While digging into Bybit’s mess following their $1.4 billion hack in February 2025 — the saga where I first stumbled upon hints of a “shadow figure” — I uncovered another oddity. As I sifted through their operational flaws, a pattern jumped out: liquidations on Bybit happen one and a half times more often than on Binance, and they come with such brutal squeezes that prices plummet far below what competitors see. This isn’t just a casual observation — it’s a red flag begging for scrutiny. What’s driving these numbers, and why does Bybit stand out?

The Numbers Tell Their Own Story

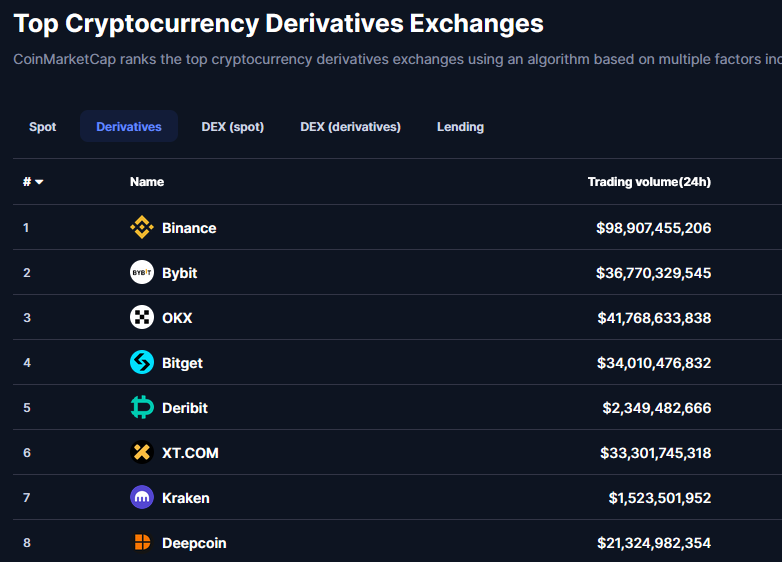

Parsing data from platforms like CoinGlass and skimming discussions on X, I found that Bybit’s liquidations veer into abnormal territory. In the 24 hours after the February hack, their liquidation volume outstripped Binance’s — despite Bybit’s daily trading volume being a mere sixth of the market leader’s. Even more striking, during these liquidations, asset prices crater to depths unseen elsewhere. Take some of a recent ETH dip: Binance logged a low of $2264.50, while Bybit dragged it down to $2252.57, wiping out traders with surgical precision. This isn’t typical volatility — it’s an outlier. What’s fueling it?

Context: A Shaky Post-Hack Recovery

The February hack left Bybit reeling. Whispers on X (@notEezzy) suggest other exchanges, possibly OKX among them, funneled hundreds of millions to prevent a systemic collapse à la FTX. Rebuilding liquidity, though, takes time — and here’s where things get murky. Bybit’s signature squeezes — sharp price drops that liquidate longs followed by rapid rebounds — favor short sellers who can anticipate or even trigger them. Could this be tied to Bybit clawing back losses at traders’ expense? It’s a stretch without hard proof, but their silence on post-hack reserves leaves the door open to speculation.

Technical Underpinnings: A Closer Look at the Engine

Bybit touts its “ultra-fast trading engine,” boasting up to 100,000 transactions per second. But how does it hold up under extreme volatility? Unlike Binance, which employs “smart liquidation” mechanisms to cushion user losses, Bybit seems to cut positions with ruthless efficiency. CryptoLeakz once noted back in 2021 that Bybit throttled liquidation data in its API to one update per second, citing “fair trading.” What does that conceal? Could their system be amplifying cascading liquidations, pushing prices into freefall? Or is it a glitch they’re in no rush to fix? Details remain scarce — Bybit isn’t talking.

Implications for Traders

For traders, these liquidations aren’t just numbers — they’re a minefield. First, deep squeezes render stop-losses unreliable: even conservative thresholds fail when the market tanks beyond expectations. X users like @_FabianHD point out that Bybit’s liquidation tally might have crossed $1 billion in recent months — a figure that feels outsized for its market share. Second, it breeds unease: traders suspect foul play, sparking a noticeable exodus of funds. Third, these anomalies amplify volatility, turning Bybit into a high-stakes gamble rather than a trading platform. This isn’t mere inconvenience — it’s a setup where users are exposed.

Possible Explanations: Coincidence or Design?

There’s no smoking gun for manipulation, but the possibilities linger. Are these squeezes a deliberate tool to shore up liquidity post-hack? Some on X (@SpeedySEEL) speculate Bybit might be coordinating with big players to short the market and profit off mass liquidations. Alternatively, it could be a byproduct of an overstretched infrastructure buckling under pressure. If so, why no public breakdown or statement from the team? The lack of clarity only stokes doubts.

Unanswered Shadows

Bybit offers no insight into how its liquidation mechanics function in such extremes. Post-hack, they’ve shared neither reserve reports nor technical postmortems. Who’s steering these processes? Could there be a link to that “shadow figure” I wrote about earlier? Or is this simply a platform unraveling under its own weight? Without official word, we’re left piecing together scraps from the sidelines.

Bybit’s liquidations aren’t just a statistical quirk. They set the exchange apart from its peers and raise questions about its stability and intent. Something about these squeezes doesn’t align with standard market logic, but the full story remains elusive. Whatever emerges next could reveal a picture far more intricate than it first appears.

Liquidations on Bybit: An Anomaly or Something More? was originally published in The Capital on Medium, where people are continuing the conversation by highlighting and responding to this story.

from The Capital - Medium https://ift.tt/tphqUBM

0 Comments