Check out our new platform 🚀 https://thecapital.io/

The last couple of weeks have been eventful for the crypto space. Bitcoin has proven itself to be the undisputed champion and in a league of itself entirely any which way you look at it.

Indeed, when speaking about crypto, it’s important not to confuse bitcoin with altcoins. Bitcoin is the experiment that worked and it will achieve heights few can presently appreciate.

While there is general consensus on the long-term viability of bitcoin, the immediate question on everyone’s mind is: now that bitcoin is trading well above its 2019 highs, where could it possibly find a local top?

Let’s find out.

Bitcoin realised price indicates organic growth

Bitcoin’s ‘realised’ price hit an all-time high of $6,903, per figures from Glassnode media — a crypto data firm.

Briefly, the realised bitcoin price is the value of all coins in circulation at the price they last exchanged hands. In other words, the bitcoin realised price is an approximation of what the entire market paid for their coins.

The calculation more or less excludes bitcoin wallets that haven’t been used in a long time, thus sniping a more reliable picture of the overall network by discounting coins which are not in active circulation.

Commenting on the organic growth, on-chain analyst Willy Woo had this to say:

Realised Price estimates the average price the market paid for their BTC.

Now at its steepest slope for this cycle, meaning capital influx into #Bitcoin is at its highest rate since the last bull market.

(Higher than last year’s $4k-$14k move; the current move is more organic.) pic.twitter.com/fF3Cn8glfA

— Willy Woo (@woonomic) November 15, 2020

Meanwhile, bitcoin is trading above $16,200 again as it continues to defy gravity in its parabolic run up.

Trade and exchange Bitcoin & crypto on Phemex. For experienced traders only.

Technically speaking

Bitcoin broke out of the bullish ascending triangle formation and tapped $16,500, falling short of the $17,000-plus target so far.

When one zooms out on the lower time-frames, it’s not hard to see why bitcoin is struggling in this $16,000-$16,500 trouble area. Bitcoin has gone parabolic since it broke out of the $10,500 level and hasn’t looked back since.

The quicker the climb, the harder the fall, and parabolas obey this rule to the letter. At any point along the parabola, bitcoin could experience a harsh rejection that would signal the end of the short term parabolic trend while opening the doors to lower levels.

However, if bitcoin maintains this extremely bullish trajectory until the end of November, momentum could take the coin towards an all-time-highs before a significant pull back takes place.

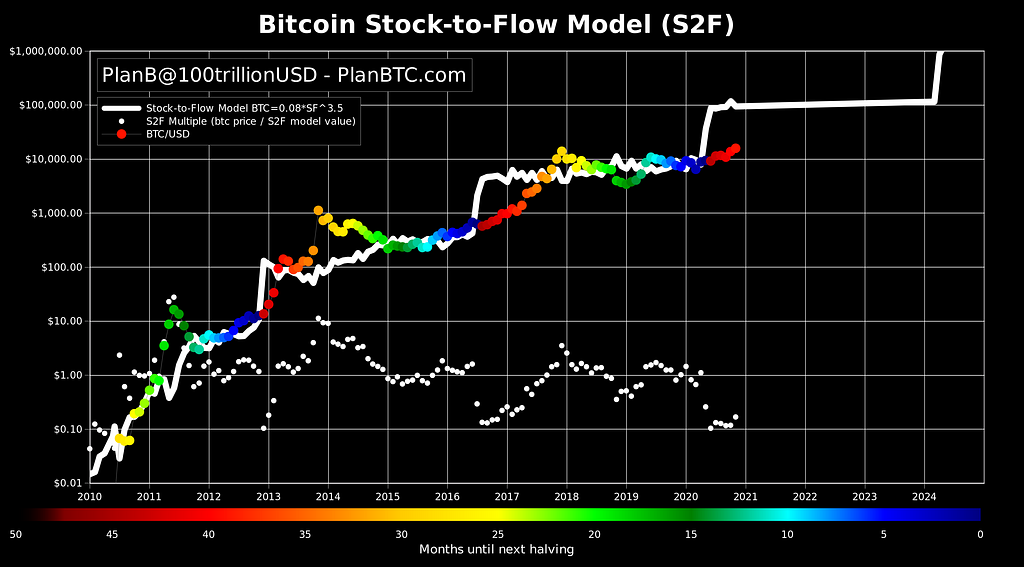

Bear in mind that various models and analyses, most notably PlanB’s stock-to-flow model, shows bitcoin at a $100,000 valuation.

