Bitcoin On Autopilot Along With Gold All-Time Highs Weekly Financial Market News

By Rubikav® on The Capital

As Congress continues to debate more fiscal aid, the Federal Reserve will likely stop the fire at the end of its policy meeting on Wednesday but will remain cautious about the economic outlook.

With market participants weighing in on escalating Coronavirus cases in the southern and western states of the US and mounting tensions with China, some of the biggest names in big technology will report their earnings.

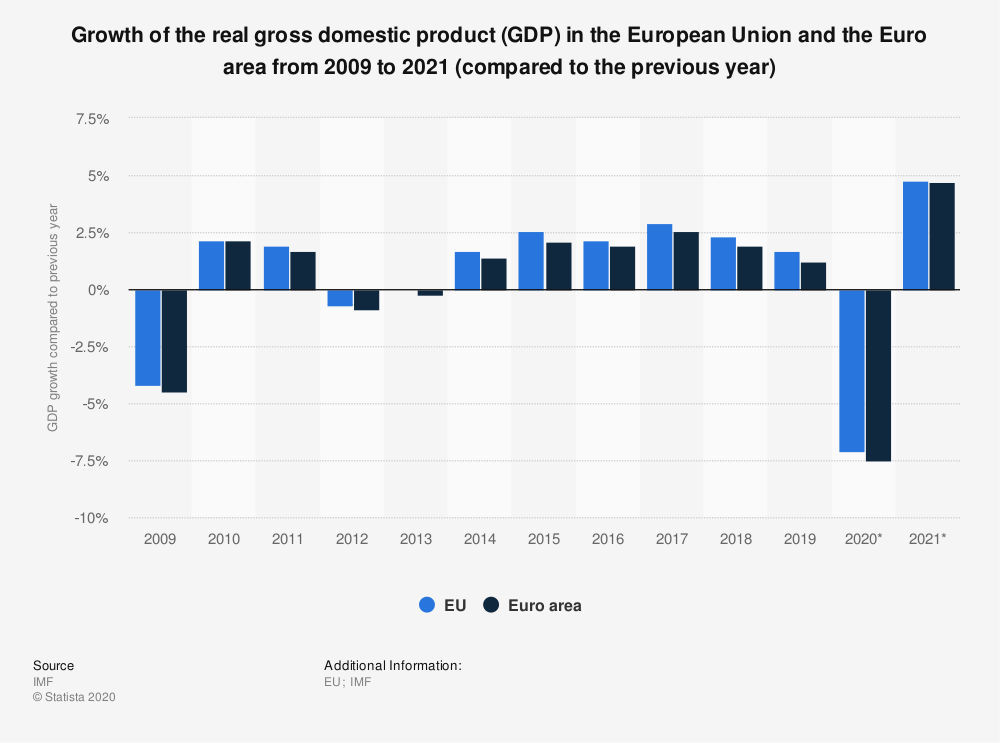

The highlight of the data calendar will be Thursday’s first estimate of US second-quarter GDP, which will show complete information on what is expected to be the largest quarterly contraction in history. Meanwhile, second-quarter GDP figures for Germany and the euro area are also expected to show sharp contractions.

This is what you need to know to start your week, according to the mainstream media.

