It isn’t the intended silver lining. Tariff wars are the adrenaline that pumps a deal maker into action, and the world is watching it play out.

Uncertainty drives countries and traditional markets into panic mode, and the world is at various panic levels.

China is in full-on fight-or-flight panic, while over 75 countries have come forward to negotiate. According to the White House, the 90-day tariff pause allows Trump time to personally sit down with each country.

US markets have seen losses as high as 20%, wiping out trillions of dollars.

Asian markets have experienced losses of as much as 13%, while German markets have seen losses of up to 15%.

The Cryptoverse has been impacted by tariff news.

Bitcoin’s price dropped by 3%, while Ethereum and Solana dropped by 11% and 10% (respectively).

The difference is eye-catching, and the rebound rate between traditional investments and the Cryptoverse will surely catch the eyes of hardcore traditional investors.

This information raises interesting questions about Crypto (especially Bitcoin) and the Cryptoverse.

It remains a high-risk investment, but its track record of resilience is undeniable. Crypto (especially Bitcoin) rose to new heights when crypto-critics forecasted its demise.

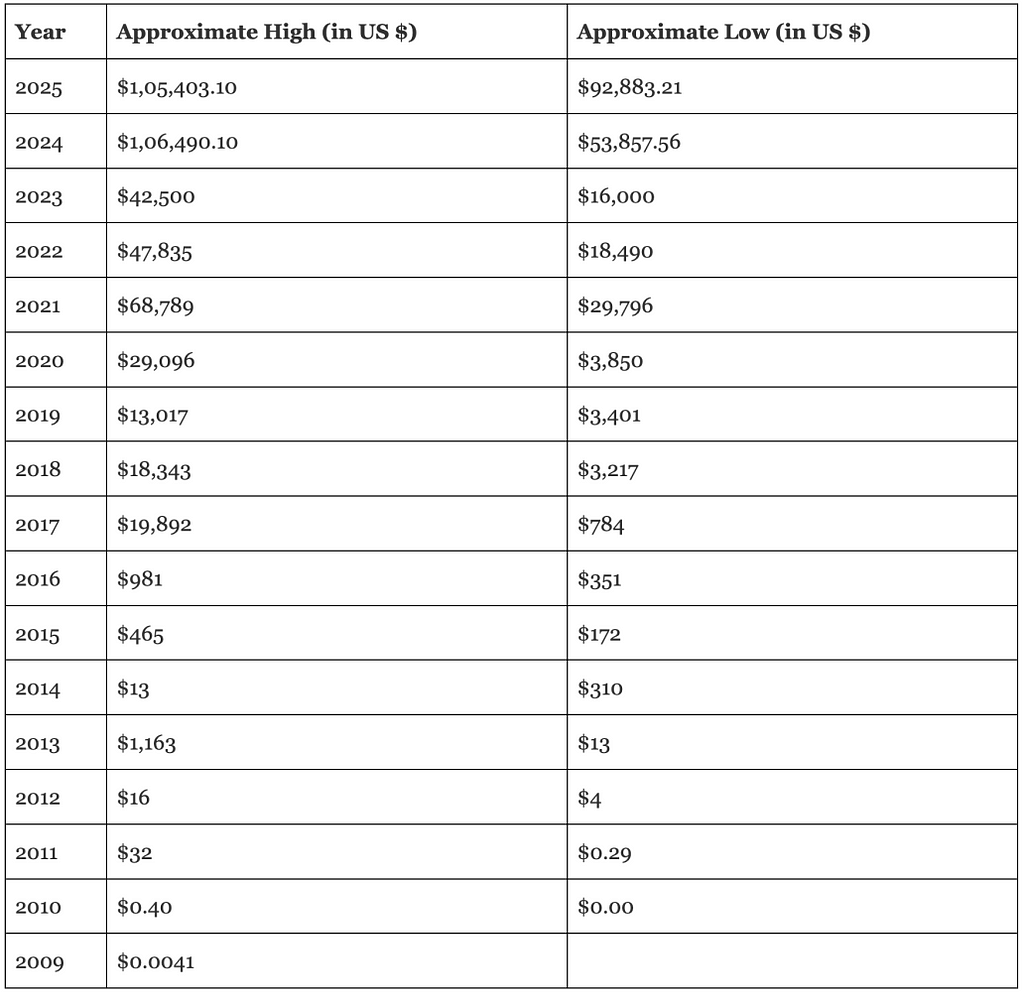

Please take a look at the chart below.

According to 99Bitcoins, Bitcoin has died 477 times, yet each time, it has found new investors who have taken the price to new highs.

The years from 2009 (Bitcoin’s beginning) to 2015 are exciting because the concept was new, and uncertainty abounded. But look at the numbers by percentage.

2009–2010–10,000%

2010–2011–8,000%

2011–2012–50% drop

2012–2013–8,000%

2013–2014–8,000% drop

2014–2015–3,700%

Bitcoin’s resilience is undeniable, and this was before global uncertainty and tariff wars abounded.

Crypto is decentralized

Crypto is decentralized by design, so it is not subject to traditional market manipulations. Tariff wars appear to be no exception.

As global uncertainty grows, Crypto’s resilience to uncertainty will catch the attention of investment-conscious investors looking for a safe haven.

That is not happening in mass adoption, but it has to make investors curious, which will cause them to investigate the Cryptoverse.

Decentralized finance (DeFi) is a thriving ecosystem within the Cryptoverse that could appeal to those wary of traditional finance.

You can learn more about DeFi in my story, The World of DeFi: the future of finance.

The Crypto long & short newsletter, February 5, 2025, said this about tariffs.

“As trade conflicts heighten distrust in traditional financial systems, decentralized finance (DeFi) may offer users a way to bypass some of the barriers imposed by tariffs and regulations. More users may turn to DeFi platforms for financial autonomy. DeFi applications allow for peer-to-peer transactions without intermediaries, reducing reliance on traditional banking, which is often impacted by trade policies. If tariff wars continue to disrupt traditional trade channels, crypto-based financial solutions could see increased adoption.”

The tariff war’s silver lining could be another step in Crypto’s mainstream adoption.

How it impacts everyday people

The Cryptoverse represents the coming digital asset change. It will impact humanity, which means change is coming and will affect you.

It will take educating yourself and a willingness to change, but once it is embraced, it will help everyday people find a better life.

It is part of the future global economic landscape and must be something you are familiar with.

Education is critical, and intelligent investing is paramount for everyday people to navigate these bumpy roads.

I am putting together a series of courses to help educate you about the world of Crypto and give you a path to financial freedom.

The thought of change often scares everyday people back into old, comfortable living patterns. There is nothing comfortable about being uncomfortable.

However, IF change is to occur, you must weigh the length of your discomfort against the lifetime of enjoyment.

In other words, is it worth the temporary discomfort to avoid a lifetime of complacency and lack?

If your answer is YES, you can follow along and learn how to make a change by being educated in the cryptoverse.

I am committed to the cryptoverse, which offers a path to help you change and find financial freedom.

Disclaimer: I am not a financial planner and do not offer financial advice. I am an avid student of the cryptoverse who is willing to make the things I learn available to everyday people eager to take a chance, change, and explore your financial freedom in the cryptoverse.

crypto, tariffs, cryptoverse, everyday people was originally published in The Capital on Medium, where people are continuing the conversation by highlighting and responding to this story.

from The Capital - Medium https://ift.tt/9DAzVve

0 Comments