- Here is what you need to know from the House Hearing on the GME Frenzy

The virtual hearing lasts more than 5 hours, starting from 9:00 am ET. CEOs of the 4 major participants[i], along with Keith Gill, the major Reddit GME post contributor, testified before the Financial Service Committee. The hearing helps to clarify several unsolved questions that arise from the GME saga, and at the same time exposes other real issues in the financial market worth examining.

Conspiracy? Outside Pressure? Absolutely No!

Vlad and Griffin both pushed against the conspiracy theory circulating on the internet that there was coordination between the market makers and the broker on the trading restriction. Griffin said during the hearing that his company did not know the restriction issue until Robinhood made the decision available to the public.

Though there has been no evidence showing any illegal correspondence among those companies, I can see why the rumor caught on so quickly:

1) Robinhood’s revenue has grown from $2.9 million in 2015 to $271 million in the first two quarters of 2020.

2) 40–55% of all Robinhood revenue come from payments for order flow.

3) Citadel Securities (a Citadel affiliated company) is the largest client who have to pay for the order flow, among other five as listed on its order routing public report[ii].

4) On 1/25/2021, Citadel made a $2.75[iii] billion investment in Melvin Capital, the major GME short seller who absorbed a 53% loss in January due to its large short position in GME.

Just looking at the size of the capital involved, and the timing of the event, it is not an exaggeration to say that they are important stakeholders to each other. But this could not be evidence against their integrity. Robinhood discloses these order routing activities in their SEC Rule 606 and 607 Disclosure[iv]. And Melvin capital refuted that the funding is a “bailout”. Cash injection at the “difficult time” is no different from investors trying to buy low during market crash. Warrant Buffet did that after the 2008 financial crisis. He handed billions of cash to Goldman Sachs, GE, and BOA, in exchange for their preferred shares, stock warrants and common stocks at a deep discount.

The hearing on Thursday is just one of a series of investigation, the SEC, FIRA and several other congressional panels are looking into the matter. More information from the oversight bodies would provide us a better understanding of the whole picture of the story and its regulatory implication.

This is a liquidity issue. Yes or No?

Unfortunately, we still did not get a satisfying answer.

Though more than a few representatives, including AOC from the 14th district of New York, challenged Mr. Tenev with the question about the relationship between the buying restriction and the clearing house collateral deposit requirement sufficiency, he avoided the simple answer of Yes or No by constantly referring back to the company’s full compliance with all clearing house regulation.

It is true that Robinhood have met all capital requirement from DTCC. But they did it by putting restriction on stock buying activities which are thought to be the main source of market volatility. In another word, if the company has more than enough capital (stronger balance sheet), they would have been able to operate as usual.

It was revealed in a Clubhouse chat between Mr. Tenev and Elon Musk that the first clearing house capital requirement is $3 billion. And it was further confirmed during the testimony that the requirement was reduced to $1.4 billion and later to $700 million because the “controlled” volatility in stock price as a result of the restriction.

Actually there are several brokers, such as Interactive Brokers, who simply restrict the margin position instead of shutting down the entire buying channel. Vanguard and Fidelity maintain normal operation throughout the whole period. Part of the reasons is that the two companies are among the top5 holders of GME[v] stock, which has given them an advantage in dealing with the shooting collateral deposit requirement. But the point is, it is the relaxed capital reserve of Robinhood, among some other online brokers, that has led to the frustration of hundreds of thousands of investors.

So how should we interpret the “Liquidity” myth? Representative Ann Wagner’s question turns out to be the best answer: The fact that Robinhood does not have enough money to maintain normal trading can be attributed to at least one of the following 3 factors:

1) The DTCC collateral amount is too high.

2) There has been unforeseeable trading volume.

3) The company is undercapitalized under the risk profile.

The first two are the emphasis in Mr. Tenev’s account of the story. Robinhood’s testimony letter[vi] has referred the buying surge activity in stocks like GME as five standard deviation, or Five Sigma, which is an event that had about a 1 in 3.5 million chance of occurring. In the company’s blog post, Mr. Tenev brought up the idea that liquidity pressure could have been relieved if the T+2 settlement cycle was reduced to 1 day or real time. The company is trying to say that:

1) Because the event cannot be modeled and we have met all regulatory requirement, it is unfair to accuse us of failing to maintain liquidity.

2) We could have done better in dealing with the lack of reserve capital if the settlement cycle is shorter. And the technology today is mature enough to bring down settlement cycle.