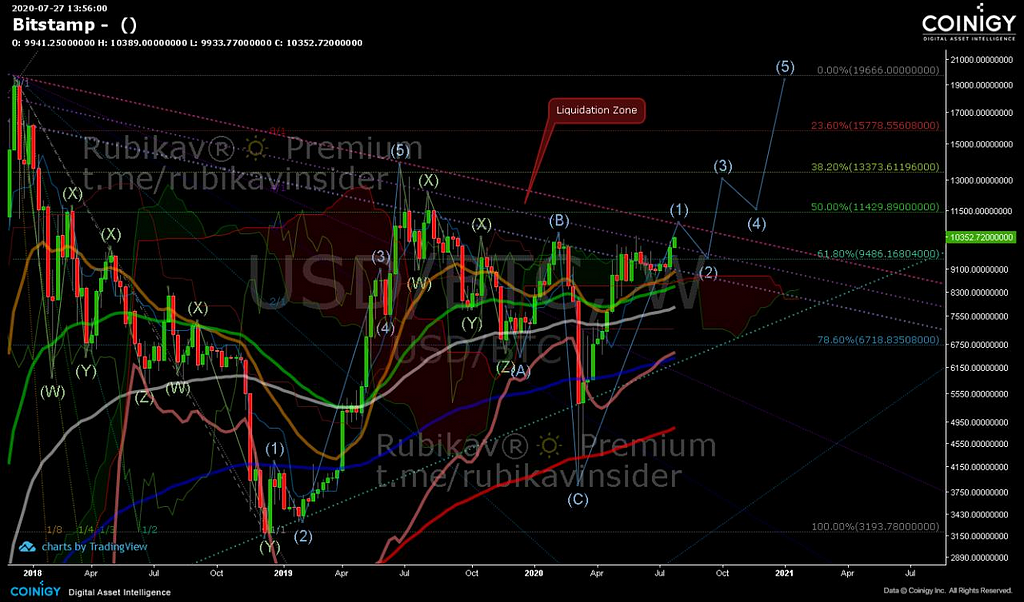

Bitcoin On Autopilot

By the time this article was written, the full capitalization of the cryptocurrency market had raised the barrier of $ 300 bn, signaling one of the biggest matches to be able to say that the bullrun is starting to walk in autopilot.

Bitcoin’s weekly outlook shows us that we have broken two downtrend lines that behaved like resistance.

We have, therefore, entered a low channel from the historical maximum, an area that we already have as a strong settlement zone. So we should expect that with the continuation of wave 1 of Elliot, the price will test exactly point 10853, where it would be touching one of the most important downtrend lines to overcome.

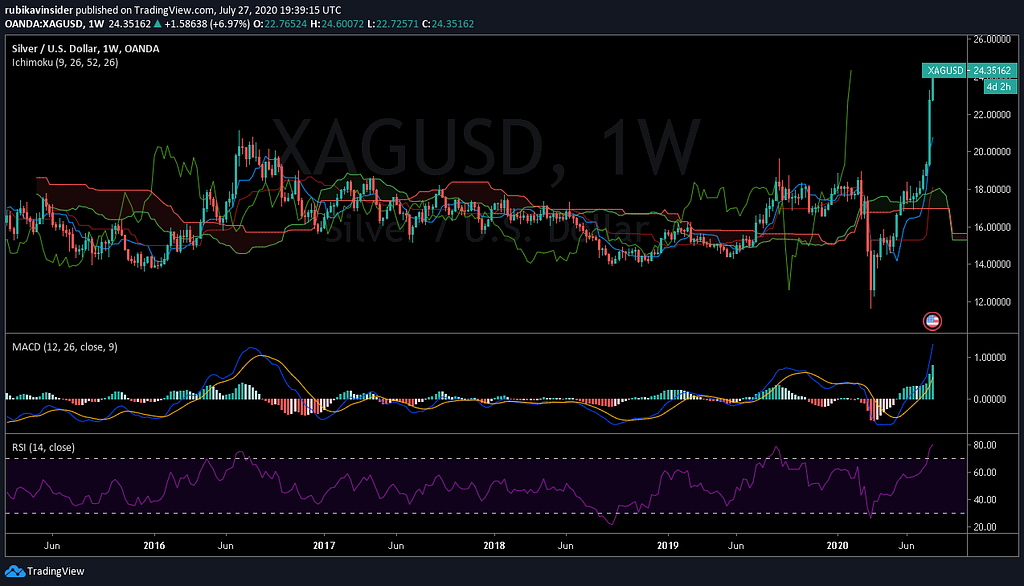

At all costs, we must avoid false breaks. So we just keep watching right now. MACD in favor of the trend, RSI with 61 points towards the oversold zone and stochastic RSI indicating continuation, but the margin of volumes continue to be low with tolerance to sudden failures.

