Fiat Money, Gold, Bitcoin — What Have We Learned?

By Grant Keefe on The Capital

The past 6 months should have quelled any doubts that the value of fiat currencies will continue their trend towards their cost of production, which is essentially zero. While the exact catalyst to the next financial crisis was impossible to predict (Corona Virus), how central banks would respond was clear to those paying attention.

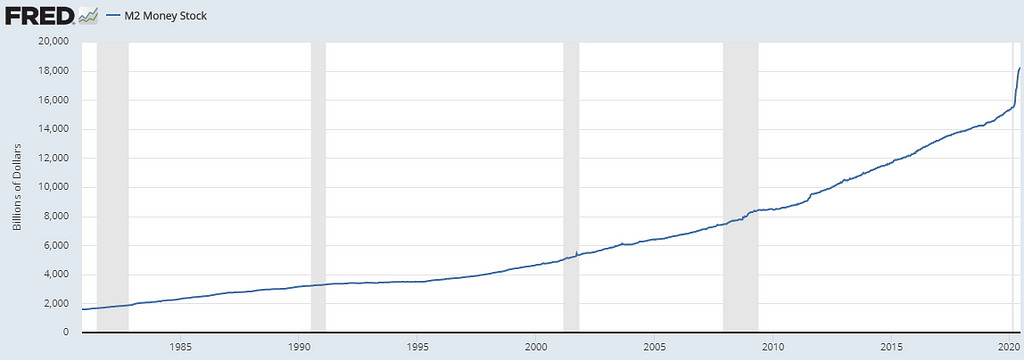

Throughout the last 10 year “recovery,” central banks regularly enacted extreme monetary policies by printing money and pegging rates to zero or even negative. This encouraged huge government spending and financial entities to lever their balance sheets to reckless levels with the promise of eventually normalizing once the economy had been saved and production picked back up. These policies did help revive the US job markets and bring unemployment to 3.5%, but GDP growth has only averaged barely above 2% over the last 12 years. Not only that, but government and corporate debt have continued to grow and any attempts the Fed has made at the balance sheet or interest rate normalization were met with violent market crashes.

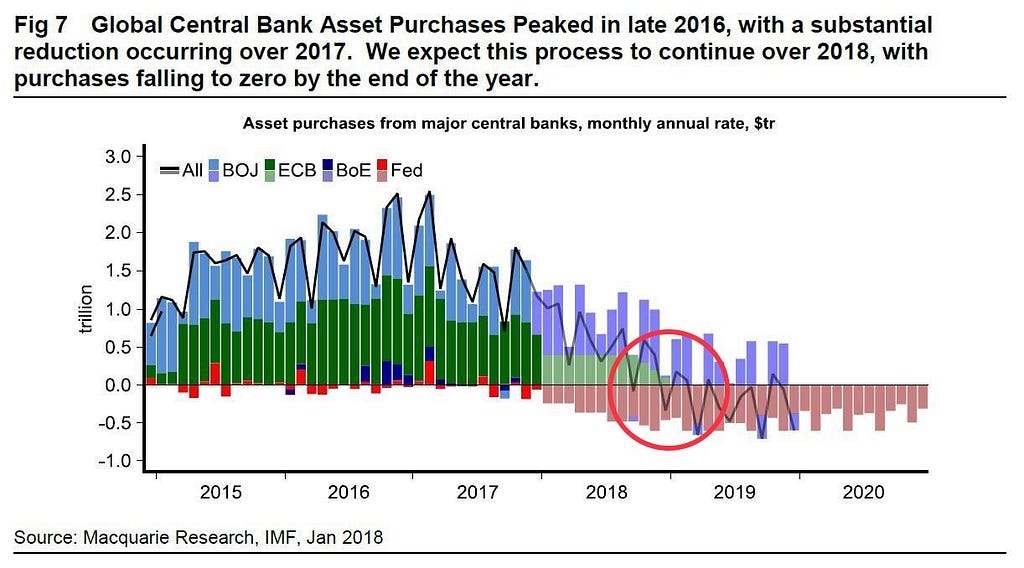

Seven years after the depths of the crisis, the Fed began their attempt at normalization. From 2015–2018, they brought rates from 0% — 2.5% and in 2018, reduced their balance sheet from $4.5T — $3.75T. This was only possible because, during that time, every other central bank was continuing some form of money printing, which helped offset the Fed’s reduction of dollar liquidity. That began to change towards the end of 2018 as the ECB, BOJ, and BOE began to follow suit. Going into the end of 2018, I warned there’d be a heightened risk of a liquidity crisis as net purchases from central banks would go negative.

