Check out our new platform — https://thecapital.io/

Stablecoins are drawing more and more attention lately as they can hedge the traders’ risks to save the value of the assets. The most popular stablecoins are collateralized with US dollar and other fiat currencies or precious metals and they are criticized for not being decentralized. But there is MakerDAO — a project producing the stablecoin that doesn’t rely on a central authority.

About the project

MakerDAO is an open-source platform on the Ethereum blockchain and a Decentralized Autonomous Organization that solves the problem of cryptocurrencies value change. There are two ERC20 tokens in MakerDao’s system: Maker (MKR) and DAI (DAI).

Maker was created to support DAI and maintain the system. MKR is the governance token used to vote on several decisions and changes inside the project. It can be created or burned to save the DAI price. MKR coin’s value depends on the success of its products and the upkeep of its projects.

DAI is a collateral-backed stablecoin whose value is pegged to the USD at a 1:1 ratio. The Maker platform stabilizes the value of DAI and the Ethereum blockchain provides independence from centralized organizations. Generated DAIs can be used as a payment method and transferred between Ethereum wallets.

How it works

Users deposit Ether into a smart contract. The asset is considered collateral for a loan. Once the assets are deposited, the smart contract issues equivalent value in DAI. So the DAI holders are ensured that the currency is backed with ETH, it won’t exist otherwise.

To withdraw deposited Ether, the user has to pay back in DAI.

MakerDAO algorithms control the DAI price, thus the contract parties don’t require to trust each other to keep up currency stability. If the system works as intended, MKR holders benefit because the total MKR supply decrease, and its price rises accordingly.

Recapitalize mechanism

When the price of DAI is below $1, the smart contract will sell the deposited collateral to buy DAI in order to return DAI’s price to $1. And when the CDPs are undercollateralized, its smart contract uses MKR tokens to buy DAI instead of relying entirely on sold collateral to raise the price of DAI back to $1.

Why use DAI

As an ERC20 token, DAI can be implemented in any decentralized application that requires a stable currency or an internal payment system. Developers can also use DAI in various smart contracts and modify the token for different purposes.

The first and most obvious use case of the MakerDAO system is the replacement of traditional financial services. People can exchange DAI without a middleman and be sure in the amount they send or get as the currency mirrors the USD. Traders use DAI to hedge the risks while keeping their funds in the blockchain space. App developers are using DAI to provide users with the ability to transact with a stable asset within their platforms. DAI enables organizations to improve the transparency of accounting and reduce corruption in corporate finances.

Project news

According to CoinDesk, The MakerDAO community has voted for the integration of 3 new tokens to use for loans that generate DAI. Loopring (LRC), Compound (COMP), and Chainlink (LINK) are now available to use as collateral in Maker smart contracts.

MakerDAO has added 11 collateral tokens in total this year. Besides LINK, LRC and COMP, the platform supports MANA, WBTC, ZRX, KNC, TUSD, PAX, USDC, and USDT.

Adding new types of collateral is the only way to maintain the DAI price at $1.

CoinGecko in its report for the 3rd quart of 2020 pointed out that investments in DAI have grown by 598% to $905.0M comparing to the previous quarter. DAI placed 3rd in Top-5 Stablecoins Market Cap & Trading Volume.

Source: CoinGecko Q3 2020 Cryptocurrency Report

In early October DAI was integrated with RSK’s Ethereum Token bridge fostering interoperability amongst different blockchains through the bridge. The integration is expected to boost decentralized financial services on Bitcoin.