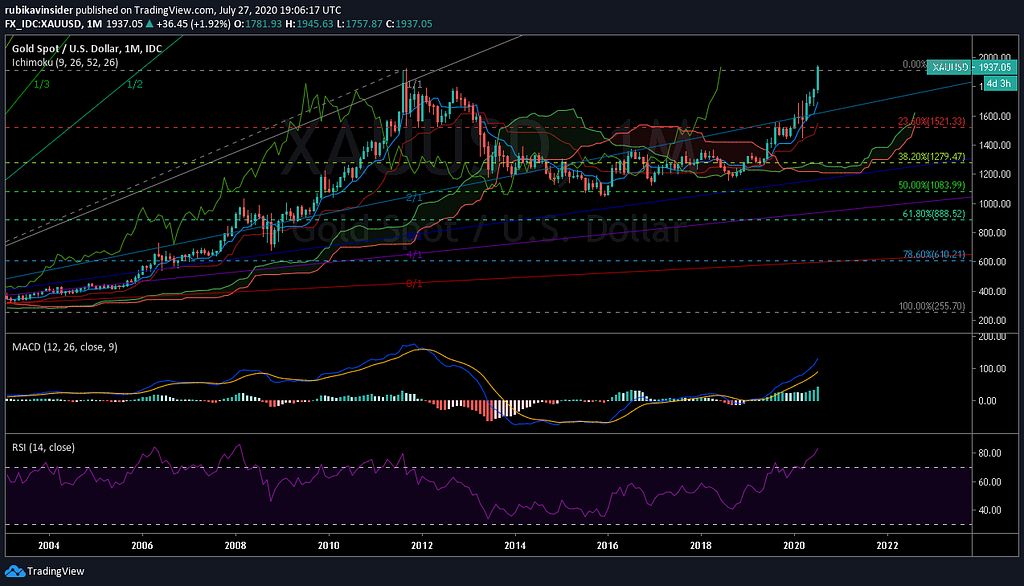

Gold New All-Time Highs

Gold prices have risen more than 20% so far this year, copper has just reached its highest level in more than two years, and silver prices have appreciated 28% this month alone as explains investing.

Gold reached $ 1,900, approaching its all-time high that it set 9 years ago ($ 1,921.17 in September 2011). We have attended his seventh week in green, a streak not seen since 2011. The reasons for this rally are as follows:

- Concerns about the future of the world economy due to the Coronavirus pandemic.

- Increased tensions between the US and China.

- Low real yields.

- A flexible monetary policy.

- Record entry of money in funds that invest in gold.

It started the year above $ 1,500 and exceeded $ 1,600 in mid-February. In March it fell from 1,500 and in April it reached 1,700. At the end of June, she set her sights at 1,800, a level that exceeded this July.

It wouldn’t be surreal if we saw $ 2,000 in September or October.

But as economies struggle to recover from the pandemic and tensions between the US and China soar, some investors have overlooked wood. Wood futures have doubled since the beginning of April and are even outperforming gold and silver, traditionally the quintessential safe haven products.