It sounds reasonable, but not so much if we consider another possible path that the company may take:

Robinhood secured the same amount of capital but did not impose any restriction. If the volatility kept on increasing to the point where Robinhood could not meet the deposit requirement, the company would be designated as “default”. In that case, NSCC, the DTCC subsidiary, would transfer current customer’s account to other members, and liquidate Robinhood’s own portfolio. By then, none of Robinhood investors would be able to make any buy or sell transactions until the whole process is settled.

This would, according to Mr. Tenev, cause even larger loss and frustration than preventing people from buying the stock.

The hypothetical recount clearly explains the intention of the no-buy restriction. Robinhood knows there could be bad consequence, not only to the company itself, but also to NSCC, the central plumbing facilities and the wall street capital that sits behind it. And yet, the company knowingly decides who should bear the loss, not only investment loss but loss of the opportunity to profit from the FREE MARKET. If we frame the choice as to minimize overall economic loss, then what Robinhood had done is the optimal solution. But again, does Robinhood have the right to make that decision?

Who is the Client?

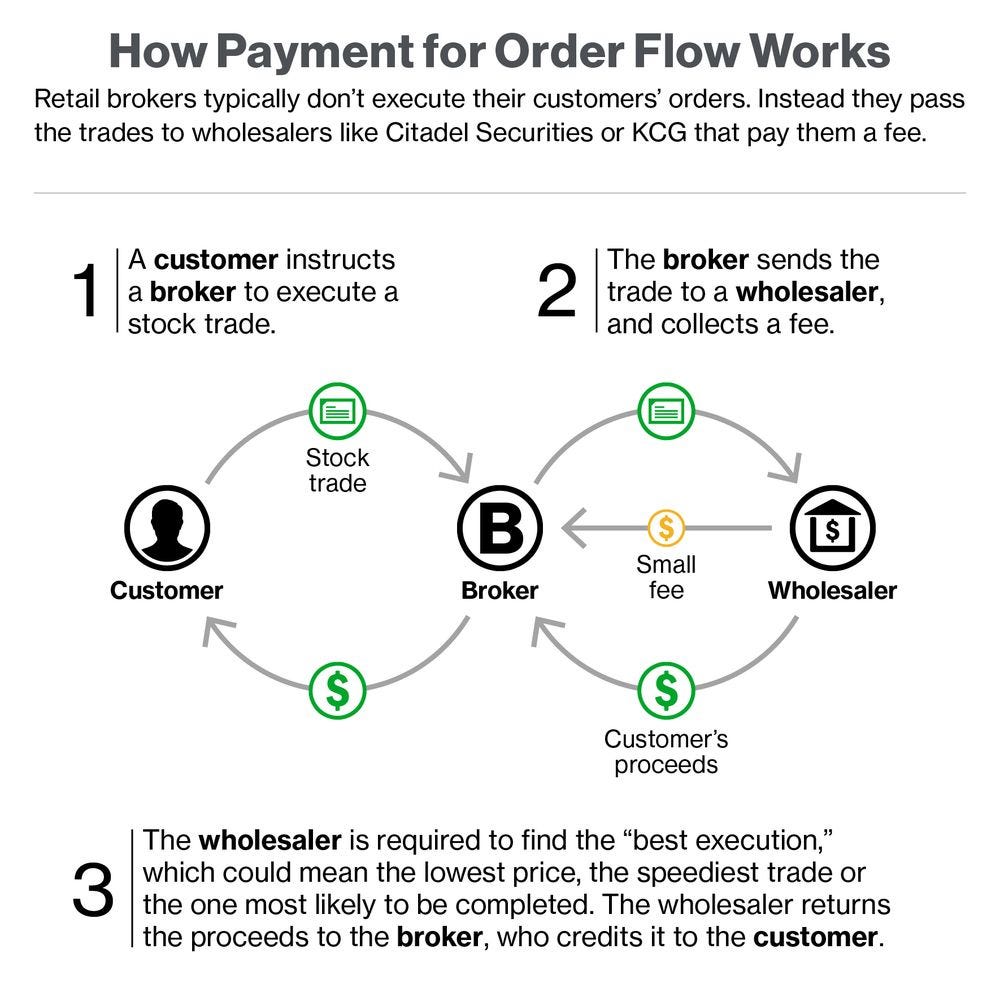

Robinhood and Citadel were grilled by the panel over their PFOF (payment for order flow) arrangement. By directing investors’ order to market makers, such as Citadel, Robinhood is able to use proceeds from the order flow routing to cover operating costs and thus eliminate commission fee on stocks, options, and cryptocurrencies. This movement is recognized as an industry disruption that has led to the financial democratization in 2019, when incumbents like Fidelity, Schwab and TD Ameritrade cancel their commission charge on online exchange-listed stocks, ETF and options.