We proceeded to have the worst month since the Great Depression forcing Powell to pause the Fed’s balance sheet reduction program and decide against his plan of 4 more rate hikes. In September of 2019, Jerome’s pivot to a looser monetary stance still wasn’t enough as the Repo markets began to go haywire. He then had to resume something he coined “not QE,” (aka QE) in order to calm the markets. We have continued printing and cutting rates ever since.

All of this was after 3 rounds of QE, Operation Twist, and cutting rates to zero from 2009–2015 to bail the US out of the ’08 crisis. So if the Fed hasn’t been able to stop printing money 12 years after the 2008 crisis during what some claimed to be “The Greatest Economy Ever!” how did we think they would respond to a new crisis?

To the few who were not sure, Neel Kashkari and Jerome Powell were quick to confirm that they had no issue continuing to print money and that the Fed can print an “infinite amount of cash” if they deem it necessary.

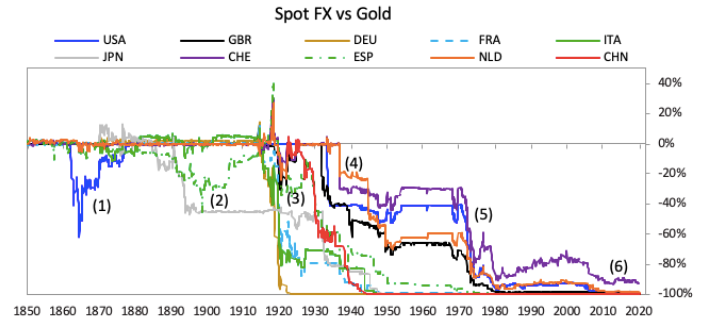

What does that mean for the future? That the trend of monetary debasement that has been progressing at an ever accelerating rate will continue as it is the only way to keep countries from defaulting on debt. If you take a brief look at history, you can see that all fiat currencies have suffered a significant amount of debasement when measured in assets that have maintained their purchasing power (ie. gold).

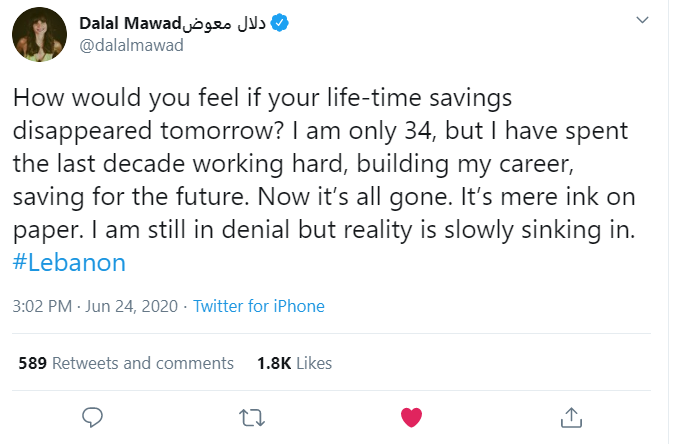

You will also notice that many of these devaluation events happened suddenly and if you were not prepared, much of your wealth was wiped out in a very short period of time.