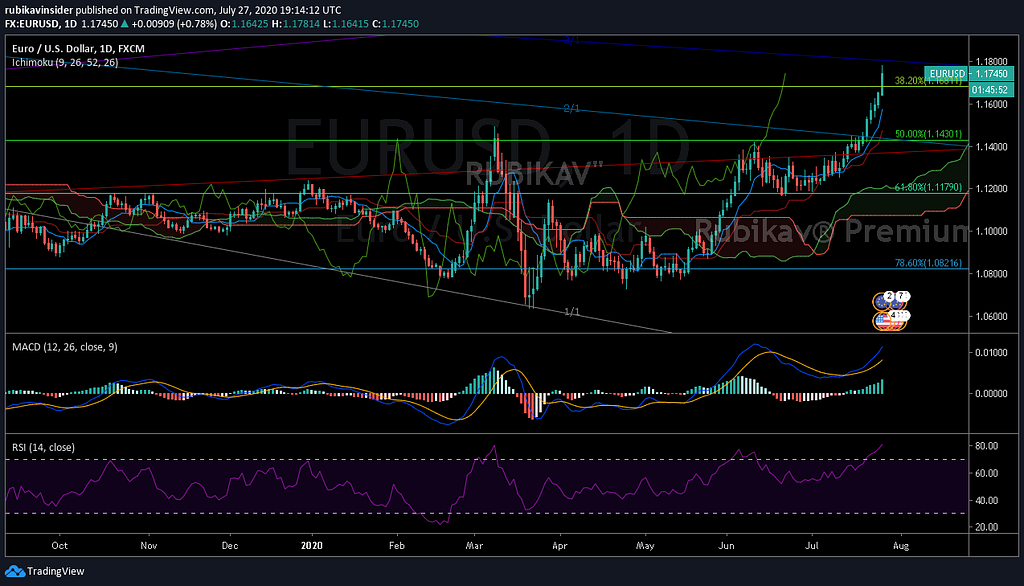

Dollar and Euro Surviving

The Dollar Index has fallen 8% from its peak in mid-March, reaching its lowest level since September 2018. It has marked its worst month since the beginning of 2018 and in principle, things should not vary much.

Three years ago, we witnessed an index drop even higher than 8%, with the S&P 500 rising 19% and emerging markets rising 34%.

Catalysts such as negative real rates in the US and the coronavirus pandemic, which continues to grow in the country, are enough arguments to think that the weak note will remain weak.

The dollar was robust during the first quarter of the year, but as equity markets have rebounded, it ran out of power. This trend may continue and would have repercussions for a number of asset classes, such as commodities, which tend to have an inverse relationship with the dollar.

The short-term correlations between equities and the dollar index have been at their most negative point for 4 years and regarding raw materials, it has been at the most negative level in more than 2 years.

The banks that handle most of the daily business volume expect the dollar to drop almost 2% against the euro and 3% against the yen in the next six months, as they believe that the reduction in foreign exchange demand that fueled the Green ticket in March will hurt you.

In addition, the Government’s budget will be another slab for the greenback and the budget deficit will be higher in the coming years than that of the euro zone.

In the EUR / USD the trend continues to be bullish and has reached the first two objectives of the rise, attending to Fibonacci levels. The next one is at 1.1824. The slightest sign of weakness will not be noticed as long as it remains above 1.13.

Regarding the dollar index, say that it was created in 1973 and started at 100. Compare the dollar against a basket of major currencies.

The main ones are the euro, the Japanese yen, the British pound, the Canadian dollar, the Swedish krona, and the Swiss franc. Each of them has a different weight in the index, with the euro having the most, with a weight of 57%, so movements in the EUR / USD will have more impact on the index.

It can be traded through contracts for difference (CFD) or futures.

A little while ago it lost the 94.87 zones, a fact that implies even more weakness if possible. We could see it in the coming months at 93.50.

Next Round Of Stimuli

Approximately 32 million Americans with unemployment benefits are currently receiving $ 600 a week in expanded unemployment benefits, but this is due July 31.

United States Secretary of the Treasury Steven Mnuchin said Saturday that the Trump administration supports extending unemployment benefits until the end of the year in the next round of coronavirus aid, albeit to a reduced level.

The administration and the United States Congress have been trying to reach an agreement on the next round of pandemic relief and Republicans are expected to reveal their proposed measures earlier in the week which will then be debated.

However, it is unclear whether an agreement can be reached before the current expanded unemployment benefits package expires, which means that even more difficult times may be ahead.

Federal Reserve Meeting

The Fed is likely to be paralyzed at its July 28–29 meeting after reducing interest rates to near zero and promising unlimited purchases of financial assets. Officials are likely to reiterate the guidance that rates will remain close to zero until the economy returns to normal.

Fed policymakers have become more pessimistic about the economic outlook in recent weeks, with some warning that recent improvements in economic data, such as job growth, may be fleeting amid a resurgence in coronavirus pandemic.

“The pandemic remains the key driver of the economy’s course. We are still surrounded by a thick fog of uncertainty and downside risks are prevalent,” Fed Governor Lael Brainard said earlier this month.