The bright side is that the Millennial and Gen Z, who used to shy away from the complex trading system and high commission fee, can now open their account and start trading in one day without any requirement on minimum balance.

The question is, while not paying for getting brokerage service from Robinhood, are the investors actually paying the cost by accepting a worse execution price as a result of the payment arrangement between brokers and wholesalers?

Critics of PFOF and the “dark pool”, like Rep Brad Sherman, Rep Andy Barr, and Rep Bill Foster, questioned Mr. Griffin about the financial impact of market making activities on investors. Honestly, I am quite convinced that investors benefit a lot from the off-exchange trading activities.

1) First of all, Payment for Order Flow is a SEC permitted and regulated practice adopted by many brokers. Brokers are required to provide National Best Bid and Offer (NBBO) by SEC, that is the lowest ask price when buying securities, or the highest bid price when selling securities[vii]. The concern around conflict of interest[viii] has been alleviated as brokers are now under SEC radar as to the quality of execution and the disclosure of their order flow routing activities.

2) Secondly, off-exchange stock trading activities can offer better price than exchanges. It is a SEC mandate[ix] that exchange maintains a minimum pricing increment of $0.01 for any stocks over $1.0. Dark pool that steps ahead of the displayed limit order by even a fraction of one cent can offer great price improvement for investors. In fact, according to many published studies, such as those by Prof. Robert Battalio at Notre Dame[x], retail investors could be hurt significantly, if all retail orders were forced to trade on exchanges and could no longer benefit from price improvement.

3) Most importantly, Competition is in the play. Market fragmentation and pricing pressure urges market makers to give investors good pricing[xi].

Nevertheless, we should not ignore Robinhood’s lack of communication and misstatement about its order execution activities, charges which the company has paid $65 million to settle at the end of last year. According to SEC’s order[xii], Robinhood provided inferior trade prices that in aggregate deprived customers of $34.1 million even after taking into account the savings from not paying a commission.

In my view, the statement that “retail investors are the product” is not an accurate description of the investor-broker relationship. Our orders as a batch may be of importance to market makers and brokers because they can profit from the liquidity and spread. As for each of investors’ orders, the average size of which usually ranges from $1000 to $ 5000, it doesn’t really provide significant value to market makers. Therefore, as an individual investor, we are not a product, but a tiny little part of the market information flow which will become a tiny little part of the liquidity fountain when transferred to the “dark pool”. Besides, Robinhood has provided many investment options and tools, such as fractional shares, high yield cash account, dividend reinvestment, to empower retail investors. And as long as the company complies with regulation to offer best execution quality and make accurate disclosure of their PFOF activities, retail investors wouldn’t lose anything.

Who is to blame?

In prior sections, we center on Robinhood and Citadel, who are certainly on the hot seat during the whole hearing. There are now over 30 class-action lawsuits against Robinhood for the restriction. Even though Robinhood’s customer agreement notes that it has the power to stop stock buys without any prior notice, the lawsuits still have a chance in court as they could challenge the validity of the term.

Questions to the other three participants are much more mild.

Steve Huffman, Reddit’s CEO, argued that the community #wallstreetbets complies with all company policy and there has been no evidence of any bots or foreign agents intervention. Mr. Huffman also pointed out that the company has already taken active measures through communication with community moderators and administrators to make sure that there is no illegal and evil content. He legitimizes the chaos and frenzy within the community with the defense that, “WallStreetBets may look sophomoric or chaotic from the outside, but the fact that we are here today means they’ve managed to raise important issues about fairness and opportunity in our financial system.”

