (ETFs) could significantly impact Solana’s accessibility and price:

Several institutions have already filed applications for Solana-based ETFs and are waiting for approval — the U.S. Securities and Exchange Commission (SEC) is expected to review these in 2025.

Major financial institutions applying for Solana ETFs include:

- VanEck

- Grayscale

- 21Shares

- Bitwise

- Canary Capital (B2BinPay, McBride)

Prediction markets currently estimate a 78% chance of approval for Solana ETFs, with the first SEC review deadline set for January 23, 2025, just 3 days after a change in SEC leadership.

Developer Adoption

The strength of a blockchain’s ecosystem often correlates with developer interest:

In 2024, Solana became the most popular blockchain for new developers. Despite a slight decline in the total number of developers across the crypto industry, Solana saw an 83% increase in its programmer ecosystem.

This surge brought in an impressive 7,625 new coding talent in 2024 — over 1,000 more than Ethereum, its closest competitor.

Currently, Solana has over 2,500 active monthly developers working on various projects, signaling a healthy and growing ecosystem.

Mobile Web3 Integration

Solana is pioneering mobile integration for blockchain:

In June 2022, Solana Labs unveiled its flagship smartphone, the Saga, a device designed specifically for Web3 integration.

The Saga runs on Android but is deeply embedded with Solana’s blockchain, allowing users to seamlessly manage digital assets such as Solana-based tokens and NFTs directly from their phones.

This mobile-first approach could significantly expand Solana’s user base and use cases.

Expanding DApp Ecosystem

Solana’s application ecosystem continues to grow:

Today, there are over 500 apps running on Solana’s blockchain — and it’s the home to many of the world’s top DeFi projects like Raydium (RAY), Ondo Finance (ONDO), Jito (JTO), and others.

The platform’s NFT marketplace has even surpassed Ethereum in 24-hour sales volume at times (B2BinPay), indicating growing user adoption.

Interested more in reading about the ETF? Click here!

Expert Price Predictions

Medium-Term Outlook (1–3 Years)

Price predictions for the next few years vary considerably:

- By the end of 2025: Between $139.32 (minimum) and $212.74 (maximum), with an average prediction of around $150–176

- By end of 2026: Between $259.80 (minimum) and $391.72 (maximum)

- By end of 2027: Between $483.03 (minimum) and $563.99 (maximum)

- Investment firms like VanEck project that Solana could reach $500+ during the first quarter of 2025 if the current market cycle continues

Long-Term Outlook (5+ Years)

For a 5-year investment horizon, predictions become more speculative but generally optimistic:

- By 2028: Between $687.48 (minimum) and $849.78 (maximum)

- By 2029: Between $1,013 (minimum) and $1,223 (maximum)

- By 2030: Price estimates range from $200 to $1,752, with most analysts settling on an average target of around $1,048–1,568

VanEck’s analysis suggests potential long-term growth to $3,211 by 2030 in an extremely bullish scenario

Most experts agree that Solana’s price in 2025 will likely fall between $220 and $750, with an average target of around $450.

This range reflects Solana’s strong fundamentals and reputation as one of the most scalable and efficient blockchains on the market.

Comparing Investment Returns

Analyzing historical and projected returns provides context:

- 5-year historical return (2020–2025): Approximately +60,900% from ICO price

- Projected 5-year return (2025–2030): +685% to +1,205% (based on average forecasts)

For comparison, Bitcoin’s projected growth for the same period is more modest:

- Current Bitcoin price: $83,454.81

- Bitcoin 2030 projections: $180,000 (VanEck estimate referenced in B2BinPay)

- Projected 5-year Bitcoin return: +115%

Risks and Challenges

No investment analysis would be complete without examining potential risks:

Network Reliability

Solana has experienced operational issues in the past:

On February 6, 2024, Solana experienced its eleventh outage in two years, lasting approximately 5 hours. This happened during a time of high trading activity, leaving users frustrated.

Historical outages include:

- February 2024: 5-hour outage

- September 2021: 17-hour outage due to a denial-of-service attack

These outages raise questions about Solana’s reliability for mission-critical applications, though the team continues to address these issues.