DAI coin price predictions

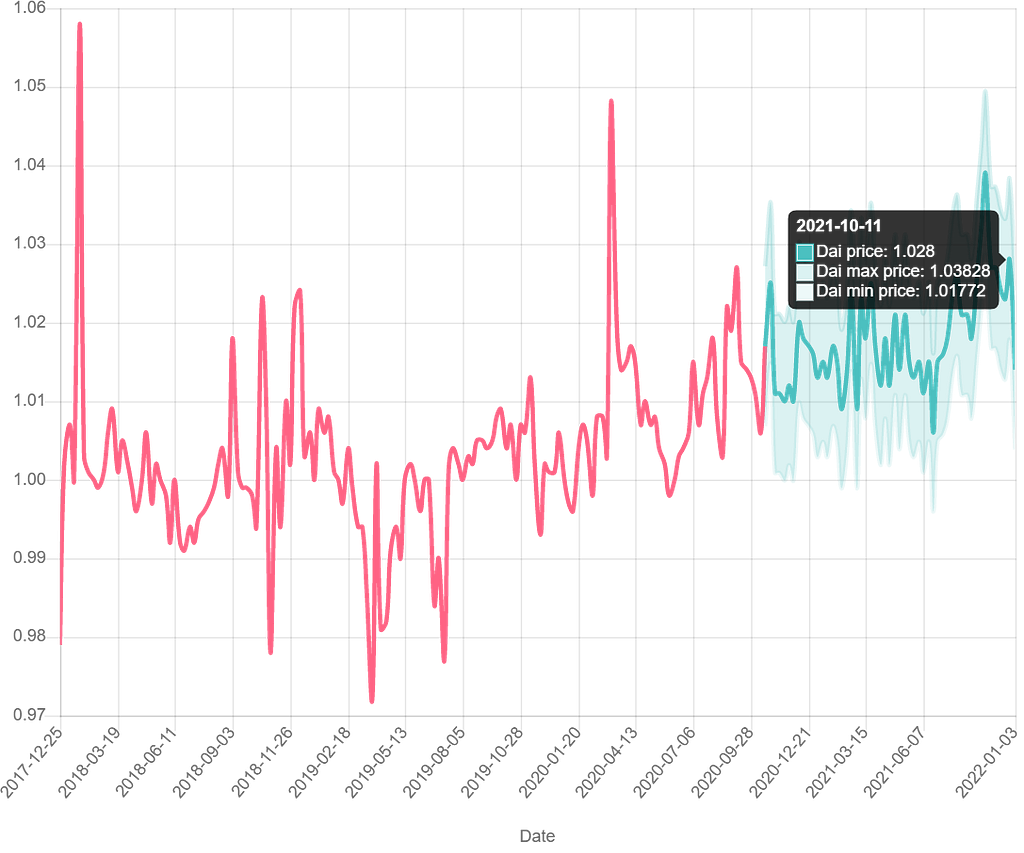

DAI’s current price is $1.01. According to the Gov Capital the next October the price will rise up to $1.028 (by 1.744%).

Source: gov.capital

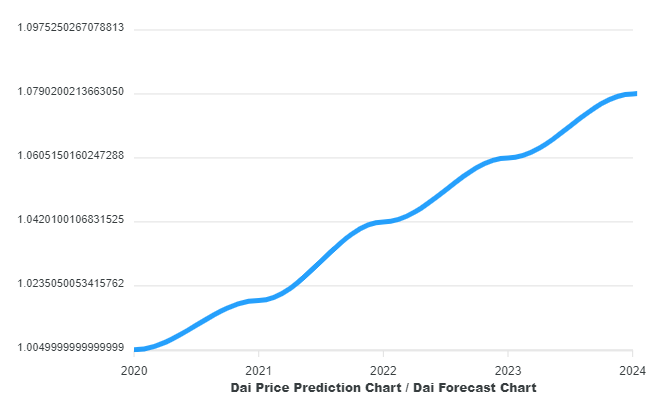

Cryptoground’s predictions of the DAI price are $1.0193 the next year and $1.0975 in five years.

Source: cryptoground.com

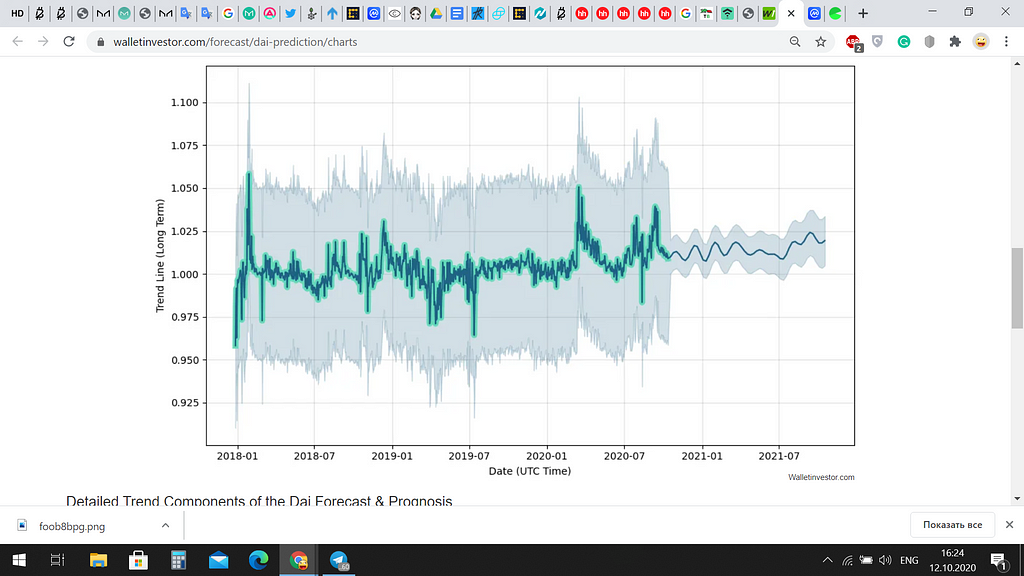

Wallet investor forecasts growth of the DAI price up to $1.019 next year and $1.063 in five years.

Source: walletinvestor.com

The price of stablecoin must remain constant and DAI is no exception.

The MakerDao project is worth attention especially now when the hype around decentralized finance projects and stablecoins is growing. The platform has a potential but before deciding on buying MKR or DAI and any other coin it’s necessary to make your own research.

Disclaimer: This article is not financial advice. Please use this information only for educational purposes.

Follow us on Twitter

Subscribe to our YouTube channel

Join our Telegram.

Originally published at https://coinjoy.io.

https://twitter.com/thecapital_io

MakerDAO: A System Of Two Tokens was originally published in The Capital on Medium, where people are continuing the conversation by highlighting and responding to this story.

from The Capital - Medium https://ift.tt/3jFaUrK

0 Comments