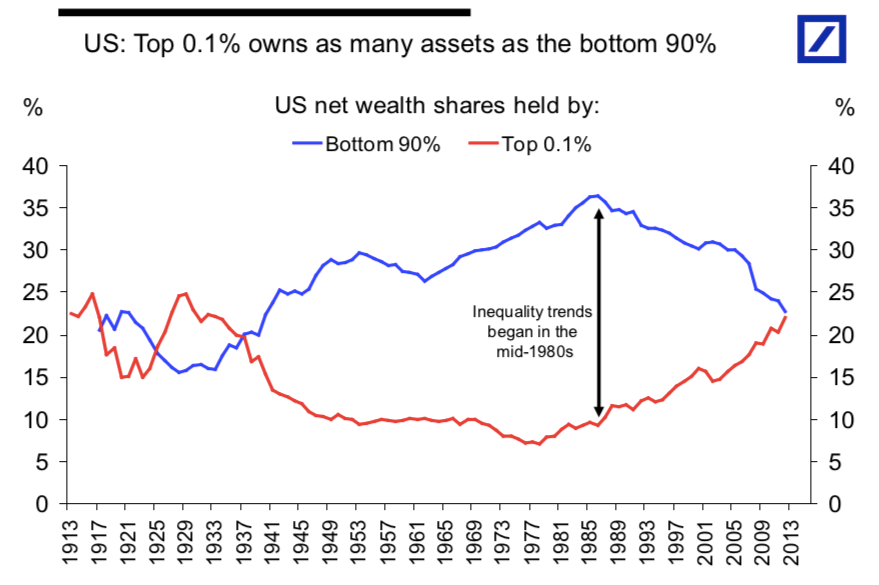

The effects of printing money have forever been downplayed by Keynesians and those who benefit most from this status quo. But the truth of the matter is, it is impossible to print value out of thin air; therefore when any amount of money is printed, there are adverse effects to society. Money printing is a tool mainly used to steal from the 99.9% through inflation to benefit the .1% as only those closest to the money printer get to reap the benefits before asset prices adjust to the new supply of money (Cantillon Effect).

In the past, gold has been the most efficient way to beat this system. It is much easier to outpace the rate of inflation buying a scarce asset like gold then it is to pick stocks and balance a portfolio. This is what led to my short-lived obsession with gold; however, I came to realize it has a few weaknesses that have prevented it from being able to act as the sound money it ought to be.

Gold is hard to authenticate, it’s heavy and not easily divisible making it difficult for day-to-day transactions. A regular guy like me is not able to verify if the gold I receive is legit or not. It’s also not easy buying daily groceries with it. This has led to gold being centralized by “trusted” third parties who verify and custody the gold for us. We allowed the Fed, for example, hold our nation’s gold and issue paper to represent our ownership of the real thing back before 1971. This significantly improved gold’s functionality; however, that power has always been abused with the custodian’s ability to very cheaply and easily issue more paper then they have gold to back it. Eventually, this leads to a crisis of debt, which is solved by debasing the paper currency and resetting the price back in terms of gold. From 1970–1980, as Nixon “temporarily” ended the Bretton Woods System, gold appreciated over 15x against the dollar. In other words, the dollar lost over 90% of its value in a single decade due to inflation from reckless monetary policies.

Unfortunately, it was against the law for individuals to own gold until December 31st, 1974, making it very difficult for people to protect their wealth the easy way. Many were forced to pick stocks and underperformed in real terms as stocks indices only appreciated ~50% during that same time period.

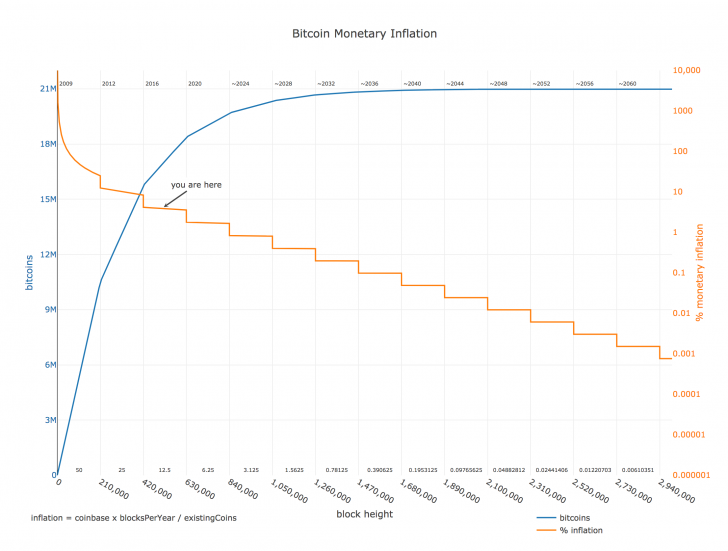

Bitcoin is superior to gold as it shares the same monetary traits except that it can be sent over a communications channel and easily verified with ones’ own Bitcoin node. The decentralized aspect of Bitcoin makes it immune to the threats of monopolization, centralization, or monetary manipulation unlike with gold. With the invention of the internet and then Bitcoin, we have made it possible to separate money from state and provide the world with a universal, apolitical, supply-capped currency that anyone with internet access is free to use.

The choice becomes simple: Will we continue to accept a corruptible currency that is in a permanent state of quantitative easing?

Or will we continue to gravitate towards an incorruptible currency that is in a permanent state of quantitative tightening?

https://twitter.com/thecapital_io

Fiat Money, Gold, Bitcoin — What Have We Learned? was originally published in The Capital on Medium, where people are continuing the conversation by highlighting and responding to this story.

from The Capital - Medium https://ift.tt/3gculaG

0 Comments