Publishing The Technology

The Wall Street rally that has brought the S&P 500 to almost 5% below its all-time high reached in February and has seen the Nasdaq gain more than 15% so far this year will be tested this week, with dozens of companies important reporting earnings.

Facebook (NASDAQ: FB) will post on Wednesday, while Apple (NASDAQ: AAPL), along with Alphabet (NASDAQ: GOOGL) and Amazon (NASDAQ: AMZN), will do so on Thursday.

Other companies slated to report include pharmaceuticals Merck, Pfizer (NYSE: PFE) and Eli Lilly (NYSE: LLY), as well as McDonald’s (NYSE: MCD), Procter & Gamble, and Starbucks (NASDAQ: SBUX). Results from energy giants Exxon Mobil (NYSE: XOM) and Chevron (NYSE: CVX) will be released on Friday.

Facebook, Amazon, Apple, Microsoft (NASDAQ: MSFT), and Google, the five largest stocks in the United States, now account for 22% of the market capitalization of the S&P 500, analysts at Goldman Sachs (NYSE: GS) Goldman said. Sach in a recent report.

Here in our country, pay attention to the figures of large groups such as Santander (MC: SAN), BBVA (MC: BBVA), or IAG (MC: ICAG).

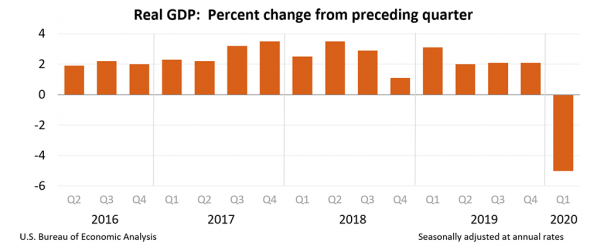

United States Gross Domestic Product

The US Department of Commerce will release its first version of second-quarter GDP on Thursday, and analysts forecast an annualized decline of 34% over the three-month period.

The recovery now appears to be at risk as cases of the virus have exploded across the country, prompting some authorities in the affected southern and western regions to close businesses again or pause the reopening.

“Despite the Fed maintaining its ultra-flexible political stance and Congress providing more fiscal support, ongoing social distancing requirements are likely to keep GDP well below its pre-virus trend and high unemployment rate in the next few years, “said Paul Ashworth. United States Chief Economist at Capital Economics.

While Monday’s data is expected to show yet another increase in durable goods orders, Thursday’s numbers on initial jobless claims are expected to remain high.

Gross Domestic Product Europe

Figures for Germany on Thursday and the broader euro zone on Friday will show the extent of the economic contraction caused by the blockades during the second quarter. Germany’s economy, the largest in the euro area, is expected to contract 9%, while the euro area is down 11.2%.

The euro hit 21-month highs above $ 1.16 on Friday after the European Union brushed aside differences and agreed to a recovery fund COVID-19. This sign of solidarity, combined with a monetary and budgetary stimulus, could boost the European currency to 1.20, some predict.

Optimism could take the sting out of the lousy GDP data.

Silver Futures Going Up

Silver futures also rose again, up 7.6%, to $ 24.59 an ounce, the highest since 2013.

The prospect of negative real interest rates for the near future has strengthened non-interest-bearing assets, with gold and silver ETFs registering strong inflows in recent weeks.

See you in the next story! With love 💛 Rubikav® Team!

Join on our Telegram Community https://t.me/rubikavinsider Channel.

Follow us on Twitter, TradingView, Coinigy, Facebook, Uptrennd, Medium, Publish0x, & Instagram.

Crypto Wallets that we recommend to use: Coinbase, Exodus, Atomic Wallet, Enjin Wallet, and Trust Wallet.

Crypto Exchanges that we use to trade: Binance, Binance Futures, Bybit, Derebit, Kucoin, Bittrex, And Houbi Global With Cornix Auto Trade Bot.

https://twitter.com/thecapital_io

Bitcoin On Autopilot Along With Gold All Time Highs Weekly Financial Market News was originally published in The Capital on Medium, where people are continuing the conversation by highlighting and responding to this story.

from The Capital - Medium https://ift.tt/3g8Hl0J

0 Comments