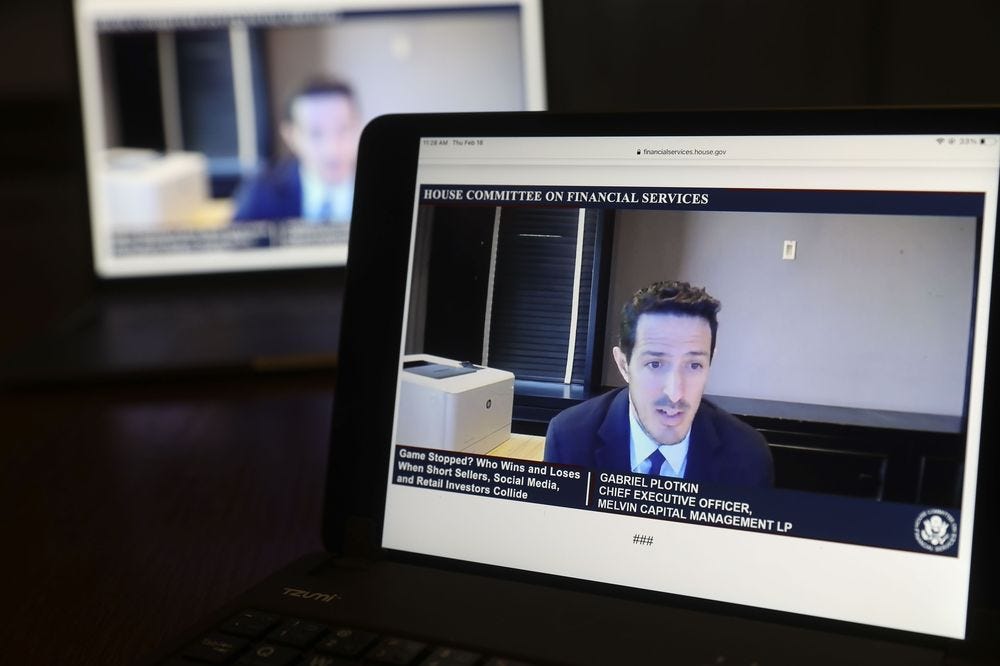

Keith Gill, the Reddit, and YouTube trading star known as “Roaring Kitty”, claimed in the latest post that he made $7.8 million off GME. In the testimony he defends his posts and says he is as bullish as ever on the stock based on his genuine perception and analysis of the company’s fundamentals. With a similar “goodwill” defense, Gabriel Plotkin holds up the company’s negative view on GME’s business outlook, based on which the company has set a short position since its inception in 2014.

Of course, there are some personal stories in their statements that give more color to the event. Keith, for example, talked about the unexpected pass away of his sister and how investment proceeds from GME have helped the family during the COVID-19 pandemic. Gabriel on the other hand told the panel that Redditors targeted his family with anti-Semitic insults and text messages because of the company’s short position.

Obviously, there is no single company or individual that is to blame or to take the full responsibility because there is no simple cause and effect. And according to Witness Jennifer Schulp, the former director of FINRA depart of enforcement, core market infrastructure is strong during the frenzied rally, and there is no sign of systematic risk.

Bringing in more organizations, such as SEC and DTCC, would be most valuable because they have nonpublic information and data that may provide different perspectives on the subject.

From 2 days to Real Time. Are we Ready?

As Tenev wrote in his testimony:

“The existing two-day period to settle trades exposes investors and the industry to unnecessary risk and is ripe for change.”

Under the current T+2 settlement cycle, brokers have to freeze required amount of capital until the stock transaction is settled on day 3. In the past, delayed settlement is to give time for the seller and buyer to gather paper document and clear funds. Nowadays, transfer of money and ownership could be done within seconds. Though we might need a more efficient market to allow for real time trading (T+0) because there is zero room for error, T+1 is not impossible given the current technology.

Price volatility increases over time. Shortening the settlement cycle to 1 day helps to reduce volatility and thus lessen counterparty credit risk. As a result, collateral deposit requirement will decrease, giving more room for brokers to manage their liquidity. It will also improve cash deployment efficiencies for investors because funds from the sale of security will now be available in 1 business day and thereby providing the ability to redeploy them for subsequent purchase.