Centralization Concerns

Some critics argue that Solana sacrifices decentralization for performance:

Solana’s high transaction throughput requires validators (the nodes that verify transactions) to use specialized and expensive hardware. This makes it difficult for everyday users to participate, leaving the network in the hands of a smaller group.

Specific centralization issues include:

- Validator hardware requirements: $3,000-$4,000 investment needed

- Cloud provider dependence: About 40% of Solana’s validators are hosted on a single cloud provider (Hetzner), representing 20% of the network’s stake

- Initial token distribution: About 50% of tokens were allocated to venture capitalists and early insiders

Regulatory Challenges

Regulatory uncertainty remains a significant concern:

The SEC has expressed concerns about whether it should be classified as a security, which could have significant implications for the network.

Key regulatory developments:

- August 2024: SEC paused review of Solana-based spot ETF applications

- SEC’s primary concerns stem from Solana’s initial token distribution

- If classified as a security, Solana could face stricter regulations affecting exchange listings and trading

Market Volatility

Solana has shown extreme price volatility:

- 30-day price volatility: 13.07%

- Maximum drawdown: Nearly 97% from all-time high to 2022 low

- Current Fear & Greed Index: 15 (Extreme Fear)

This volatility represents both risk and opportunity for investors.

Competition

While Solana offers performance advantages, it faces significant competition:

Ethereum (ETH):

- First-mover advantage in smart contracts

- Largest developer community

- Institutional backing through approved ETFs

- Transition to Ethereum 2.0 improving scalability

Polygon (POL):

- Layer 2 solution for Ethereum

- Low fees attracting developers

- Complementary role in Ethereum ecosystem

Sui (SUI):

- Claims up to 125,000 TPS under optimal conditions

- A newer blockchain with a growing ecosystem

Investment Strategies to Consider

For those considering Solana as a 5-year investment, consider these approaches:

Dollar-Cost Averaging

Consider Dollar-Cost Averaging: Invest a fixed amount regularly over time rather than making a lump-sum investment. This strategy can help you navigate market volatility.

This approach helps mitigate the impact of Solana’s significant price swings while potentially capturing long-term growth.

Portfolio Diversification

Spread your investments across different assets to mitigate risk. Consider a mix of cryptocurrencies, stocks, and other investment options.

While Solana shows promise, cryptocurrency investments should typically represent only a portion of a diversified portfolio.

Staking for Passive Income

Solana’s Proof-of-Stake mechanism allows investors to earn additional returns through staking:

- Current staking APY: Approximately 6–8%

- Staking can be done through various platforms and wallets

- Compounds return beyond price appreciation

Focus on Technological Development

A key metric for long-term investment success is continued technological innovation and adoption. Watch for:

- Improvements addressing network outages

- Growing developer activity

- Increasing application variety and usage

- Institutional adoption through ETFs or corporate partnerships

Your time is your most valuable asset. Stop wasting it on endless chart analysis. Fat Pig Signals delivers clear, actionable insights directly to you, so you can focus on what matters: profit. Simplify your trading and reclaim your time.

Use code ‘THELUWIZZ’ for a 15% boost to your efficiency.

Conclusion

Solana offers a compelling investment case based on its technical advantages, growing ecosystem, and potential price appreciation.

However, significant risks exist, including network reliability issues, regulatory uncertainty, and fierce competition.

For a 5-year horizon, consider Solana as part of a diversified portfolio, implemented through dollar-cost averaging to manage volatility risk.

💡 Want deeper insights into financial, mental, and physical freedom?

📩 Subscribe to The FREE Nomad on Substack for exclusive content, in-depth analysis, and behind-the-scenes stories on wealth-building and financial independence

Follow my journey worldwide on Youtube and Instagram!

📸 Instagram: @lukaswiesflecker

🐦 Twitter: @TheLuWizz

🎥 YouTube: Subscribe here

Be cautious of scams — I will never approach you with investment opportunities or promotional offers.

Is Solana a Good Investment for 5 Years? was originally published in The Capital on Medium, where people are continuing the conversation by highlighting and responding to this story.

from The Capital - Medium https://ift.tt/wmYUCrA

0 Comments