While bitcoin has yet to reach this target, the author has frequently mentioned that this model is a guide and not an all-knowing oracle. It is a simplification of various processes, knowns, and unknowns, which have been relatively accurate so far.

The pull-back scenario

Being a buzz-kill is not great, especially when you consider yourself as the number one buzz bringer. But it’s vital to be prepared for a pull-back scenario which will invariably take place. Nothing goes up in a straight line forever and it doesn’t take a genius to notice this.

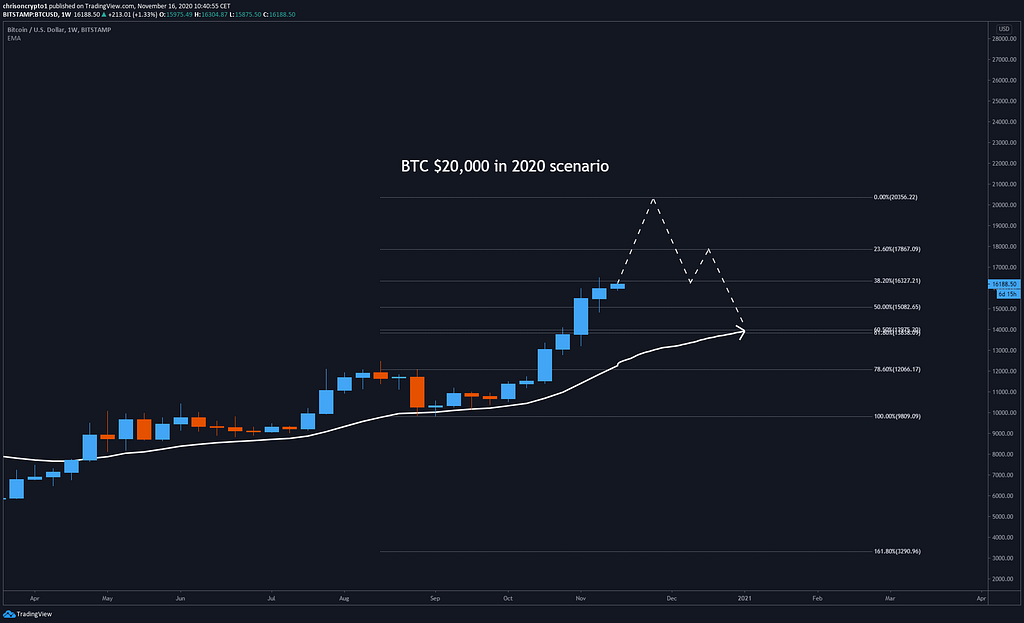

Considering the 2019 high, the $13,800 level is significant and has yet to be confirmed as support. Assuming bitcoin will eventually retest this breakout level, we can deduce where bitcoin might ‘top out’ in the event that it remains within this parabola for the next two weeks.

If this level is to act as a pivotal point, then we can assume that it will be the 61.8% fib retracement level (measured from the breakout) just after bitcoin enters the cool-off period.

With one exception (in 2013), bitcoin has never spent more than 8 weeks in the green. Should the parabola continue, bitcoin could top out at $20,300 (possibly higher) before correcting to the 20-weekly EMA, per the above projection.

Confluence is everything when it comes to technical analysis, and while it’s possible to cheat your way into your own bias, having a system reduces the risk of confirmation bias.

This scenario assumes that bitcoin will not violate its parabolic curve until the end of the month.

Needless to say, bitcoin could break down right now (and there are a plethora of reasons for that to happen), but until then one can speculate on the next local top based on historical precedent.

In any case, the bull market’s true glory will come into its own next year, when politics is no longer interesting and corona hysteria takes a back-seat (where it belongs).

This is not financial advice. Take care of your money fellow bitcoin Spartans.

Catch you next time.

Share this content on your socials. Appreciate your support!

Join the Telegram channel for live updates!

Follow me on Twitter & Instagram for more lighthearted content.

Referrals, business opportunities and feedback are also appreciated.

Read More: Grayscale loads up on $240 million BTC in a week

Are you a frequent reader? Tip me!

Send BTC to this address:

3EydsEYpjHn68axKnCUqBB7EbqcxrEjamr

Best regards,

Christopher Attard

Founder of Chris on Crypto

Contributor to www.cityam.com

Connect directly on: Telegram

Originally published at https://mailchi.mp.

https://twitter.com/thecapital_io

Will Bitcoin Hit $20,000 Before Cooling Off? was originally published in The Capital on Medium, where people are continuing the conversation by highlighting and responding to this story.

from The Capital - Medium https://ift.tt/2ULFvKt

0 Comments