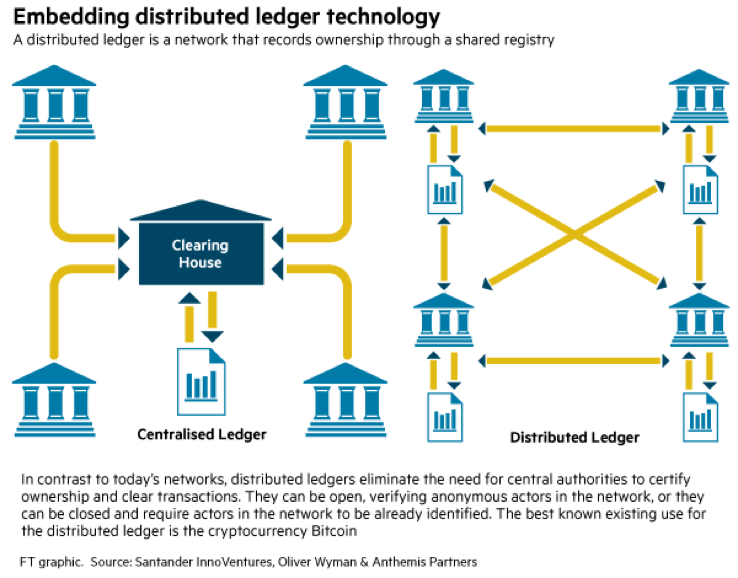

DTCC has long advocated for shortening the settlement cycle to enhance market resilience, reduce margin requirements and lower costs for investors. In Mid-2020, DTCC has announce the initiative to explore the T+1 and T+0 settlement cycle by leveraging digital assets and DLT (distributed ledger technology). In a recent Q&A session[xiii], Michael McClain, DTCC Managing Director and General Manager of Equity Clearing and DTC Settlement Services, said:

“Although DTCC’s equities clearing and settlement subsidiaries, NSCC and DTC, can support some T+1 and even same-day settlement using existing technology, many market participants don’t leverage this option because of market structure complexities, legacy business and operational processes.”

Of course, a lot more arrangement and market cooperation need to be in place both upstream and downstream for this change to happen. For example, option exercise, short sale transactions and corporate dividend actions have to be moved up 1 business day accordingly. New risk models and end-to-end process, such as predictive financing, and real-time reconciliation are also crucial to the transition.

The market will not be ready for the change until industry participants align and agree to the plan by implementing necessary and usually costly operational and business changes.

Not a Political Theater!

So how should we, as individual investors, interpret the event? And what can we learn from this? There might be a lot of technical, mechanical, financial and market implication, but the one and only principle is that,

This will be and should be a perfect chance for conversation and improvement.

And for those who tends to believe one group more than the other, or look at one news outlet more than the others, keep in mind, just as Chairwoman Maxine Waters responded to Rep. Bill Huizenga’s appeal,

“This is not political theater at all. This is serious oversight responsibility.”

Reference

[i] Robinhood, Citadel, Melvin Capital, and Reddit https://financialservices.house.gov/calendar/eventsingle.aspx?EventID=407107#YT

[ii] Robinhood Securities — Held NMS Stocks and Options Order Routing Public Report, May 29, 2020 https://cdn.robinhood.com/assets/robinhood/legal/RHS%20SEC%20Rule%20606A%20and%20607%20Disclosure%20Report%20Q1%202020.pdf

[iii] PR Newswire, https://www.prnewswire.com/news-releases/melvin-announces-2-75-billion-investment-from-citadel-and-point72--301214477.html

[iv] Robinhood Disclosure Library, https://robinhood.com/us/en/about/legal/

[v] GameStop Ownership Summary, https://news.gamestop.com/stock-information/institutional-ownership

[vi] Testimony of Vladimir Tenev Robinhood Markets, Inc https://financialservices.house.gov/uploadedfiles/hhrg-117-ba00-wstate-tenevv-20210218.pdf

[vii] National best bid and offer, https://en.wikipedia.org/wiki/National_best_bid_and_offer#:~:text=National%20Best%20Bid%20and%20Offer%20(NBBO)%20is%20a%20regulation%20by,as%20governed%20by%20Regulation%20NMS.

[viii] Payment Order Flow, Investopedia, https://www.investopedia.com/terms/p/paymentoforderflow.asp

[ix] Rule 612 (Minimum Pricing Increment) of Regulation NMS, https://www.sec.gov/divisions/marketreg/subpenny612faq.htm

[x] Testimony of Robert Battalio, https://www.hsgac.senate.gov/imo/media/doc/STMT%20-%20Robert%20Battalio%20(20140612)1.pdf

[xi] Breaking Down the Payment for Order Flow Debate, Alex Rampell & Scott Kupor, https://a16z.com/2021/02/17/payment-for-order-flow/

[xii] SEC charges Robinhood Financial with misleading customers about revenue sources and failing to satisfy duty of best execution, https://www.sec.gov/news/press-release/2020-321

[xiii] Why Shortening the Settlement Cycle Will Benefit the Industry & Investors? https://www.dtcc.com/dtcc-connection/articles/2021/february/04/why-shortening-the-settlement-cycle-will-benefit-the-industry-and-investors

Check out our new platform 👉 https://thecapital.io/

https://twitter.com/thecapital_io

This is not a Political Theater. was originally published in The Capital on Medium, where people are continuing the conversation by highlighting and responding to this story.

from The Capital - Medium https://ift.tt/3saT58w

0 Comments